One of the more popular funds from Franklin Templeton AMC is the Franklin India High Growth Companies Fund.

The fund has just completed 10 years of existence. It started in July 2007 when the previous bull market was hitting its peak.

As is the norm, new fund schemes get launched during such times to capture on renewed and bullish interest of old and new investors.

The fund is categorised as a flexicap / multi cap fund, which means it can invest across the market. Keeping in line with that status, its benchmark too is the Nifty 500, the broad market index from NSE.

In terms of Asset Allocation, the fund has a stated mandate to invest in equity and related investments from 70 to 100% of the portfolio, it can also invest in debt and fixed income instruments upto 30% of its portfolio.

As mentioned before, the fund aims to find high growth opportunities across sectors and market caps. The definition of high growth is not clearly stated. In one way, any multi cap fund would be following a similar strategy.

Franklin has 2 more quite well known funds in the multi cap space – Franklin India Flexicap fund and Franklin India Prima Plus Fund.

How does Franklin India High Growth companies fund differ?

The big difference is that the high growth companies fund is more nimble in its approach.

It has a lesser focus on large caps. As of July 2017, while the other 2 funds have 70% plus exposure to large caps, High Growth fund has only 62%. The fund is more aggressive than its 2 peers.

It goes without saying that high growth opportunities are more likely to come by in the mid cap and small cap space.

Let’s look at the other side.

Interestingly, in just the last 3 odd years, the fund has almost doubled the assets it manages. The AUM as of July 2017 stands at approx. Rs. 7000 crores.

In fact, I have seen this fund a part of majority of investor portfolios I have looked at with most adding them during 2015-16. That is when the past performance number started to look super attractive.

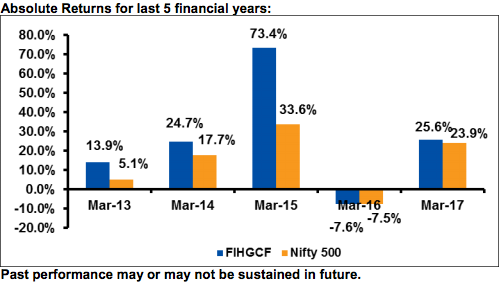

The reason is not far to seek. See this chart below:

Source: Fund SID, regular plan returns.

As you see, financial year 2015 was a bonanza year for the fund clocking a 73.4% growth in its regular plan NAV. For the direct plan, the growth figure in the same period is 75.4%.

Combine 2014 and 2015 growth and you a 100%+ growth in the fund’s NAV.

For investors solely guided by the past performance of the fund, this appeared to be an ultimate winner. And they voted with their money passed on to the fund.

The effect of that one time ‘high growth’ will continue to dazzle for a couple of more years, before it starts to settle towards its average.

I hope you realise the problem. You enter after the high performance is done to only get the average performance later.

Other facts about Franklin India High Growth Companies Fund

The fund manager of the fund has also changed since May 2016. The new manager Anand Radhakrishnan replaced the earlier manager, R Janakiraman.

The fund has also been increasing its expense ratio steadily over the past year. From 1.02 % in May 2016, the expense ratio now stands at 1.24% as of June 2017, an increase of 21.6%.

I find this very amusing that a fund with steadily growing AUM chooses to increase its expense ratio. Read my disappointment on increasing expense ratios here.

Based on the turnover ratio (above 40%) of the fund, the average holding period of a stock in its portfolio is 2 to 2.5 years. That suggests a quite active portfolio with lots of buying and selling decisions.

One of the facts you probably would not know as an investor, is that the fund has an exit load till 2 years of holding. You have to pay 1% of the market value of your investment as exit load if you redeem or switch out before 2 years of allotment.

To know more about the fund and peer comparison, click here.

Note: I have no holding in this fund. This note is only for educational purpose and should not be construed as investment advice.

Leave a Reply