It is a known fact that the returns of an investment instruments (say mutual fund) and the actual return of an investor vary significantly.

Why is that?

Before we take it up, let’s look at this question.

Is it advisable to continue SIP for ICICI Prudential Dividend Yield Equity Fund Growth Direct Plan (return of -3%) and ICICI Prudential Multi cap Fund Growth Direct Plan (return of 2.1%), Started SIP from May month (this year). Present performance of the funds is too low, Can you provide me a solution to switch with other funds or redeem at this moment.

I get such questions often. You can ignore the amount. I can add a few zeroes and easily it can be a question from another investor. I see it all around including with people I know and care about.

To a large extent, the question also contains the reason for the difference between investment returns and investor returns.

The investor behaviour is in stark contrast to what is required to get market returns. This difference is known as the behaviour gap.

Okay! What is the ideal investor behaviour? It is a systematic approach where you

- Identify your goals

- Define your own risk appetite

- Assess your current financial situation (income, expenses, assets, liabilities)

- Identify your asset allocation or how you will diversify your portfolio

- Select the investment instruments in line with asset allocation and risk profile.

- Review periodically and rebalance investments to derisk the portfolio and maintain asset allocation

But what does the investor actually do:

- Invests a tiny portion of his investment into mutual funds or stocks.

- Invests a disproportionate amount of time on this tiny investment portion.

- Becomes obsessed about the highest returns.

- Acts on hot tips promising 15% returns instantly.

- Churns frequently from one fund or stock to another.

Goals, risk, asset allocation are all thought of some hi-funda concepts with no role in this investor’s life. If there was any hope for alpha from the mutual fund / stock, the investor behaviour neutralises it.

With zero focus on risk, asset allocation, diversification, rebalancing and the goals, the investor keeps running around like a plucked chicken.

Most investors loses money as well as confidence. They give up any hope of building a sensible and smart portfolio.

An investor’s biggest enemy is the investor himself.

And it is so difficult to beat this enemy.

It is not impossible though. Once you understand the benefits of transforming the behaviour gap into behaviour alpha, you will likely do it.

So, how does good behaviour translate into benefits?

I believe that if the investor behaviour is largely correct (counting a few mistakes for sure), s/he can easily add a 1% to 2% extra returns, the alpha.

Not just that, it also ensures that you actually receive the investment alpha too. Put together the behavioural alpha + investment alpha and you are riding faster to your goals, with much less stress.

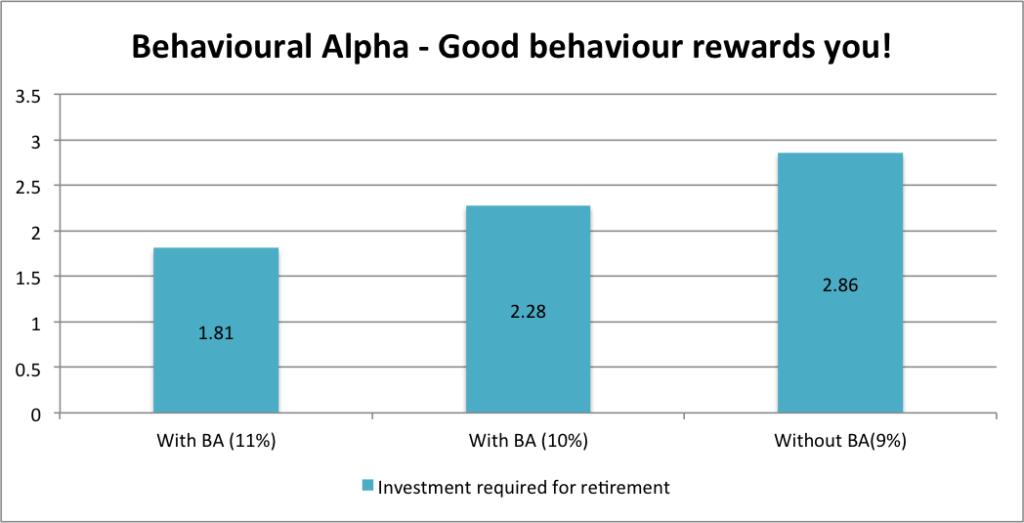

To give you an example, for a 35 year old, a 1% behaviour alpha can reduce his investment requirement (lump sum) towards retirement by 25.4%.

Investment requirement is in Rs. crores (one time investment). BA means Behavioural Alpha.

If you get this to 2%, the requirement comes down by 58%.

As you can see, this is a big win with a small change. Why won’t you do it?

Time to do it!

How to generate Behavioural Alpha?

This is how it can be done.

- Figure out your goals and the requirements and how will you diversify your portfolio. Then go after it like it is the only thing that matters.

- Save more and invest more – Specially, in the initial years of your life. More than changing funds, this will help you build the big number to let compounding magic work for you.

- Have patience. Stop expecting a mutual fund/stock to deliver immediately.

- You can do without generalised advice from friends, colleagues, family, blogs, portals, magazines to build their own portfolio (yes, it applies to this blog too). You have to put your own context to your investment decisions. An FD can be good for one and a debt fund for another.

- Don’t just try to ‘do it yourself‘. Also invest time to learn how to ‘do it yourself‘. Getting some help and advice doesn’t hurt.

Easier said than done.

What is your own behaviour with your investments? Are you working on changing it? Do share with us in the comments.

Notes:

- Carl Richards, a renowned financial planner and also known as the Sketch Guy, runs a blog by the name of BehaviorGap and has penned a book too by the same name. It contains some brilliant sketches showing the gap between what we ought to do and what we actually do as investors. I highly recommend it.

- The retirement example, assumed the 35 year old to target a Rs 1 lakh income (in today’s terms) post retirement, with 8% inflation. He expects to retire at age 60 and live till 90, so 30 years to provide for. The assumed portfolio returns are 9% (without behavioural alpha) and 10% (after behavioural alpha).

Leave a Reply