Recently, I asked for your help on evaluating an investment product.

An executive of a large mutual fund company pitched a mutual fund product. The investment uses a dynamic asset allocation method where they would invest in a set of equity and debt funds based on predefined allocation and also rebalance the portfolio to maintain the allocation.

He claimed that this asset allocation was best in the industry and has delivered superior performance.

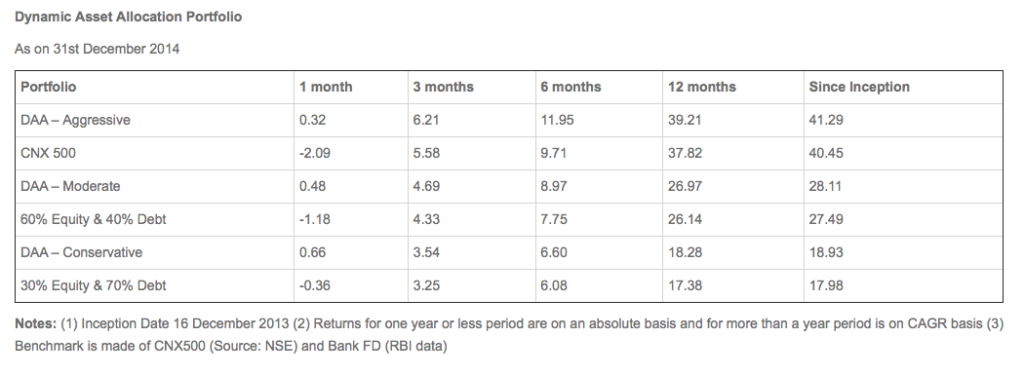

This is the data in a chart that he shared with me.

Indeed, as it appears from the data, the superior results highlight the strength of their research and selection process.

However, I was not completely convinced and hence I asked you what other information should I ask for before I sign the dotted line?

As generous as you are, you did send in your comments and asked me to look into the following (some of the comments have been combined):

- Check the portfolio performance vis-a-vis its peers

- Ask for 3 and 5 year data as well, based on availability

- Check fund manager’s experience

- Go into the details of the scheme including its objective, holdings, risk measures, taxation, etc.

- What will be basis of deciding its asset allocation?

Great! I feel so glad to be surrounded by such caring individuals.

All these inputs are relevant and have to be looked into. However, I would like to bring your attention to 3 more things.

#1 The benchmark data is not clear

If you observe, the benchmark information does not state if it is a price benchmark (based only on changes in market price) or a total return benchmark (which also includes dividends, bonus, etc). My guess is that the benchmark information in the table has only price and not the total return.

This makes the performance of the scheme look great. The truth is opposite. Even if you were to add 1.5% of dividend yield to the price returns mentioned, it makes the MF product look like a loser.

For example, for the 12 month return of the Aggressive portfolio, the price return is 37.82%. Add 1.5% and you get 39.32%. This is higher than the scheme return of 39.21%.

The takeaway is that there is no additional advantage (also called Alpha) in taking on the fund manager risk.

You are probably better off with a combination of index fund and PPF (which again gives better tax free returns than a Bank FD).

Further read: Benchmarking fund performance

#2 Where is the debt investment going?

As an asset allocation product, where is the debt investment going? Which type of debt funds? Or is it using Arbitrage funds to bring in tax efficiency to the overall product structure?

You see arbitrage funds produce liquid fund like returns but are taxed like equity funds.

That brings us to the related question #3.

#3 Allocation changes and costs

As a part of rebalancing, the fund switches from one fund to another. Even the research process may do away with a particular scheme and introduce another. When these changes are made, who bears the costs? Who bears the exit loads, if any?

What happens to taxation of realised gains (short term, specially)? Do I as an investor pay tax on the gains myself hands or the MF pays it?

These are essentially the 3 big questions I have in mind.

And yes, I did say NO to this investment.

Remember this quote from Aaron Levenstein,

“Statistics are like bikinis. They reveal what is essential but hide what is vital.”

Anyways, it is time to convey my thanks to the contributors.

2 people are eligible to receive one of the following:

- 1 year subscription to the Uno Plan (worth Rs. 950) on the Unovest Platform.

- If you are already a subscriber, then you get a 20 minute phone consultation time with me to discuss anything.

- Additional 10% off on the Money Master Course, which begins soon.

Congratulations! An email is on the way to your inbox.

Leave a Reply