There is a concern raised on rising cash holding levels in mutual funds.

The argument against holding cash is that it can lead to underperformance as the markets may rally faster than the funds can search for opportunities to deploy the cash.

Let’s see if this argument holds any water.

Why is a fund holding cash in its portfolio?

Point 1, a fund needs to hold some cash to meet short term liquidity needs such as redemptions, etc. This is typically a lower portion of the portfolio, say upto 5%.

Point 2, some funds hold cash as a part of their investment strategy or their inherent nature.

Such funds fall into 3 categories:

- Dynamic Funds: They intend to switch to debt or equity based on their assessment of overall market valuations. They move the portfolio across asset classes. When stock valuations turn expensive, they add on a lot more debt/cash and vice versa. E.g. ICICI Pru Dynamic Plan

- Hybrid Funds: Here we refer primarily to hybrid equity funds. They are also known as balanced funds. These funds have a minimum of 65% invested in equity and the remaining in debt or cash. They rebalance the portfolio between debt and equity to maintain the stated allocation. E.g. HDFC Prudence Fund

- Value focus funds: These funds do not buy unless the a business is available at the right price, at least as per their evaluation criteria. E.g. Quantum Long Term Equity Fund

What is the result of the ‘holding cash’ strategy for each of these funds? Does the performance suffer?

Let’s use some data.

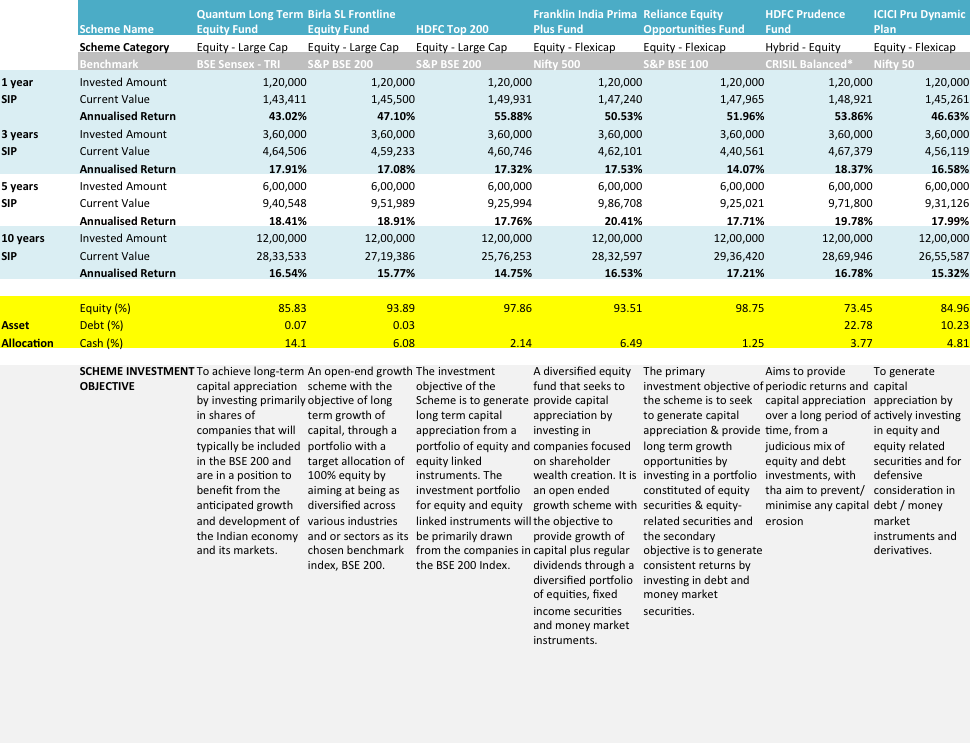

Take a look at the following table.

IS CASH HOLDING BAD FOR FUND PERFORMANCE?

Data Source: smart.unovest.co; HDFC Prudence’s benchmark is CRISIL Balanced – Aggressive Index. Data points as on May 11, 2017.

As you can see, there are 7 funds – 3 Flexi caps (Reliance Equity Opportunities, Franklin India Prima Plus) 2 large cap – Birla Sunlife Frontline Equity & HDFC Top 200) and 1 each of the categories identified above, that is, hybrid-equity, dynamic plan and value focus.

These funds are some of the most popular funds given and also command large Assets Under Management or follow the ‘holding cash’ strategy to the hilt.

Only regular plans have been considered to study data over longer periods. Direct plans were started only from Jan 1, 2013.

For reference, the stated investment objective and the current asset allocation of the funds is also included.

The SIP performance of the funds over past 3, 5 and 10 year periods is mentioned. The SIP amount is Rs.10,000 per month. The performance is measured backwards from May 2016 for the stated time period.

To put it in context, in December 2014, Quantum Long Term Equity was holding cash to the extent of over 30% of its portfolio. Even as recent as April 2016, the cash holding in the fund is over 15%.

Did the performance suffer because of holding cash?

Based on the selected funds that we studied, it appears that, if done right, holding cash is not working against funds holding cash. Except for ICICI Pru Dynamic Plan, which faltered on its performance.

Quantum’s fund, despite having significant cash holdings, has managed to deliver a performance at par or sometimes better than its peers.

Compared to the ICICI Dynamic Plan, HDFC Prudence has done a much better job. As a hybrid fund, it has deftly used equity and debt to deliver a superior performance.

Another noteworthy effect of this strategy is that these funds are able to reduce volatility in their portfolio and provide better risk-adjusted returns.

Should you be worried about a fund holding cash or not?

Frankly, it’s a choice you have to make.

Any fund that does not deliver, with cash holding or without, is a matter of concern. If you continue to believe in the fund house, the scheme, its investment objective and its process, hold on. Else, you can always move your money to a different fund.

Remember though, funds that hold cash, may underperform in the short term. That’s a given.

Unsolicited advice: Do not evaluate a mutual fund on the basis of just 1 or 2 year performance. Go beyond performance.

What’s your vote? Do let us know in the comments.

Leave a Reply