The Franklin Ultra Short Bond fund is a debt mutual fund which invests in various short term corporate bonds, government securities and money market instruments.

If you look at the holdings of this fund, you will observe that they all carry a credit rating. A credit rating gives an idea about how safe or not is the investment and whether the issuer is in a position to service the debt in a regular manner.

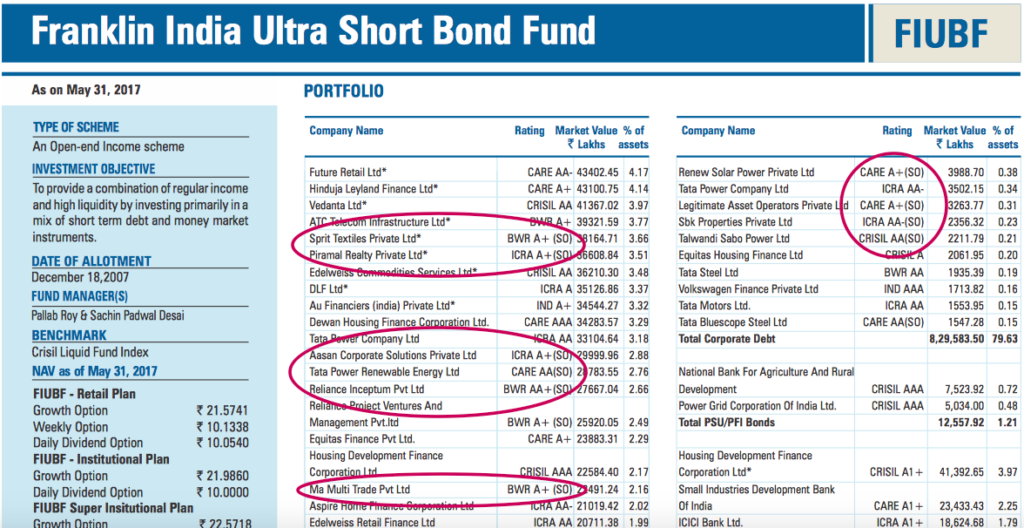

Have a look at the snapshot below. This is from the latest factsheet of Franklin India Ultra Short Bond Fund.

Source: www.franklintempletonindia.com

Now, Take for instance a few of its holdings:

- Piramal Realty – ICRA A+ (SO)

- Ma Multi Trade Pvt Ltd – BWR A+ (SO)

- Renew Solar Power – CARE A+ (SO)

- Talwandi Sabo Power – CRISIL AA(SO)

The first word in these ratings is the name of the rating agency. The next letters AA, A+ refer to the rating. The top most rating is AAA and the lowest is Junk usually denoted by D.

Debt instruments with upto BBB- or more rating are considered investment grade. Anything lower than that is speculative or junk.

However, as you see, there is this additional mark (SO) with these ratings. What is this?

What does SO mean?

SO refers to a Structured Obligation.

A structured obligation is a modified way to raise funds from the market.

Organisations which use this method create a Special Purpose Vehicle or SPV (usually a Trust) and commit their existing assets or future receivables to it. It then creates special ownership rights called as Pass Through Certificates or PTCs and sells them to prospective investors.

These certificates can come in various pools or tranches, some being high credit quality while others taking the lower grade. As a result, they enjoy different return profiles as well.

The investors buy into these certificates/instruments based on their risk taking ability thus providing funds to the organisation for its further use. Banks, Financial Institutions, Infrastructure companies use this method a lot to raise money.

For an organisation whose individual credit rating is not good can create an SPV structure and command a better rating. This allows them to either raise more funds than they could as an organisation or at lower interest cost or both.

The rating agencies use the SO mark to differentiate these instruments from others.

Do structured obligations pose additional risk?

A structured obligation for all practical purposes is as good as a fixed income instrument except for the way it is structured. This can introduce additional risks.

It can have, for example liquidity risk, since the market for structured products is not very deep.

If there were to be a default from this portfolio, there may be no other recourse to recovery. To compensate for this additional risks, these instruments can offer a higher reward to the investors.

In some cases, these investments tend to uplift their credit profile by using various measures. For instance, they can go for credit enhancement where a bank or financial institution agrees to provide additional funds to service the investors, in case the cash flows from the investment itself were to suffer.

In other cases, a group company or another entity guarantees the servicing (return of principal + interest) of these investments.

These credit enhancements and guarantees make structured obligations more attractive for investors who are willing to take on more risk for a higher reward.

Should you worry if your fund holds Structured Obligations?

From your debt funds holdings point of view, the fund manager has to take into account the investment mandate of the fund and see if such an investment fits in the profile. If the fund has a mandate to go only for AAA investments with no exposure to structured investments or derivatives then such investments should be a NO NO.

If the fund mandate allows, then the manager has to work out the risk reward ratio and evaluate if the risk with the investment is being adequately compensated via returns.

For the Franklin fund, most of the structured obligation instruments are rated A+ or above. This indicates that they enjoy a good credit profile and are likely to return the principal as well as the interest to the investor.

Having said that, the fund manager has to do a original evaluation of the instrument and not completely rely on the credit rating provided by a third party*.

There have been instances in the past where funds have held questionable debt instruments which have been downgraded by credit agencies later. The downgrade triggers a fall in their tradability and negatively impacts the value of the holding in a fund’s portfolio. We had J P Morgan (because of Amtek Auto crisis) and Taurus funds being affected.

Franklin’s funds as also ICICI Prudential have been impacted by JSPL downgrades which it had to sell at a loss. Here’s a related article.

This was not a structured obligation though. They were ordinary fixed income corporate debt issues.

For you as an investor, it is important to entrust your money to a manager who does not take undue risks with your money. And you too, along with your advisor, need to keep an eye on the portfolio to see if your portfolio risk is in line with your personal risk preference.

Note: *The working of credit rating agencies has been questionable in the recent times. However, one can use them as an input and not as a final parameter to arrive at an investment decision.

Leave a Reply