Do you know you can invest in direct plans of mutual funds on Unovest. Yes, that’s right. No strings attached! No hidden charges! No transaction charges!

Just open an account and start building your mutual fund portfolio right away.

Here’s a step by step process of how you can invest in direct plans of mutual funds on Unovest.

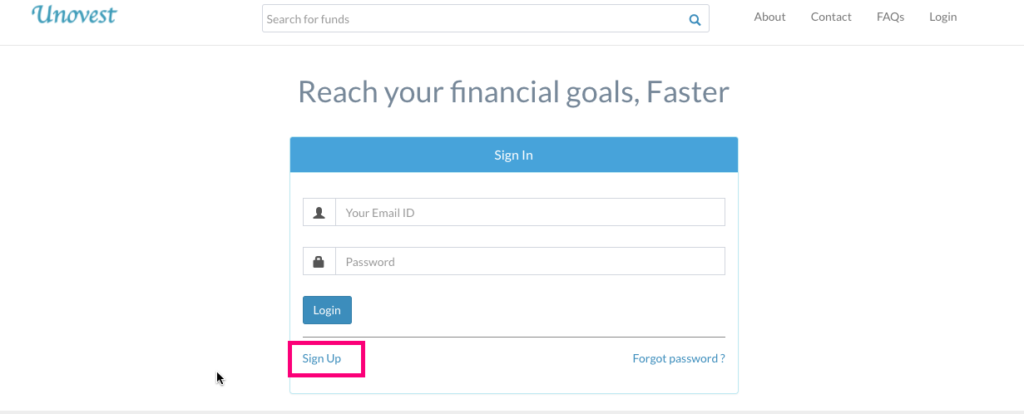

Login to your account at smart.unovest.co. If you don’t have an account, create one at smart.unovest.co.

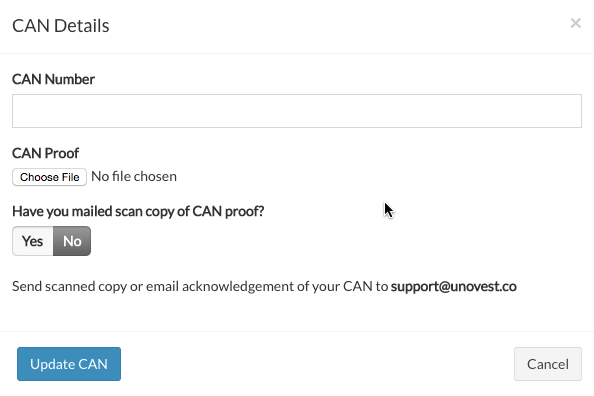

After logging in, you can enter your Common Account Number (CAN). You also have to upload the CAN proof (such as an email from MFU). Our team then verifies the CAN and your Online Transaction service is activated.

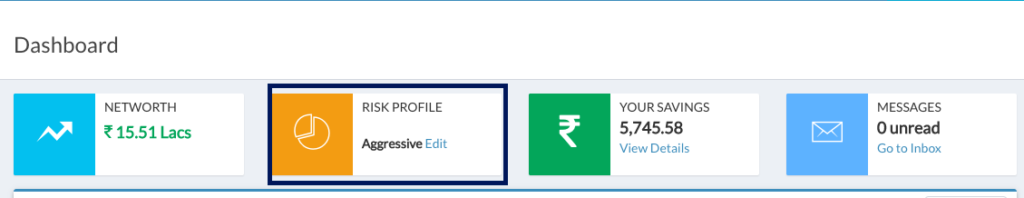

After this, you are required to complete your Risk Profile. You can find the link on the Dashboard or under My Account.

Once you are through this, you can start investing online in direct plans of mutual funds on Unovest. Currently, you can do transactions in mutual fund schemes of 27 fund houses.

