The next fund in the series of the ‘hot’ mutual funds is ICICI Pru Balanced Fund.

The fund is a hybrid fund, which means it invests in equity as well as debt. However, the name balanced does not mean the ratio of equity and debt is 50:50.

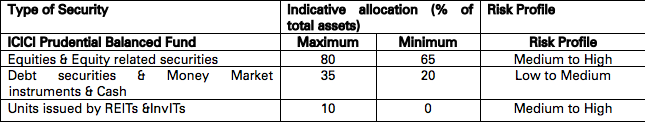

To ensure that it provides the investors the benefit of equity taxation (ZERO capital gains after 1 year of holding), it invests at least 65% or more in equity. The Scheme information document suggests that the fund will invest a maximum of upto 80% in equity.

The fund defines its asset allocation as follows:

Source: SID

The investment objective of the fund is quite general and vague.

The primary investment objective of the Scheme is to seek to generate long term capital appreciation and current income from a portfolio that is invested in equity and equity related securities as well as in fixed income securities.

Source: SID, Fund Factsheet

The scheme benchmarks itself against the CRISIL Balanced Fund – Aggressive Index, which comprises of 65% of Nifty 50 and 35% of CRISIL Short Term Bond Index.

Given the limited options available, this seems to be the best fit. Ideally, the equity portion of the benchmark should be a broader index such as Nifty 500. This is because while the fund invests predominantly in large cap stocks, mid and small cap stocks also form a decent portion of the portfolio.

Why do we say that the ICICI Pru Balanced fund is hot?

Well, hot here refers to the pace of its growth. In just over one year, the fund size has grown 4 times from about Rs. 3000 crores in June 2016 to Rs. 16000+ crores, currently.

Why so? A few reasons.

One, markets have been choppy and first time investors were looking at a “not so risky” option. A balanced fund with its debt and equity combination helps investors believe the story of “less risk”.

Two, late 2016 onwards, a lot of new investors were looking to enter new financial investment avenues. ICICI Pru has a massive distribution network and it appears it managed to tap these new investors.

Three and probably the big one, is the addition of Naren Sankaran – the CIO of ICICI Pru AMC – to the team of fund managers. His name was officially added in December 2015 and the fund started to see an upward move since then.

FYI, Naren is considered as a star fund manager in the MF industry and is known for his contrarian style of investing.

Once he joined, a lot of other things also started to move upwards. Notable are the expense ratio and the portfolio turnover.

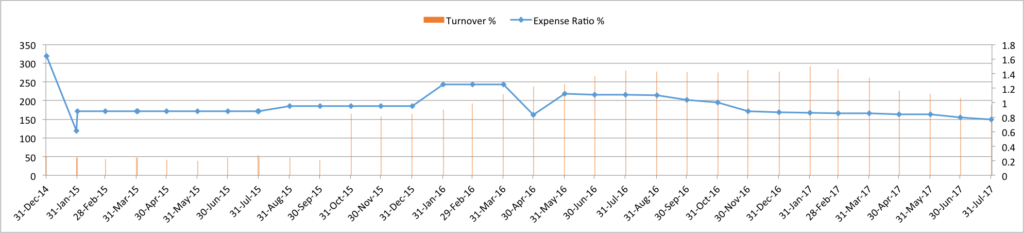

See the chart below for ICICI Pru Balanced Fund which maps the Turnover and Expense Ratio from December 2014 to July 2017.

Source: ACE MF; The turnover are the orange lines with reference to the left hand side axis. The expense ratio is the blue plot lines with reference to the right hand side axis.

The turnover as shown in the chart above is composite as it includes both equity and debt portfolio turnover.

The turnover went up significantly starting Oct 2015. The latest reported turnover as of July 2017 is 189%. In recent times, the equity portfolio turnover has been above 100%.

A high turnover ratio indicates lot more activity in the portfolio. Typically turnover ratios should not exceed 25 to 30%, indicating a more stable and thought through portfolio.

The expense ratios in mutual funds remain a mystery. The expense ratio may not always indicate the actual expenses incurred by the fund including fund management and other expenses.

Many a times the expense ratio is also used as a signal by the marketing teams. It is decreased temporarily to attract more investors and AUM.

ICICI Pru Balanced Fund – Performance

Now, you cannot ignore the role of performance in the fund’s growth. The fund has been able to catch investor’s attention.

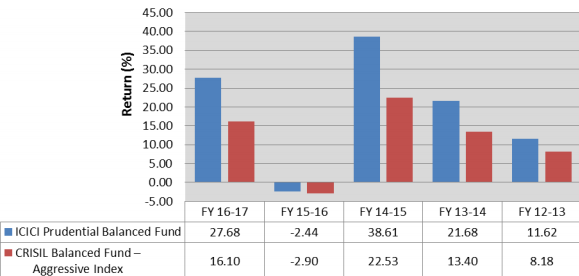

See the chart below of financial year wise performance sourced from its SID.

The fund has impressively outperformed its index over the years.

The point clearly made by the above chart and what the investors need to understand is that balanced funds, despite having the debt portion for risk management, can still lose money.

This fund too lost money in the Financial year 2015-16. It is also the same period when it increased the expenses charged to the fund. Hmmm.

Remember, do not invest in the fund as an alternative to a pure debt fund or a Bank FD – specially, if short term capital preservation is high on your mind.

Will the size impact performance going forward? Only time will tell.

To view a detailed factsheet of ICICI Pru Balanced fund as well as a comparison with its peers, click here.

To read more about balanced funds, click here.

Leave a Reply