One of the biggest pain points in mutual fund investing has been the KYC or Know your Customer. Most likely you have gone through it.

Initially, it was a plain simple application in a physical form with basic investor details. Subsequently, an In Person Verification or IPV was made mandatory.

Today, it is a much simpler process, less time consuming and completely online.

Now the big question – how do you get your EKYC done?

Thankfully, several agencies specially mutual funds have jumped onto the bandwagon to help you do your KYC. Mutual Funds houses such as Aditya Birla SunLife, Nippon, Quantum, ICICI Pru, etc are offering online facility to enable this.

There are caveats though. Some fund houses expect you to make an investment with them. So, as long as you plan to invest with them, this should not bother you.

The one service which does it without any obligation (except for your permission to send marketing messages to your email) is that of Quantum Mutual Fund.

Here’s the link to Quantum’s eKYC Process page. (best done on Chrome)

ICICI Pru Mutual Fund has come with a completely online process to do KYC in association with Signzy.

Some of the key features of online KYC service are:

- You do not need to send any physical documents.

- The whole process is instant without delay or need for any person visiting your place or online for doing IPV.

- This process is valid for only new KYCs. You cannot update your KYC for any changes using this process. All changes are to be processed via offline applications.

Once you submit the required information, it takes about 2 weeks for your KYC to be registered.

How to do your KYC with ICICI Pru MF in 10 minutes?

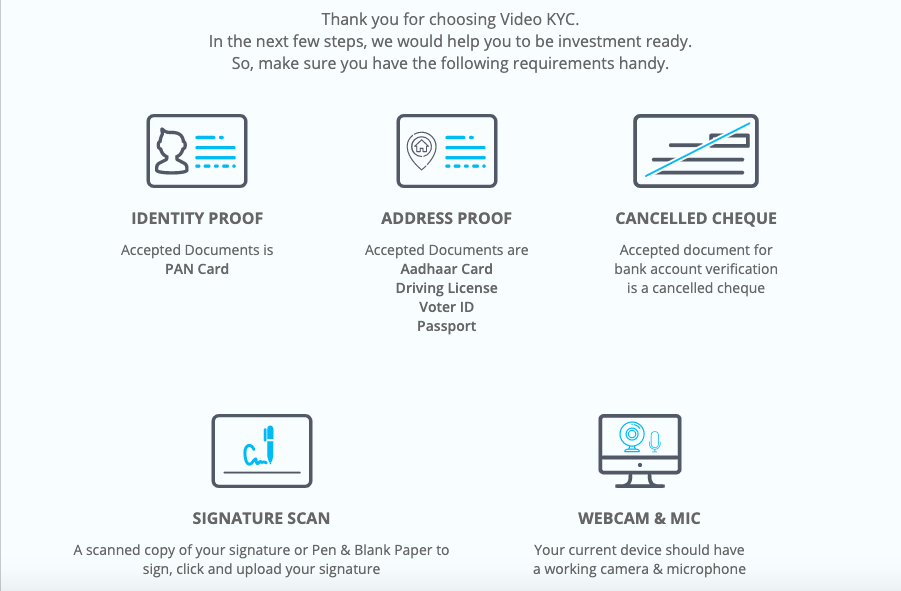

Before you proceed, keep the following ready.

- Latest Web browser – Chrome/Firefox/Mozilla

- A reasonably smooth internet connection.

- Working Web camera & microphone

- Identify Proof – PAN card

- Address Proof as one of Aadhar card, Voter ID, Driving License and Passport (verified via Digilocker, you should have a DigiLocker account)

- Signed Cancelled Cheque (for bank account verification)

- Signature Scan copy

Once you are ready:

- Go to https://www.icicipruamc.com/online-kyc. (For best results, use Chrome browser)

- Enter your Name, PAN, Email and Mobile. The system checks if it is a valid PAN.

- On the next page, you will get to view all the required documents as mentioned before. (If you already have a previous KYC, it will show your previous documents with an option to change them)

- In a step by step process, you will upload all the documents.

