Today, we are doing a role reversal. Today, you are going help me make a decision to invest in a product.

I am sure over time you have got a good understanding about evaluating financial products and hence I call for your help.

Here’s what happened and why I need your help?

An executive of a large mutual fund company has come to me and is pitching their mutual fund product. He tells me that using a dynamic asset allocation method, their product has delivered superior performance.

He shows the performance chart of the product with great confidence.

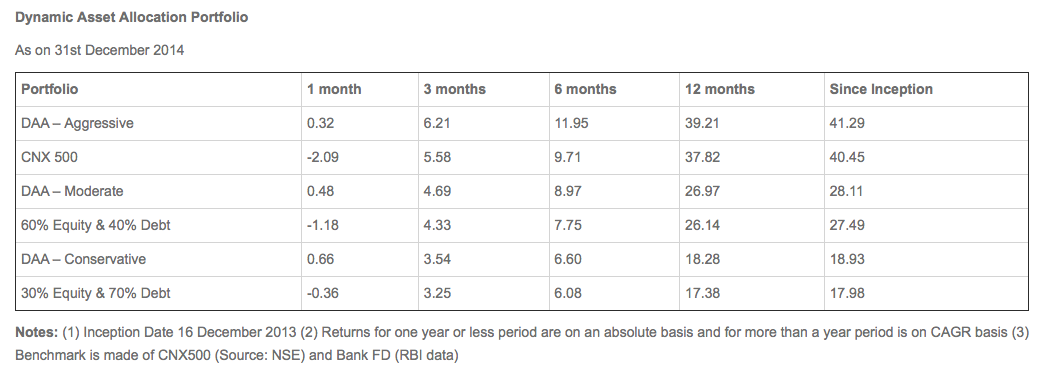

The image below shows an asset allocation based portfolio performance and comparison with an index benchmark.

Source: Undisclosed; Ignore the date of the publication for now.

Indeed, as it appears from the data, the superior results highlight the strength of their research and selection process.

The executive is pushing me to make a decision and sign the cheque.

I ask him to hold his horses. I tell him that there is a wise person whose opinion I need to seek.

This wise person is none other than you. As a Unovestor and a reader of this blog, you are a pool of wisdom. Can you help me make this decision to invest or not?

Please take a few minutes to go through the data by yourself.

Use the comments box of this post and list down all the questions that you believe I should ask based on what is shown to me.

What other information should I ask for before I actually make the decision?

or

Is the portfolio performance unquestionable?

This is how I want to say thanks to you

Now, I can’t be so mean that I take your help and not thank you enough. So, here’s how I plan to offer my gratitude.

The 2 most comprehensive and relevant responses can claim either of the following:

- 1 year subscription to the Uno Plan (worth Rs. 950) on the Unovest Platform.

- If you are already a subscriber, then you get a 20 minute phone consultation time with me to discuss anything.

- OR, additional 10% off on the Money Master Course, which begins soon.

So, get your grey cells working. I keenly look forward to your responses.

Note: Send your comments before midnight of August 9, 2017. You do want to help me, right?

Hi vipin,

From the picture conclusions I can get are

1. It is a dynamic asset allocation (DAA) fund (mix of equity and debt).Based on the market situation it will change its colors. Inception date is 2013 December. Returns are shown just a few days more than a year 🙂

2. Benchmark is CNX500 (equity index) and Bank FD data.

First of all investment process is not to chase returns. So coming to the questions part that I would suggest 🙂 you to ask are.

1. Scheme objective: What is the main aim of the scheme? Whether to provide the investor long term capital appreciation or better risk adjusted returns?

2. Nature of the fund: Is it an equity, debt, balanced fund? (Basically to know the taxation part)

3. Asset allocation strategy: How much in equity and debt? On what factors the scheme will be deciding when to be aggressive, moderate, and conservative?

4. Volatility & performance measures: Standard deviation, Sharpe ratio & Turn over ratios if available. To know the performance and volatility of the fund returns. Since fund is not more than 3 years old, I think they may not be available.

5. Expense ratio & exit load details. That’s all.

Finally To invest or not: Investment is a goal based process.so If the goal is short term (less than 5 years) I would go with an ultra-short term debt (pure debt) fund and if the goal is long term (more than 5 years) I would go with an equity oriented balanced fund on conservative side. If I can be aggressive for that goal I would a go with an equity multi-cap fund. So I don’t need the fund manager to do that much exercise of DAA to meet my goal :).so if I were you I would simply stay away from it.

I know it is not that comprehensive :). i tried to give my best .Give your feedback as well

Thanks and regards

Sai Ravikiran Thaduturu

Thanks Sai. Quite comprehensive. I accept your advice. 🙂

I have written a follow up post on the case. Read it here. http://unovest.co/2017/08/investment-evaluation/.

1. Goals for investment

2. Time horizon

3. Investment style( Risk profile)

4. Check Portfolio allocation

5. Scheme capital

6. Top holding of schemes

7. Compare with other peers

8. Track record for 5 to 10 years

9. What are expense ratio

Thanks Bhagwat.

Sir,

I have gone through the data shown by the executive . As per my little knowledge ,the portfolio is not unquestionable at all

Because the date of the report is 31 December 2014 at market was at its peak having Mr. Modi sworn in as PM.

Moreover The comparison of the portfolio is only with its benchmark, but executive is not talking about how portfolio fared compared to its peers.

The report only shows data of last one year which is not sufficient, you can ask him for 3 year and 5 year data as well. ( Though past performance cant guarantee you future returns, its one of the criteria)

Apart from this you should ask him about the fund manager and his experience.

Thank You

Hello Vipin,

my questions are:

1. The scheme seems to be new to the market . I am looking forward for the consistent market market performer. What if the market slashed down or side wave pattern , then what about the performance data?

2. What are the basis of Dynamic asset allocation of your scheme?

3. What are the main scheme objectives?

4. What are the management fee and expenses ?

Thanks.

Thank you. Do read the follow up post: http://unovest.co/2017/08/investment-evaluation/