The case of expensive mutual funds

Not a long time ago, there were sellers out there who used to convince prospective investors to invest in a mutual fund NFO or a New Fund Offer by showcasing a low price or NAV of Rs. 10.

The existing plans which had a much higher NAV of Rs. 20, Rs. 50 or Rs. 100 were deemed to be expensive. The NFO with a Rs. 10 tag was hence cheaper and made more sense to invest in.

The gullible investor fell for the trick and signed the dotted line. She didn’t know if the investment was a useful addition to her portfolio. She thought she was getting a bargain.

The reality of course was different.

Now, I am not saying all NFOs were mis sold this way but the sad reality is a lot of them were. Investors have lost unbelievable amount of money serving the greed of a few.

Today, the same convoluted logic is likely to be thrown at you with respect to direct plans vs regular plans.

“See Ma’am, the NAV of the direct plan is higher. You should invest in the regular plan and you will get more units allotted.” or so goes the argument.

The truth though is that direct plans are not expensive just because they have a higher NAV. In fact, if at all, they deliver more value compared to regular plans.

Let’s see how.

Are direct plans expensive?

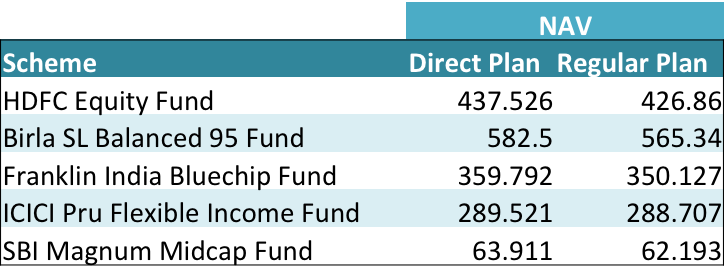

Take the NAV of any direct plan mutual fund and compare it with the NAV a regular plan mutual fund. You will invariably find the direct plan NAV to be higher.

Here are some examples.

Source: Unovest Research. NAVs as on May 9, 2016; Growth options only

A new investor, when she looks at the NAVs in the table above, might feel that the direct plans are indeed expensive. That’s not the correct way to look at NAV.

Let me explain. Now you see, the portfolios of a scheme with direct and regular plan is exactly the same. The only difference between the two is the expense ratio.

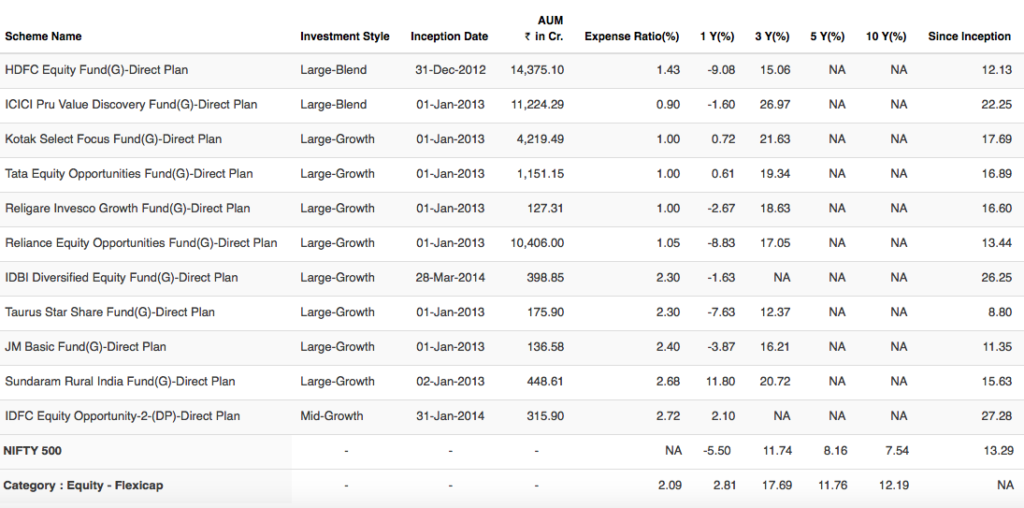

Here are some examples of mutual funds from the flexicap category. Have a look at the expense ratios for direct plans and regular plans.

Source: Unovest Research, Data as on May 06, 2016.

Since the direct plans enjoy a lower expense ratio, it allows the NAV to grow faster. Hence, NAVs of direct plans are higher. By this logic, direct plans deliver more value to you.

Look at the other side – the benefit. If you were to sell your fund, you would get more money from a direct plan than the regular plan, courtesy higher NAV.

And don’t fall for the units trick. You might get lower units but a faster growing NAV will produce better results.

So, are direct plans expensive? You know the truth now.

Read more: All that you need to know about direct plans of mutual funds?

Disclaimer: The mutual fund schemes used in the examples above are only for illustration purpose. They are not recommendations.

[…] proposition of a direct plan is clear. An investor who wishes to bypass the distribution channel and take the DIY approach to […]