Have you come across fund schemes given below?

- Birla Sunlife MIP II – Savings 5

- Birla Sunlife MIP II – Wealth 25

- HDFC Children’s gift fund

- HDFC MIP

- HDFC Multiple Yield Fund

- HDFC Retirement savings fund

- ICICI Pru Child care plan

- ICICI Pru MIP

- SBI Regular Savings Fund

- Sundaram Regular Savings Fund

There are many more similar ones from almost each and every fund house.

All these schemes fall under a category called Monthly Income Plans or MIP. While several of them have the words MIP or Monthly Income Plan included in their names, that’s not a prerequisite. See the examples used before.

What is a Monthly Income Plan or MIP?

An MIP is what you call a hybrid investment with a mix of debt and equity components. The debt portion is typically more than 70%, rest is invested into equity.

The idea behind an MIP is to attract that investor who is not so happy with the returns of a Bank Fixed Deposit and is willing to take a small risk to get a better return.

So, the financial engineers working at the mutual funds created the MIP. The debt portion provides the safety to the portfolio where it relies on bonds to bring in more certainty. The equity portion is expected to bring in that extra kicker of returns.

So, do you get a monthly income?

To get a monthly income, you will have to choose a monthly dividend payout option. Strange as it may sound!

The irony is you can actually choose a growth option in a Monthly Income Plan where the value of your holding keeps going up.

By the way, the dividends are not guaranteed. If the fund manages to make money, it will announce a dividend. If push comes to shove, they may even sell existing investments within a fund to generate cash to pay the dividend (income).

Then why are they called MIP?

Well, that’s the job of the marketing department. To enhance its appeal to a low risk, income seeking investor, it was named as an MIP. In fact, they went a step ahead and used some emotional hooks such as child, retirement, etc. See the example names mentioned at the beginning.

What about taxation?

That’s an important question. An MIP is taxed like a debt fund. It means that if you sell the fund before 3 years of buying, the capital gains are taxed as per your income tax bracket.

However, if you sell it after 3 years, you get to index your cost and pay a lower tax at 20% of the cost indexed capital gains.

From a taxation point of view, it is more efficient on a 3 year plus holding basis, as is any other debt fund.

Also, while the dividends are tax-free in your hands, the fund pays a 28.84% dividend distribution tax on your behalf, which is ultimately charged to the fund expenses.

Ah, expenses. What kind of expenses do these funds charge?

Expenses is a touchy topic. If you were to look at the structure of MIPs, the most aggressive ones hold about 25 to 30% equity and the rest in debt. The debt portfolio is also in medium to long term bonds.

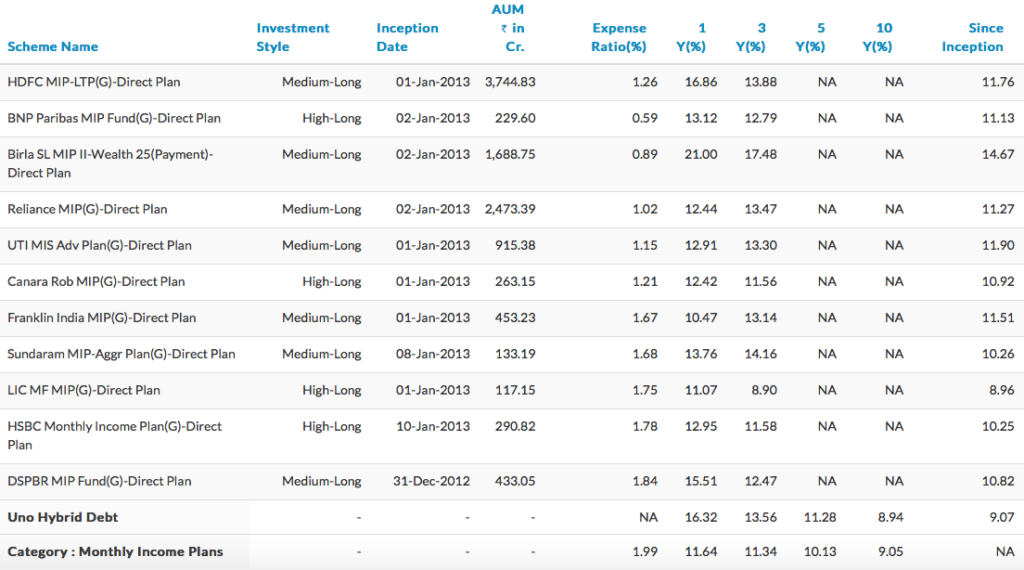

The expense ratio of Birla SL MIP – 25 is about 0.89%. For HDFC MIP – Long term plan, the expense ratio is at 1.26%. The number for ICICI Pru MIP is 1.81%.

All ratios are for direct plans only. See more the peer comparison table of monthly income plans below.

There is a quite a range. In some cases the expense ratios are equal to those charged by equity funds.

Source: Unovest. Data as on April 14, 2017 for direct plans only.

Does it make sense to invest in an MIP?

The benefit of having an MIP is the auto rebalancing in the fund. Since it strives to maintain a pre-defined ratio of debt:equity, it keeps rebalancing the portfolio to maintain the ratio.

For those who cannot take the effort (basically, you are lazy) to maintain a similar asset allocation may be better off using an MIP.

But overall it is a disaster. You see you include equity investment in a fund, take on the risk associated with equities and yet get taxed like debt.

If you know, an equity fund after 1 year of holding attracts zero tax on capital gains. But for MIP, the taxation is as mentioned earlier.

What’s the alternative?

The alternative is to choose a pure debt fund or bonds for upto 70% of the portfolio and invest the remaining money into an equity fund.

The further caution is don’t chase the returns only. A Birla SunLife MIP was able to deliver a 21% 1 year return for specific reasons in investment choice. It is unlikely to replicate it in the future.

As far as returns are concerned, your expected returns will be in line with the broad asset class expectation. Read more here.

Take these facts into consideration before you make your investment into an MIP.

Note: Unovest does not recommend MIPs in its MF portfolios.

These so-called MIPs also charge an exit load if you redeem within 1 year. Some of them — those with retirement or children in their names — make you hold for 3 years to avoid any exit loads. Proceed with caution if you expect to redeem within 3 years.

Good point, Jai.