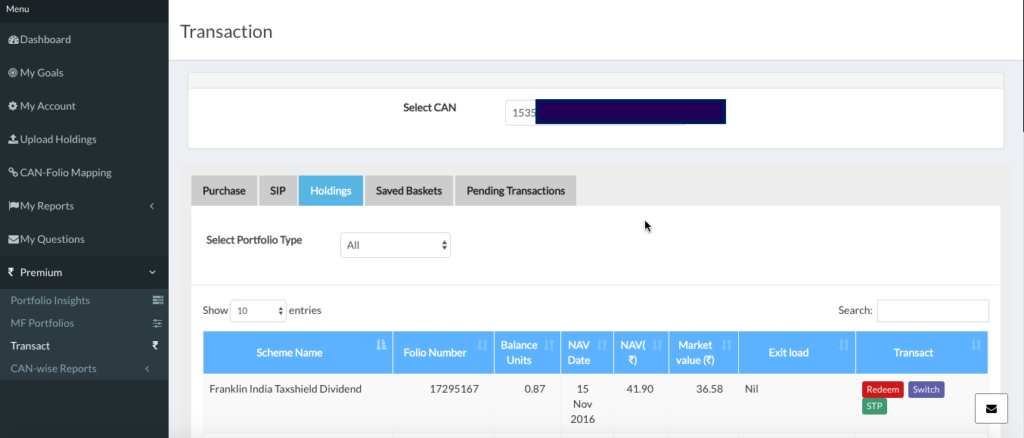

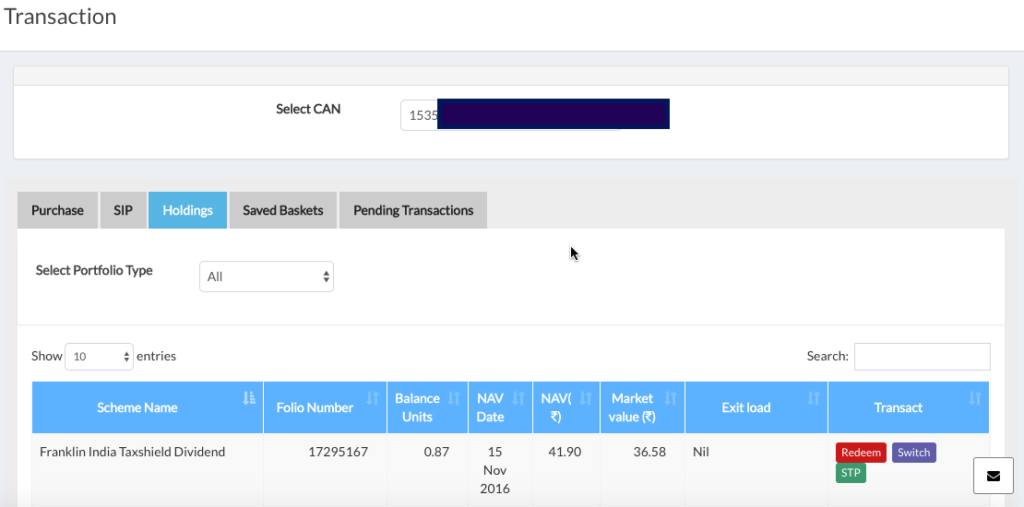

The Transact link is visible under Premium Section on the left hand menu.

You can make lump sum one time investments, sell existing investments, start SIPs and do STPs, SWPs and make Switch transactions (including switch from regular plan to direct plan) through Unovest.

You can execute transaction baskets too, that is, upto 12 transactions of a single nature (Lump sum or SIP or STP or Switch) at one time and with one payment.

You already have investment in mutual funds? Great! You can invest using your existing folios as well.

Once you have created an account with Unovest, you can upload your existing mutual fund details. Here is how to do it: Track all your mutual fund portfolio in one place with Unovest

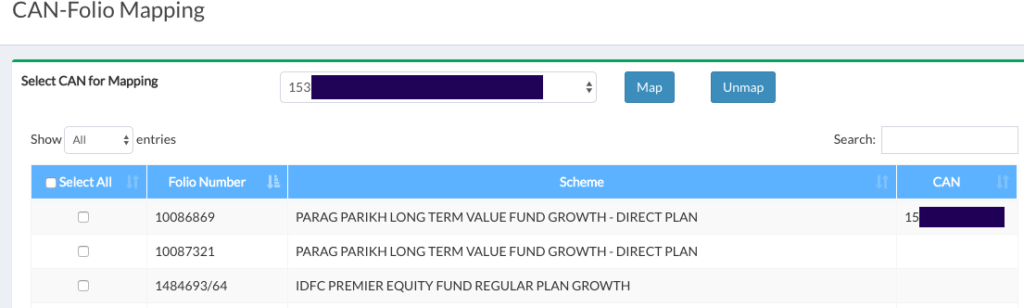

Once the portfolio is uploaded, map your folios to your CAN using CAN-Folio mapping (see left hand menu on Unovest).

Then go to Transact service under Premium Section. There is a list of your existing folios mapped to your CAN along with quick buttons to make a transaction in those folios.

The other interesting feature you can use is the Switch Report. Once you complete your CAN folio mapping, you can use the Switch Report to see which of your existing mutual fund investments in regular plans can be converted into Direct Plans.

This report has information on when these investments will be capital gains tax-free as also free of any exit loads. Regular alerts are also sent to your email to remind you to switch to direct plans, worry free.

Don’t have a CAN or Common Account Number? Not to worry.

If you do not know what a CAN or Common Account Number is, it is your universal folio number for mutual funds, issued by MF Utilities, a Mutual Fund Industry initiative. To know more click here.

You can create your CAN electronically and paperless. It is a one time, highly useful exercise. Click here to know how.

There are 100s of users on Unovest now who believe that this is the place to be for their mutual fund investments and to invest in direct plans.

This is what our premium service user Amit Srivastava, Head of Consulting, Excelsoft Technologies, Delhi/NCR says:

I was looking for a platform to invest into the direct plans of mutual funds. While I perfectly understood the benefits of moving to direct plans, until a while ago, the only option was to invest individually through different AMCs (which would be really painful). To my surprise, I realized that there are several options now to invest in direct plans from a single platform.

I did a thorough research and decided to choose Unovest over the competition for their sheer focus on functional aspects. It took me 5 minutes (yes just 5 minutes!) to register and have a coherent view of my entire mutual fund portfolio invested through different brokerages with some amazing reports. It also suggested which funds I should switch to direct plans. Most importantly, the team responded very promptly to a number of queries that I raised.

Also, based on the MFU platform, you are not locked into Unovest in any way. You can always manage and track your investments from the MFU portal (I bet you won’t do this though!). Wishing the team loads of success ahead!

The power of the Trial Account on Unovest

A 30 day Trial account enables you to do several things including invest in direct plans of mutual funds. You can use it to

- Add your goals,

- Upload your existing mutual fund portfolio in 1-click,

- Create and/or Add your Common Account Number or CAN(s),

- Map your existing folios with your CAN(s) as well as to your goals and

- View quick portfolio reports including a summary, analysis, gain/loss and switch report.

If you want to know which mutual funds to invest in, click here.

Still have questions? Write to us at hello@unovest.co or mention in the comments.

Leave a Reply