Axis Mutual Fund recently sent out an information email to the investors of its Axis Treasury Advantage Fund. The email mentions about a change in a fundamental attribute of the scheme and provides the option to investors to withdraw (in case they are not okay with the change) without paying any exit load.

What is Axis Treasury Advantage Fund?

The Axis Treasury Advantage Fund is a debt fund in the Ultra Short Term Fund category. It has been in existence since Oct 2009.

The investment objective of the scheme is

to provide optimal returns and liquidity to the investors by investing primarily in a mix of money market and short term debt instruments, which results in a portfolio having marginally higher maturity as compared to a liquid fund at the same time maintaining a balance between safety and liquidity.

To understand it simply, the fund aims to predominantly invest in instruments that will mature within 1 year (70%) and others that can mature after 1 year (30%). Most of its portfolio is of high credit rating.

The Duration and the Average Maturity of the scheme are:

To put this in perspective, a liquid fund’s duration is 90 days or less. Hence, an ultra short term fund is expected to carry a little more risk than a liquid fund.

It must be noted that about 30% of its portfolio as of August 2017 is invested in its own Axis Liquid Fund. It is not clear whether it is by design or due to dearth of opportunities.

Now, the fund proposes to change the way it is managed.

What is the proposed change?

As per the communication by the Mutual Fund:

Currently, the investment strategy of the Scheme is to maintain average maturity in the range of upto 6 months. This is being altered to a range of upto 12 months. The change does not alter the basic investment strategy of the Scheme. It is expected that the larger range will allow the fund manager to act flexibly in responding the change in interest rate landscape and constructing the portfolio better suited for different market conditions and enhance the Scheme performance.

As mentioned, the fund manager now wants more flexibility in choosing investments. There is a sort of consensus view in the market that interest rates are likely to further go down. The fund manager may want to take advantage of this scenario to optimise portfolio returns.

However, that wouldn’t come without assuming additional market risk, a result of increasing the average maturity of the portfolio.

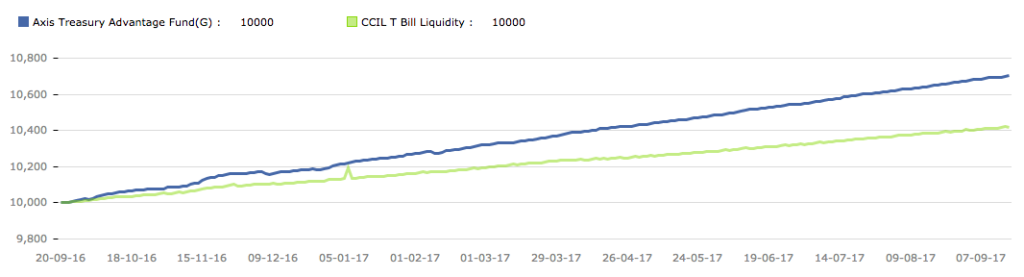

Go to the Unovest factsheet page of the scheme here and scroll down to the Growth chart section. Change the time period – 3 months, 6 months, 3 years to see the movement of an investment. You will observe the volatility. Sample this one for 1 year.

To be clear, this is not how your Fixed Deposit investment line moves. An FD is a straight line. No kinks, no bumps.

To be clear, this is not how your Fixed Deposit investment line moves. An FD is a straight line. No kinks, no bumps.

Coming to the revision in average maturity, Aa previously indicated the current average maturity is close to 185 days or 6 months. Based on the fund’s statements, the average maturity can now go up. How much – upto 12 months.

To give you an example, another fund in the ultra short category – ICICI Pru Flexible Income Plan – has the following Duration and Average Maturity.

The Average Maturity is close to 12 months or 1 year. Axis Treasury Advantage Fund’s average maturity can look something like this in 1 year’s time.

What should you do?

The proposed change comes into effect from Oct 17, 2017. If you are invested in the Axis Treasury Advantage Fund and you are not comfortable with this change, you can exit the scheme now.

Please do take into account the capital gains that you might have to pay. In less than 3 years of holding, gains are taxed as short term at the rate of your income tax bracket.

There are no exit loads in the scheme.

In our view, there is no particular cause for worry. The fund house has now streamlined the positioning of the fund by putting it into the 3 to 12 months average maturity bracket. The liquid fund falls in upto 3 month maturity bracket.

Investors can observe the fund for another year and see if there is any adverse impact. A decision can be taken accordingly.

Leave a Reply