I recently did an investing workshop / presentation for a company with over 100 participants. After the event, I evaluated what is the most important message I wish to communicate.

I summarise as the things that matter and things that don’t.

First the things that don’t matter much

- Current market levels

- Which stock to buy

- Which IPO to invest in

- Best mutual fund

- Daily price tracking

- Daily profit / loss

- Save tax, save more and more tax

It is not that all of these don’t matter at all but not the first things that should be occupying your mind.

What you need to focus at the beginning is on the the things that really matter.

Here they are

- My Goals – what do I want my money to do?

- My risk capacity/tolerance – How much can I afford to lose, temporarily, in the near term?

- My current savings rate – How much am I saving as a %age of my income?

- Am I working for myself or the bank?

- What should be my target expected rate of return?

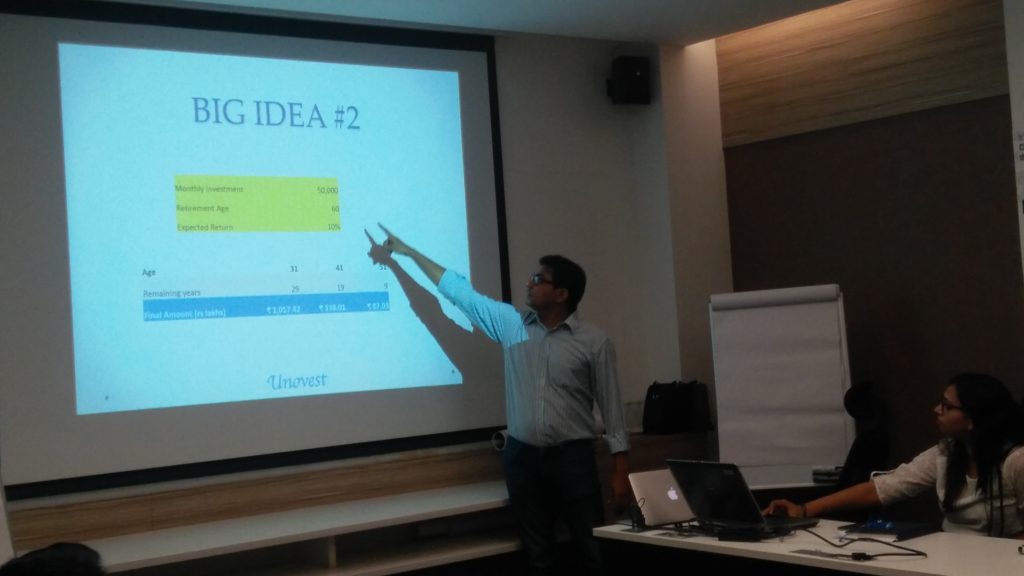

- How much do I need to save?

- My Net worth growth

- Asset Allocation – How much should I invest where?

- Which investments will fulfil the above for me?

- How do I track my goals and investments?

Go back to Stephen Covey’s time management matrix and you will know what I am saying.

Interested in attending my workshop. Click here to know more and register.

Excellent way to look at investing Vipin.

Also, “how much can I save”? “How much do I need to live comfortably now and so how much can I save each month?”

Awesome! Thanks for adding Nakul.