L&T India Value Fund has been on an eye catching performance spree for the last few years.

In fact, the fund size has more than doubled from the start of the year 2017 till now. The last reported AUM is at Rs. 5,250 crores (August 2017), up from approx. Rs. 2,500 crores in Jan 2017.

Let me share the history of this fund with you.

L&T India Value Fund was not always owned by L&T. In fact, the fund scheme actually started in Feb 2010 under then active Fidelity Mutual Fund.

Fidelity is quite a name in the investment industry, worldwide. It was operational in India till about 2011/12.

However, when Fidelity decided to quit its India operations, L&T bought it out in 2012 and renamed the funds. Basically, the word Fidelity was replaced with L&T. Everything else remained the same including the fund management team.

Except one of the funds, Fidelity International Opportunities Fund, which was renamed as L&T Indo Asia Equity Fund.

Then in 2015, even L&T Indo Asia Equity Fund was merged with the L&T India Value fund.

That’s where the fund is today.

Let’s look at other fund details.

Investment objective of L&T India Value Fund

From the Scheme Information Document of L&T India Value Fund (SID),

The investment objective of the Scheme is to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, in the Indian markets with higher focus on undervalued securities. The Scheme could also additionally invest in Foreign Securities in international markets.

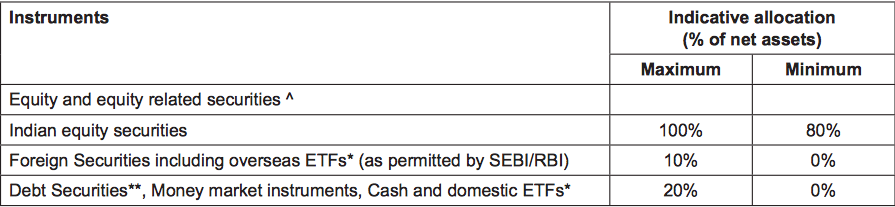

The indicative asset allocation of the fund is as below. (Source: SID)

As you can see, the fund can go upto 20% in cash as also invest upto 10% in foreign securities.

The value style fund

The L&T India Value fund prides itself as a “value investing style” focused fund. What does it mean?

It’s quite simple. The fund identifies businesses that are doing well and finds out their value, that is, what is their worth, if you were to buy it outright. Then it looks at its traded stock price.

If the traded stock price > true worth of business, it’s overvalued. PASS

If the traded stock price < true worth of business, it’s undervalued. BUY

As per the SID, the fund will “identify undervalued stocks having the potential to deliver long term superior risk-adjusted returns. Undervalued stocks would include stocks which the Fund Managers believe are trading at less than their assessed values.”

Interestingly, L&T India Value Fund uses the phrase “assessed value” to indicate the real value or true worth of a business. Reach out to any value investor and the actual phrase used for this is “intrinsic value”.

Well, what’s in a phrase?

Benchmark

The fund’s benchmark is S&P BSE 200, a predominantly large cap index.

This is a little misleading since the fund takes a flexible approach to picking its investments from across the market. In the recent times, the fund has had higher exposure to the mid and small cap segment.

As per the last reported allocation (August 2017), the fund has about 47% in large caps, 32% in midcaps and the remaining 21% in small caps.

It’s clearly a diversified equity fund or a flexi cap / multi cap. Hence, the appropriate benchmark is the BSE 500 or the Nifty 500.

With this benchmark discrepancy, a lot of portfolio measures stated by the fund, which use the BSE 200 benchmark information, become irrelevant.

Fund Managers

The Fund Managers for the Scheme are Venugopal Manghat (since November 24, 2012 and overall 23 years of experience) and Karan Desai (since February 2, 2017) (for investments in Foreign Securities).

The fund does not have any foreign security investment so far.

Performance

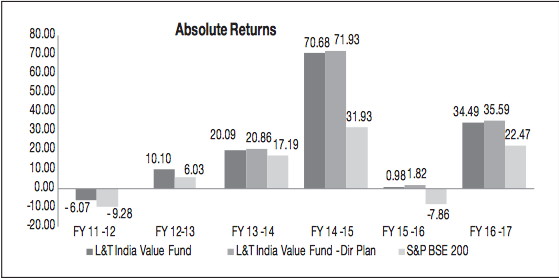

This is the favourite part. The fund’s first big hit came in 2014-15 and it found itself clocking a 70%+ return.

See the financial year wise performance chart below (Source: SID)

The direct plan started only in 2013.

Expense Ratio and Turnover

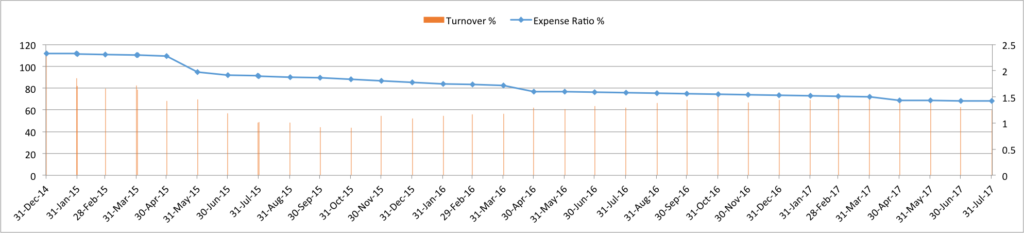

On the expense ratio front, there has been a consistent reduction. The graph below suggests that there has been a cut in the expense ratio at the beginning of every financial year.

The current expense ratio of the direct plan is 1.42%, higher than some of its peers.

Source: Unovest Research, data from December 2014 to July 2017. Turnover is on the left axis and expense ratio on the right axis.

However, the turnover ratio of the fund does not look inspiring at all. For a fund that professes to follow value style of investing, the turnover ratio is way high at close to 60%. The last reported turnover is 71% (Aug 2017).

For other fund schemes in the market having the same value style philosophy, the turnover is just about 20%.

No. of Stocks held

Basis the holding of last 6 months, the L&T India Value fund holds, on an average, about 80 stocks.

While that is a fund manager’s call and is probably good for wide diversification, it leads to a very distributed holding pattern with very few stocks being able to provide any significant push to the portfolio.

As per the current portfolio, no stock has more than 5% allocation and the lowest allocation is at 0.11%.

What is the fund trying to do, is not very clear.

What is clear, for now, is that the fund is working against some of the things, it says it stands for.

What value do you assign to L&T India Value fund?

Hi Sir, I have Query, Always seen advise that One should review his MF performance atleast once a year. If the MF performance is exceptional for say 3 years and in the 4th & 5th year the performance deteriorates, then how to handle that situation. If I withdraw from that MF and invests in new MF, till next 01 year (current It rules) it will become STCG as it will be considered as new Investment and also have to find ways to invest those redempted amount which is risky if I invest as lumpsum. How to move in such a scenario. Kindly guide. Thanks

Hi Pritpal, don’t just look at performance. If the fund has stuck to its mandate and is following that path, a year or two of downturn should not matter. Only if something terrible has happened with a fund, including a change in its strategy, should you plan to exit it. This is with the assumption that you have done your study in selecting the right fund in the first place. Thanks.