In 2016, ICICI Prudential Mutual Fund became the largest fund house by assets. One of the funds that rode along with it into this stardom was ICICI Prudential Value Discovery Fund, a fund that started as a midcap fund in August 2004.

The ICICI Pru value discovery fund’s stated objective is to:

to invest stocks available at a discount to their intrinsic value, through a process of `Discovery’. The process involves identifying companies that are well managed, fundamentally strong, and are available at a price, which can be termed as a bargain.

Through this bargain hunting, it aims to discover and benefit from undervalued stocks.

It is relevant to note that with value investing, all that an investor looks for is a business that is available at less than its intrinsic value. (a subject for another day)

So, for example, if there is a manufacturing company whose current stock price is less than the total market value of all its assets including plant, machinery, land, cash in bank, etc, then it qualifies as an undervalued stock.

The question remains as to how much steadfast and committed did the fund remain to this approach.

Anyways, that didn’t matter to the investors.

Over the years, the fund delivered above average performance and soon became an investor/distributor darling. The fund attracted more and more assets.

The size of ICICI Pru value discovery fund grew from 0 to Rs. 10,000 crores in about 10 years. However, it took less than 2 years to grow another 70% to Rs. 17,000 crores.

Size brings with it problems, specially if you start as a focused fund. More so in this case, since ICICI Pru Value Discovery Fund called itself a midcap fund.

You see, you cannot remain a midcap fund with more than Rs. 10,000 crore asset size.

Two big reasons.

- There are only as much opportunities available in midcaps.

- SEBI rules also restrict a fund from owning entire companies and hence that further restricts how much you invest in any one company.

The fund house probably became greedy. It didn’t want to turn the tap off and stop further investments. And so, it decide to do something else. It started to accommodate.

Thus the fund restructured itself, quietly though.

First, it started to invest in large cap stocks. Where else would it find the avenues to deploy all that money. This was visible as early as 2014-15.

Next, it changed its benchmark to S&P BSE 500 from CNX Midcap. this was a clear signal that the fund would now be managed as a multicap/flexicap fund. It will find and invest in opportunities across the market and not limit itself to mid cap stocks. This happened in late 2015.

The current fund managers too are at the helm only from January 2013.

However, the fund continues to maintain that it still follows its original philosophy of value investing.

The current portfolio of the fund doesn’t seem completely in line with that philosophy.

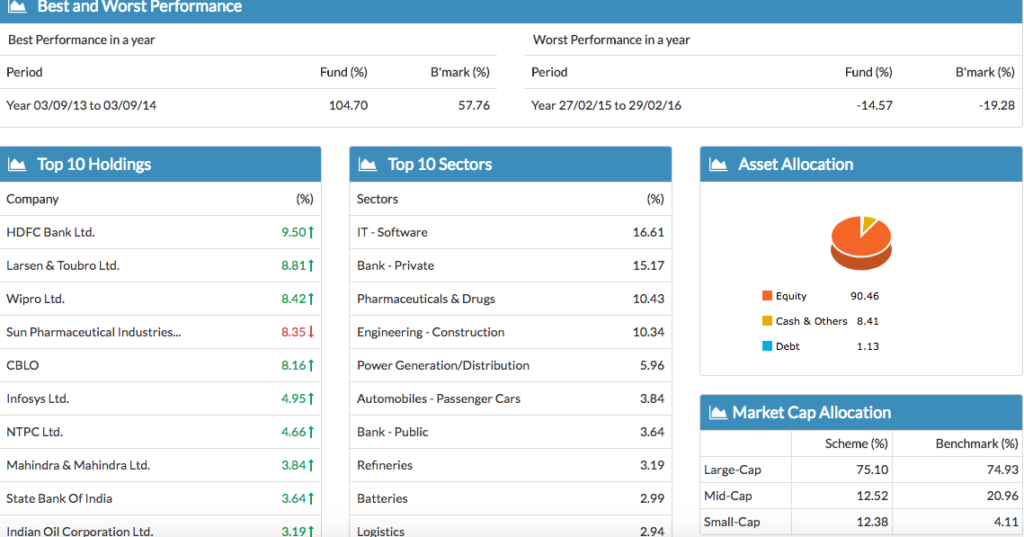

Source: Unovest, data as on July 31, 2017.

Does the investor care?

But an investor is not looking for this gyan. The investor wants the fund to deliver alpha performance.

Unfortunately, the current performance is completely uninspiring. Forget the Total Returns Benchmark, the fund underperformed even its price benchmark in the last 1 year.

Investor’s are running like plucked chicken wondering what to do – stay, sell, invest?

The problem is not as much with the performance as is with the investor’s reference point.

The investors entered the fund with an anchoring basis. They saw the huge returns, which was a result of it mid cap avatar. They expected the fund to deliver on the same lines.

As a multicap fund, it will be difficult to replicate that feat. The risk reward ratio has changed now.

Media has played an ignorant role in further confusing investors.

The sorry part is that several analysis of the fund ignore its history. Even in terms of performance comparison they use statements such as “In the 8 of the last 10 years, the fund has outperformed its benchmark BSE 500.”

As if, BSE 500 was its benchmark forever. It’s an incorrect representation.

Ideally, for performance comparison, you shouldn’t be looking at its regular plan history since beginning. Look at only the past 3 years. In fact, in its current avatar as a multicap fund, the direct plan of the fund has more relevant history.

Finally, if you are planning to invest in ICICI Pru Value Discovery Fund, you should have a minimum time horizon of 5 years. There is no point panicking every few months.

As an investor, you should now be ready for more tamed returns, like any other multicap fund. Please adjust your expectations. The fund has already adjusted itself.

To know more facts about the ICICI Pru Value Discovery Fund, click here.

What’s your take on this fund? Do share with us in the comments.

Excellent analysis Vipin on this one.

In fact, if we look a little deeper and dispassionately we will find a lot of other funds like these from big names doing similar stuff.

One such practice is merging underperforming funds with top performing ones in the same fund house which conveniently results in eradication of historical track record of the underperforming fund – Of course, it doesn’t help investors as they don;t have the luxury of getting rid of historical underperformance. Rating agencies also don’t have any system to capture this behavior. The research which captures this issue is called Survivorship bias, which means a bias in reported performance figures due to data availability of only surviving funds and not the funds which got merged or discontinued.

True Ashish.

funds like this one which has seen a drastic increase in AUM, made the fund mangers difficult in producing the past alpha,with there current mandate.As said, they need to change the avatar to multi caps and large caps to show same past alpha.Otherwise they may end up like passive index fund as well, who knows 🙂 .So as an investor,before investing we should have some realistic returns expectation from the equity mfs, not taking the past returns as your expectation.Then you won’t be disappointed.This one is classic case.Good one vipin.

Thanks for adding Sai. Keeping expectations in check is key.

As a retail investor if one is not able to track all these changes, it is prudent to index. Nifty Next 50 Index Fund of same fund house.