Lesson #4

Do you know how much tax do you pay on your annual income?

If you have an income of over Rs. 10 lakhs per annum, you easily fall into the 30% tax bracket. What it means is that a portion of your income will be taxed at the highest rate of 30%. That’s a big cut of your hard-earned money!

When you are a salaried person, I totally understand ‘what a pain taxes are‘. I have been there too. We feel the pain when the salary that we receive and the one we we signed on in the appointment letter is never the same. The annual bonus too somehow magically is just 70% of the declared number. And as you rise up the career ladder, your income ladder always seems to lag behind.

All this is courtesy one Income Tax Department that makes some demands on your hard earned money with that one dreaded word, TAX. Even before the monthly paycheque hits the bank account, the tax guys have already deducted the tax in advance. And what we have is just the leftovers.

Early on in the year, the HR department chases you to declare your investments for tax savings. When you don’t, it follows up with a threat note that says, “Taxes will be deducted”. And then starts the scramble to find out what you can do to reduce your taxes to less than the minimum.

As the year end approaches, there is yet another battle to provide proofs of investment or expenses against which you claim a lower tax. If you do not do it within the deadline, you risk your salary being reduced to just a pittance.

You realise that you haven’t done much so far and so begins the act of making mindless investments that add little value. You end up buying crappy insurance and tax products just to make sure that you are saved the tax guillotine.

Worse, sometimes under pressing work conditions you are just like “who’s going to bother with all this headache” and you just give it away – you decide not to do anything and let the taxes eat away your salary. After all with your talent, you can always make more money. Ah!

Sounds familiar? Let me tell you that you are not alone in this trial by taxes.

Why does it repeat itself with such consistency? The reason is not too far to seek.

Simply, it is a lack of adequate understanding of the investment and tax planning methods.

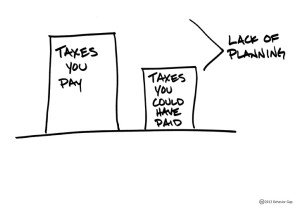

Taxes deserve planning and nothing represents this better than the following sketch by Carl Richards of BehaviorGap.

Source: Behaviorgap.com

Plan your savings smartly to save taxes (and fund your week long vacation)

You don’t need to squander your hard earned money to taxes. With a brief understanding of the process and some planning, you can save a lot of money going away to the tax coffers, sometimes as much as to fund a week long vacation with friends and family.

Thankfully, there are several rules that you can use in your favour and save a ton of taxes, either by way of making certain defined expenses or investments.

The beauty of these provisions is that with some thinking you can not only save taxes, a lot of it in fact, but also secure you and your dependents financial future.

In this post, we will see how. Read on…

The 10 step checklist to save taxes smartly

So, as I said just by understanding the tax planning process, you would be able to make a significant difference in the way you approach your tax planning.

You can use some of the most common tax saving options available to build a solid foundation that help you deliver on your investment plan too. Let’s begin.

- First things first. Put your investment plan in place. It should tell you how much insurance you should have, what is the emergency fund corpus that you need to build and what are your investment goals, amount you need for them along with the time period.

Determine what is the amount you need to invest to save taxes to the maximum possible limit. You will need a good tax calculator or your accountant to help you with that.

Buy Life Insurance for self – Buy term plan only (and not any other). Term plan will give you the right amount of insurance cover at the minimum price. The premium paid for the term plan is tax exempt upto Rs. 1.5 lakhs under section 80C of Income Tax (IT) Act.

Buy Health Insurance for self – In the age of rising medical expenses, a health insurance is a must. Health insurance premium of upto Rs. 25,000 paid for your spouse, kids and yourself is eligible for this benefit under Section 80D.

Buy Health Insurance for parents – You can also buy health insurance for your dependent parents too and receive tax benefit as well. Premium upto Rs. 30,000 paid for such insurance is eligible for the benefit under Section 80D.

5-year Bank Fixed Deposits also receive tax benefits under section 80C. Most banks will create one for you. They are risk free and provide assured interest. If you are in a later stage of your life, you will find this option more attractive.

Investment in Public Provident Fund (PPF) also receives tax benefits under section 80C to the extent of Rs. 1.5 lakhs. In fact, it is tax free at all stages – when you invest, the interest you receive and on withdrawal. And it is backed by government guarantee. Your money is totally safe unless the government itself goes bankrupt. You can open a PPF account with a PSU bank or at your neighbourhood Post Office. You can make recurring deposits into it starting as small as Rs. 100.

(Your company may also have an Employee Provident Fund (EPF) where you and your employer contribute equal amounts. That is different from PPF. However, your contribution into EPF is also eligible for tax benefits under Section 80C).If you have financial goals for the long term, say over 5 years, an investment in Equity Linked Savings Scheme (ELSS) popularly known as Tax Saving Mutual Funds is a great option to go for. They are eligible for tax benefits under Section 80C. They invest their funds into stocks of companies and hence take on additional risk which creates an opportunity to generate higher returns. They have a lock in of 3 years – which means you cannot withdraw your investment before 3 years.

National Pension Scheme is another eligible scheme created to provide retirement benefits to Indian Citizens. An amount invested upto Rs. 2 lakhs (1.5 lakhs + additional 50,000) in this scheme is eligible for tax benefits under section 80CCD. But you must be sure you want to do this.

If you have bought a home on a mortgage (Home Loan), then the interest you pay on that loan during a financial year is also eligible for tax savings of upto Rs. 2 lakhs. The principal (repayment of the actual loan) amount is eligible for deduction under Section 80C. These limits are for your first house that either you currently live in or you own one but in a different city.

Important: Spread out your tax related transactions and investments over the year so that you do not feel the load in a single or a couple of months. For example, you can pay for your life insurance in the first couple of months, followed by health insurance. Your other investments could go monthly in the form of systematic investments.

It will be important to note that under section 80C, the overall tax benefit is limited to Rs. 1.5 lakhs. You can make a higher investment in them but they would not receive the tax benefit.

For emergency funds, while you can rely on the investments you make for tax savings too and dip into them if need be, there are several other options (without tax benefits) that you can use.

There are other avenues also that you can factor in to save more taxes. The rent that you pay for your house and some allowances like Conveyance, Medical and Leave Travel can help you further reduce your tax payable.

The week long vacation

Assuming you are in the 30% tax bracket, even if you were to smartly make your investments under Section 80C which has a limit of Rs. 1.5 lakhs then at the rate of 30%, you would already be saving Rs. 45,000. Add others and you are well on your way to a week long vacation. Congratulations!

Be Proactive

You should not take your tax planning lightly. Instead of scrambling at the last moment which can result in poor investment decisions or worse a giveaway to taxes, it is best to start now and ease the pressure. Remember.

A penny saved is a penny earned.

All that you save from going as taxes will add to your wealth over time, bit by bit.

Finally, Benjamin Franklin, who was hailed as the first citizen of the 18th century and an eminent statesman, scientist, inventor and writer remarked, “There are only two things certain in life – death and taxes”.

What can be more true than that?

Now are you ready for a small quiz on your tax knowledge? Click here to check your personal tax quotient.

Please note: Please do not consider this as investment advice. These are only pointers to help you understand the scope of the things you have available.

This note is a part of a free course – Investing 101. Want to subscribe to the full course on email?