- You add your photo by clicking via your device camera. (Yes, be dressed properly)

- For your signature, you can sign on a plain piece of paper and take a picture of it. Then upload it to the site.

- Next is IPV or In person verification. Your IPV is done via a live video recording through your device camera.

- Confirm all the information you have provided and submit.

It’s done. Yes, your KYC is now uploaded to the servers and it is verified and registered within 2 weeks. You will also receive an email communication stating the same.

—

You can also do eKYC with CAMS as well as Karvy. However, they may insist to make an investment with one of their serviced funds. You can always choose a liquid fund with a minimum investment to get past this hurdle.

The biggest benefit of online KYC

The biggest benefit of online KYC is to people residing at distant locations including NRIs. Using this feature, you can now get your KYC done. So, get going!

And once your KYC is registered, take the next step to create your online CAN. Here’s how.

And when you are ready to take a structured approach to build generational, long term wealth, come visit here

It is a very good experience for me with quantum in doing my ekyc. they have pioneered in this thing especially the feature of eipv. As explained by you in the article it happened in the same way for me .simply just follow the process mentioned by you.Best part they are not insisting that after making investment only they will do your kyc. After submitting the application i got the kyc updated exactly after 2 weeks.i got a email and SMS from CKYC saying that my kyc has been registered in the CKYC database and a CKYC identifier no.they have given to me.Thanks vipin for writing such a good article in simple words in your style 🙂

Thanks Sai. You have been a great encouragement.

Good article. One thing is not clear though. In the section How is it different from Aadhar based eKYC?, you have said that “However, this KYC is limited in nature. You can invest only upto Rs. 50,000 in a fund in one year.”

Do you mean to say that if we do our KYC through Quantum MF, we can invest only upto 50K in a fund in one year?

50,000 per fund per year is what it means and is applicable to Aadhar based eKYC. The one explained in the article is for Central KYC with IPV. Aadhar based eKYC is offered by most fund houses as well as CAMS and Karvy. Hope this clarifies.

Will our existing KYC will be ported to Central KYC (I already have KYC and investing in MF) or we have to do this eKYC?

HI Riyaz,

Your current KYC will be ported to Central KYC.

Hello Vipin, I am already a KYC compliant and investing in mutual funds. Do I have to follow this process to get CKYC done or my existing KYC details along with FATCA and additional KYC details will be uploaded to CKYC? Kindly clarify. Thanks, NK Vijayvargiya

Hi,

You should check your current KYC status using this link

http://cvlkra.com/kycpaninquiry.aspx

If your IPV flags is Yes, then you don’t need to do anything. Thanks

Hello Vipin,

I checked the IPV flags at the above mentioned link as stated by you. For CVL KRA, the IPV flag value is Yes whereas for NMDL KRA the value is empty.

For few more KRA’s like DOTEX,CAMS and KARVY it shows as not checked .What does this mean?

Which KYC is created for me CKYC?Can I go ahead and create my e-CAN? Please suggest. Thanks.

Regards,

Ragavendra

Even if one IPV flag is yes, it is good to go. You may proceed to create ECAN. Thanks.

Thanks

Still, physical verification is kept as requirement. This should be done away with as for Aadhaar Card, physical presence is mandatory to ensure taking finger print etc. It should be based on aadhar verification and for ensuring additional security, let the concened agency officer talk to the investor placing online application for verification of details to make it doubly sure. But physical verification and presence should be done away with. At two places, physical presence and verification should continue, for issue of Passport and for issue of Aadhar Card.

This will be a most user friendly measure to give impetus to central kyc totally paperless and least hassle or hassleless for investors.

Good Article and process explained.

I have attempted today to do CKYC, since I have already done KYC previously but there is not KIN number.

I have followed steps upto 5 its then divert into investment page only as KYC is already registered but step # 6 as mention” On the next page, your add more of your personal details required for Central KYC.”, it doe s not appearing and unable to do CKYC.

Please provide alternate solution if available.

How to update the KYC details for old registered central KYC users?

For now, that is an offline paper application based process. You can submit one to CAMS / Karvy in the required format.