I was asked to answer a question on Quora:

Which debt fund is better for investment for an investment horizon of 3-5 years, Dynamic Bond Funds or GILT funds?

While I wrote my answer there, I thought I would share an extended version with you on Unovest.

Let’s refresh 2 basics about debt funds first.

- Debt funds operate on ‘mark to market’ principle, that is, they take stock of their investments daily and then mark their value based on the prevailing market price. This value is reflected in the NAV or Net Asset Value per unit.

- In case of debt funds, the price is inversely correlated with interest rates. Simply put, if the interest rates go up, the value of that investment will come down and vice versa.

This is reflected in the NAV. So, if interest rates go down next time, expect a little uptick in the value of your investment. Vice versa is also true.

Cleary, the Quora user’s choice was between a volatile fund (Dynamic Bond) and much more volatile fund (GILT).

I guess the choice of the GILT fund has come up from the fact that they invest only in Government Securities (long term as well as short term) and thus are considered absolutely safe from credit risk point of view.

The other choice – Dynamic Bond Funds – don’t shy away from holding sovereign securities too.

Look at this one – Quantum Dynamic Bond Fund with 81.5% (July 2017) allocation to Sovereign investments.

Look at this one – Birla Sun Life Dynamic Bond Fund with 64% (July 2017) allocation to Sovereign investments.

Now, what is more interesting is to observe the investment journey of a debt fund investment.

Let’s look at a journey of Rs. 10,000 invested in not just the two types of debt funds mentioned in the investor query but also several other categories.

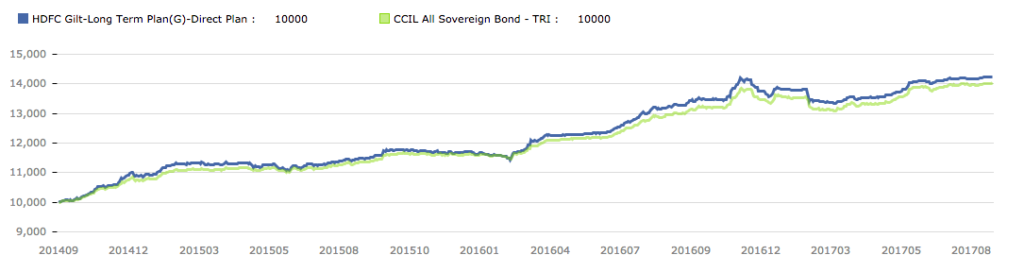

#1 GILT FUNDS

This is the journey of Rs. 10,000 invested in HDFC Gilt Fund over last 3 years.

However, as mentioned before, this safety is accompanied with high volatility and risk of losing capital in the short term.

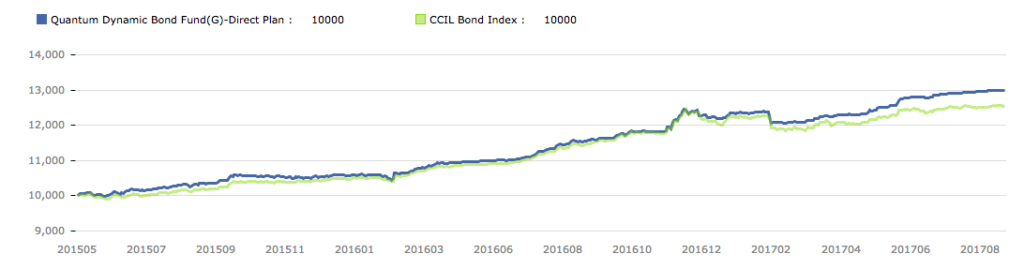

#2 DYNAMIC BOND FUNDS

This is the journey of Rs. 10,000 invested in the Quantum Dynamic Bond Fund over last 2+ years.

The Dynamic Bond Fund too doesn’t look encouraging to someone looking for a smooth ride.

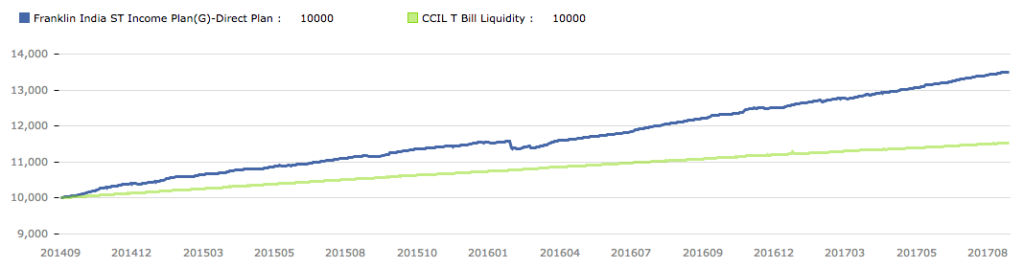

#3 SHORT TERM FUND

Let’s see a journey of Franklin India Short Term Income Fund from the short term income fund category.

The short term income category has periods of reckoning with volatility.

