Hoarders!

That’s the word that defines personal finance of several investors. You know at least one such person.

Just look at what his/her list of personal finance products and what their investment portfolio contains.

- Count the number of mutual funds in their portfolio – 20, 30, 40 upto 50 sometimes.

- Then the number of stocks in their portfolio – anywhere from a dozen to 100.

- A whole lot of insurance policies – from a few to a dozen.

- Add to all this the Bank Fixed Deposits, PPF, EPF, NSCs, NPS, Bonds, etc.

S/he has been literally hoarding.

It’s utterly complex.

One will need several sheets to list down all these items on paper.

The sad part is that in most cases, the investor is little aware of this complexity.

Why do we make life around personal finance so complicated?

Is this greed?

Is this ignorance?

Or the investor has a different formula that appears to work for him/her?

I have not been able to find an answer to this puzzle.

What I have understood is that it need not be complex to be needing reams of papers.

To use the cliche, it can be simple.

But, what is simple?

My golden rule of personal finance is “Less is more.”

In my view, there is no special benefit that one derives with ‘more’ products in the personal finance basket. A few well considered investment products driven by an investment plan are sufficient to fulfil one’s financial goals.

OK, but how much is more?

Here’s a quick test to know.

The A4 Test of Personal Finance and Investments

I believe any individual’s personal finance products list must fit into an A4 sheet of paper. An A4 sheet is what is normally used with a printer.

Today, why don’t you apply this test to yourself?

- Take an A4 sheet of paper or more, if you have to.

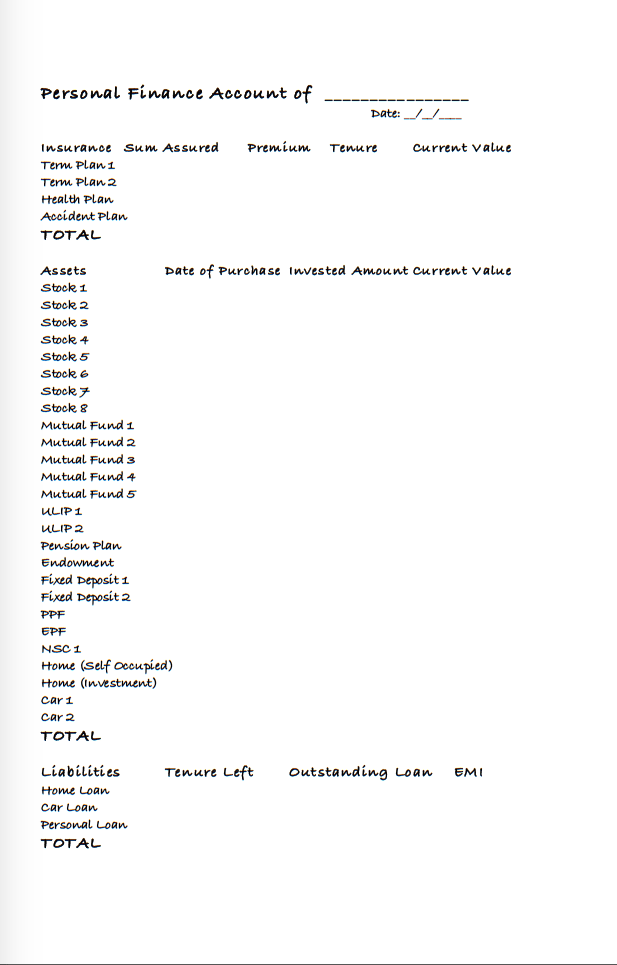

- Write down, and I insist you write, all your personal finance items one by one including insurance, investments (stocks, mutual funds, NSC, EPF/PPF, FDs), loans, assets such as home, car, etc.

- Once you are done, hold the sheet(s) in your hands, in front of your eyes.

What do you see? Feel?

This exercise is likely to do three things for you.

One, if you need more than one sheet, it shows you probably haven’t thought through as to how your money should be put to work. You have a vast selection of products, mostly random, driven by equally random advice or consideration. There is no thought of ‘best fit’.

Two, the A4 sheet will act as a boundary for you. You will have to now evaluate every action related to your money in terms of – Should you add that one more investment or insurance to your portfolio or not?

Three, it brings to the fore the areas you need to work on. You might have a lot of insurance policies which you do not need. You might have too many mutual funds or stocks. Your loans may exceed the value of your assets. Time to work on them.

Make the A4 Sheet your Personal Finance Account Dashboard

The specific asset or loan or investment may be different for different individuals, yet thinking in terms of containing it all in a single A4 sheet will make you question your own thought process and find the right reasons to add any additional product.

Remember, at all times, this A4 sheet is where all your personal finance items should fit in. It’s your dashboard.

Sample A4 test sheet of Personal Finance

You can download this sheet too and use for yourself. Click here.

Don’t try to fill the sheet in the font size of Terms & Conditions pages of a credit card. ![]()

What did you discover with the A4 Test? Is a single A4 sheet enough for you?

I look forward to your comments.

Hi Vipin,

I would need 3 pages for stocks 🙁 and have so many stocks in watchlist , unable to trim them down.

Rest fits in 1 page.

Thanks

Rohan Shenoy

Hi Rohan, What’s the XIRR of your stock portfolio? That should help you take some decisions.

can we consider and add Residential land plots also as an investment to this sheet.please give your suggestion on this.

Yes, we can. As along as it is an investment.

Thanks vipin