If you have recently sold a stock or a mutual fund investment, you need to report capital gains or loss as a part of your income tax returns.

I am sure, like me, you too find the concept of capital gain or loss esoteric to understand. Yes? Well, not anymore.

Here’s a quick primer on what is capital gain or loss and how you can now get a automated readymade report on your mutual fund portfolio gain / loss. It’s easy.

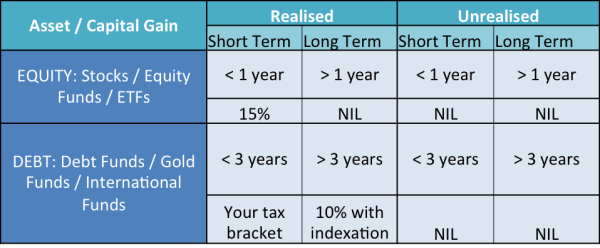

Before we move further with the questions, have a look at the table below.

What is capital gains or loss?

Simply put, when you make an investment and it rises or falls in value, the change is knows as a capital gain or loss respectively. However, you pay the capital gains tax only when you sell the asset and realise the actual gain.

- A capital asset or an investment includes land, building, house, equity mutual funds, stocks, bonds, debentures, debt mutual funds, etc.

- Capital gains / loss can be short term or long term.

- Whether the gain is short or long term is defined by the holding period and the type of asset.

- Equity Mutual Funds, for the purpose of taxation, are those that invest at least 65% of their assets into Indian equities.

- Any fund with less than 65% investment in Indian equities is treated as a Debt Mutual Fund. So, if an international fund makes all its investments outside India, it is treated as a debt fund from tax point of view. A gold fund and a Fund of Fund also fall into the same taxation category.

- Holding period is counted from the date of purchase of the investment to the date of sale.

How is capital gain or loss calculated?

There are certain rules that have to be taken into account. The tax rates are applicable accordingly.

- Equity, if sold after 1 year of holding, will result in long term capital gain / loss. Currently, the long term capital gains tax is ZERO if you are paying Securities Transaction Tax or STT, else you pay tax at 20%* on the capital gains. In certain cases, this rate of tax can be 10%*.

- Short term capital gains in equity are taxed at 15%*.

- Debt, if sold after 3 years of holding, will result in long term capital gain / loss. Gains from debt are taxed at 10% after indexation using Cost-Inflation Index.

- Short term capital gains in debt are taxed at the rate* of your income tax bracket.

- If you have invested in different instalments over a period of time, then the calculation is done on a First in First Out basis.

*plus applicable cess and surcharge

Well, if all this still sounds complicated, there is an easy way to calculate your capital gain or loss on your mutual funds.

Unovest report on capital gains – loss

Unovest has a report which is automatically generated from your mutual fund transaction data. Here is how you can get it too.

Step 1: Upload your existing mutual fund portfolio. It is nothing but your CAMS consolidated transaction statement, which can be uploaded in 1 click onto Unovest.

Step 2: Go to Gain – Loss report under My Reports and see your capital gains statement for any selected financial year. The report is free to view.

Here is how the Capital Gain / Loss report on Unovest looks like.

You will notice two column headings in the report – Realised Gain / Loss and Unrealised Gain / Loss.

- Realised gains or loss are calculated for the investments that are sold during the financial year. This is what has to be disclosed in your income tax returns.

- Unrealised gains or loss represent the gain/loss for the investments that you continue to hold.

So, isn’t it easy to get to know the gain / loss on you mutual funds?

What are you waiting for? Upload your latest mutual fund portfolio on Unovest and see the capital gains or loss on your own mutual investments.

Leave a Reply