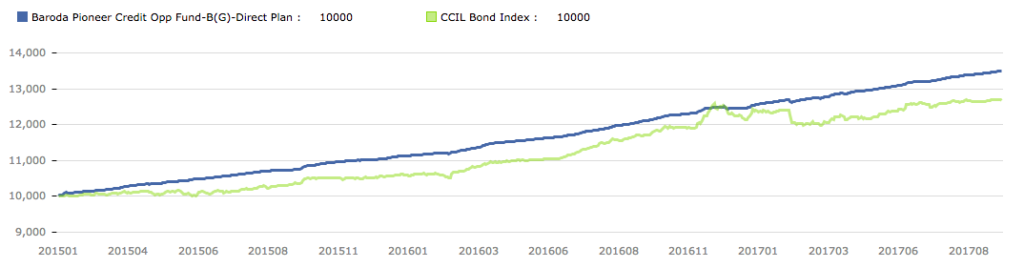

#4 CREDIT OPPORTUNITIES FUND

Here’s the journey of Rs. 10,000 invested in Baroda Pioneer Credit Opportunities Fund.

The Credit Opportunities fund by definition seeks to profit from changing credit profiles of debt offerings and hence takes on more risk.

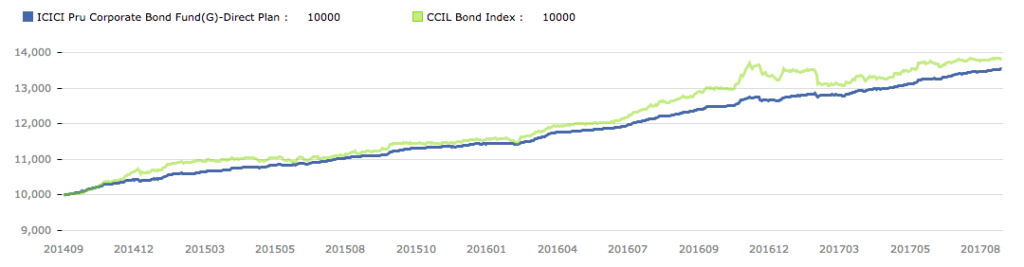

#5 CORPORATE BOND FUND

Then there is the corporate bond fund from ICICI Pru MF. Here’s the 3 year journey of Rs. 10,000 invested in it.

The Corporate Bond Fund is the other side of the GILT category with lesser volatility.

#6 ULTRA SHORT TERM FUND

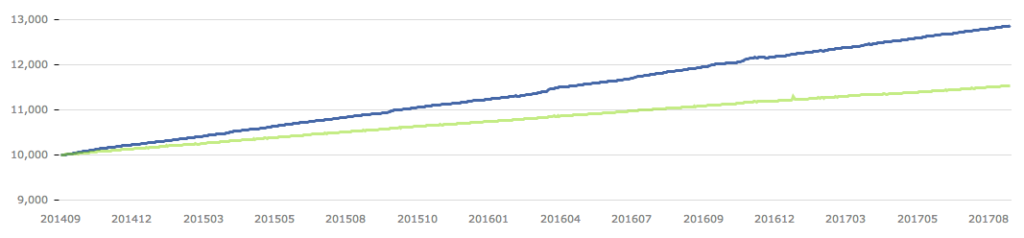

This is the ultra short term fund – UTI Treasury Advantage Fund – Institutional Plan

The ultra short term presents a much more smooth journey for your investment.

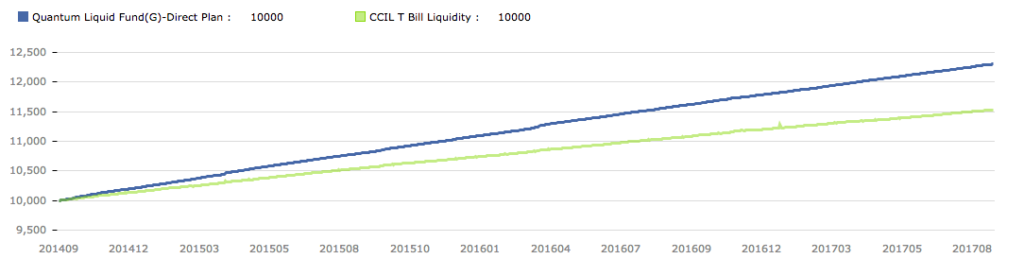

#7 LIQUID FUND

Finally, the Quantum Liquid Fund and Rs. 10,000 invested in it for 3 years.

The liquid fund carries the minimum risk specially in terms of maturity profile of its investments.

Each of the above fund types uses a mix of credit profile plus the maturity of the investment to build its portfolio. A liquid or an ultra short term fund will go for much lower time horizon compared to a Gilt Fund.

You should observer the Average Maturity number or the Modified Duration of these funds to get a sense.

Except for the last 2, none of them appears to be a smooth ride like your Bank Fixed Deposit.

As for the user, she has to determine what kind of a ride she wants to determine her investment.

Note: The fund names are used only as examples. Please do not consider them as investment recommendations.

Leave a Reply