It is being said that ULIPs will underperform mutual funds.

Reverse it – Mutual Funds will deliver better returns than ULIPs, for one simple reason – the lower costs of mutual funds.

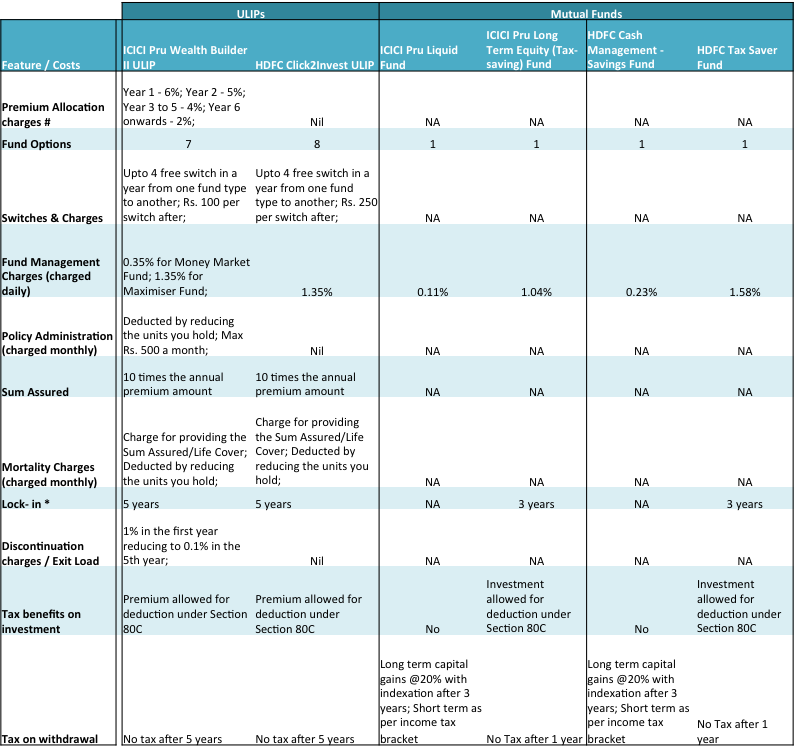

Here is a comparison of 2 ULIPs from 2 of the market leaders ICICI Pru Life Insurance and HDFC Insurance. Pitted against them are mutual funds from the same group companies, which incidentally also are the largest in that space as well.

ULIPs vs Mutual Funds – A comparison

Source: MFs – Unovest; ICICI Pru ULIP – Product Document; HDFC ULIP – HDFC Insurance website; Data as on July 19, 2016.

Notes:

Only direct plans of mutual funds have been considered. Tax saving mutual funds have been considered for better comparison

# Premium allocation charges are deducted from the premium. It reduces your investible amount.

* Liquid funds do not have a lock-in. Generally, exit load of 1% is applicable on equity funds if redeemed within 1 year.

In equity mutual funds, there is no capital gains tax after 1 year of holding.

Some observations from the table on ULIPs vs Mutual Funds :

- The biggest difference between ULIPs and Mutual Funds is the cost – it goes without saying. If everything else remains the same, including the choice of investments, styles, etc., the costs will reduce ULIP returns significantly.

- Between ULIPs and MFs, MFs offer you far more flexibility as an investment. In a ULIP, you cannot withdraw your investment before 5 years. Even your investment underperforms, you cannot do anything. In comparison, you can withdraw money from tax saving fund after 3 years. If tax saving is not your need, then you can choose any equity mutual fund. Yes, ULIPs offer tax free switches and insurance cover, but losing the flexibility is too big a cost to pay.

- ICICI Pru Wealth Builder II ULIP has a range of costs including premium allocation charge and policy admin charges. Between this and the ICICI Pru Long Term Tax Savings Mutual Fund, one will go for the latter. The fund management charge of the mutual fund at 1.07% is far less than 1.35% of the ULIP. The tax is not a differentiator here. Both have similar tax benefits. Final point – You get more returns in mutual funds just because of lower fund management costs and zero premium allocation charges.

- Between HDFC Click2Invest ULIP and HDFC Tax Saver Fund, what would you choose? I would choose none. Just from a cost point of view, there are better options.

- The liquid fund option makes no sense in a ULIP. Look at the HDFC ULIP. Why would you pay 1.35% fund management charge for a liquid fund? HDFCs own liquid mutual fund is a far more cost effective option. In case of ICICI too, it is a no brainer to go for the ICICI liquid mutual fund.

The Cost of Insurance cover in a ULIP

So, ULIP also gives you an insurance cover, which is equal to at least 10 times of your annual premium amount. But how feasible is to take a ULIP for an insurance cover?

For example, you need an insurance cover of Rs. 50 lakhs. In a ULIP, you would need to have a premium of Rs. 5 lakhs annually to get that cover size. A portion of this premium will be used to give you life insurance cover and the rest will be invested in “high expense” funds. In all probability, you will not take a policy with this high a premium and hence leave yourself underinsured.

In contrast, as a 35 year old, you can buy a term plan for your insurance cover. You can get a risk cover of Rs. 50 lakhs for a premium of Rs. 5,000 approx. per year.

Isn’t that interesting?

So, what choice would you make? ULIP or Mutual Fund?

Leave a Reply