A friend in need is a friend indeed, so goes the old saying.

In the world of finance, there are 3 friends that prove that. Like all our friends’ short names, they are called – PV, FV, XIRR, short for Present Value, Future Value and Modified Internal Rate of Return.

Let us get introduced to our friends today.

Investment Decisions Case 1 – Insurance Premium

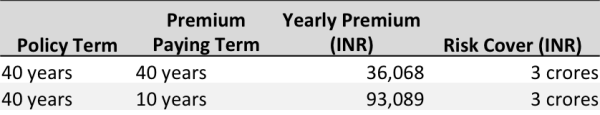

A few weeks ago Rishi called up an insurance company to buy a term plan. He wanted a cover of Rs. 3 crores for 40 years. (Yes, he had used the Insurance calculator you looked at in a previous lesson.)

The agent heard him and said that for a cover of this amount Rahul would have to pay Rs. 36,068 every year as premium.

The agent then told him that he wanted to make another suggestion.

“Yes, tell me.” Rahul was keen to know.

“Sir, I will give you an option where you pay premium for only 10 years but you will get a cover for full 40 years.”

Rahul was excited. This seemed like a bargain.

The agent continued, “The premium in that case would be Rs. 93,089 which you have to pay for only 10 years.”

Rahul first reaction was, “This is expensive, close to 3 times of the regular premium. I don’t think it makes sense.”

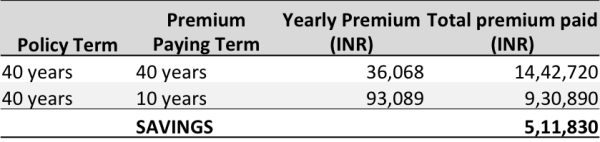

“Hear me out, sir”, the agent was confident. “In fact, you will save upto Rs. 5 lac with this option.”

Rahul was still wondering how is this possible?

“Sir, when you pay 36,000 for 40 years, you pay close to Rs. 14.5 lakhs overall. But when you pay Rs. 93,000 for 10 years, you only pay Rs. 9.3 lakhs.

The difference between the two is over Rs. 5 lakhs. That is your savings.” the agent stopped to take a breath.

Rahul couldn’t believe it. How could he miss a simple calculation like this? It was indeed a huge saving.

But, he wanted to be doubly sure. So he asked the agent to think about it.

Let’s take another case.

Investment Decisions Case 2 – Two birds in one shot!

Siddharth lives abroad and was visiting India for his vacation. He went to the local bank for some paper work.

After the paper work was done, the sweet lady at the desk asked Sid, “Sir, would you want to know about an investment plan?”

“Yeah, sure. Tell me.” Sid was all ears.

“Sir, we have an investment plan where if you invests Rs. 1 lakh for 10 years, then at the end of 20 years, you will get Rs. 20 lakhs.

As you already know, HUFC company is a market leader and our parent company is a trustworthy name in the financial services space.”

For Sid, this sounded like a great plan. Rs. 10 lakhs invested over 10 years doubling in the next 10 years.

He immediately booked the investment and signed the papers.

When he returned home, Sid felt something was not right with what he had done. So, he did the numbers.

Oh God, what a realisation!

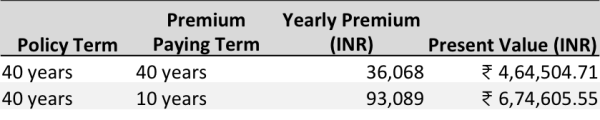

Coming back to the first case, what is a good choice – 10 years premium payment period or 40 years premium payment period?

Prima facie, 10 years looks like the right thing to do. A saving of Rs. 5 lakhs is very attractive.

Until – you remind yourself of the concept of the Time Value of Money.

Simply put, a rupee today is more valuable than a rupee tomorrow.

In this particular case, while we know how much amount is to be paid in each of the years, what we don’t know is the value TODAY of all those future payouts?

How do we calculate this present value? Our friend is here to help – PV.

Just use a simple formula in excel called PV or present value.

Open your excel sheet and in one of the cells, type

=PV(rate, nper, pmt, (fv),type).

You will see the 5 input items. This is what they mean.

RATE is the expected return based on which you will discount the future payments to bring them to the present value. Consider it to be the opportunity cost, or what you would have earned in case you had invested the money elsewhere. In this case, we will consider a rate of 7 to 8%, typically offered by a Bank Fixed Deposit.

NPER is the number of periods for which the payments are made.

PMT is the payment amount, the premium in this case. This option is used when we calculate present value for a series of regular cash flows. We will input the premium amount for PMT.

FV is the future value amount. This option is used when we calculate the value of just 1 cash flow from the future and not a series. We will leave this blank.

TYPE is representative of the fact whether the payment is happening at the beginning of the period or end. So, if you are paying the premium at the beginning of every year, you should enter 1, else 0 or leave blank.

Now, when we apply this quick formula to our two premium payment terms, it appears something like this.

- =PV(8%, 40, -36068,,1)

- =PV(8%, 10, -93089,,1)

And the result.

So, which is the more expensive insurance policy? It’s obvious, right!

Simple mathematics has quite a role to play in investment decisions.

From a planning point of view, it is also important to note that when you take a 40 year policy you have an option to discontinue the policy at a later time, when you may not need the cover.

Our second friend, FV, is quite like our friend PV. We used the PV to calculate present values of future premium payments. Revere this and you can now calculate the future value or the current investment.

Take for example, Rs. 1 lakh invested at 8% for 5 years will be what value at the end.

As per FV formula in excel, =FV(rate,nper,pmt,PV,type)

Looks quite similar to the PV formula?

So, we enter the value =FV(8%,5,,-100000,) and the answer is Rs. 1,46,932.81.

As you would notice, the PMT is used to indicate a series of investments while PV for a one time investment.

If you are making monthly or quarterly investments, then you have to adjust the rate and NPER accordingly.

Try out more for yourself.

Let’s take up Case 2 now.

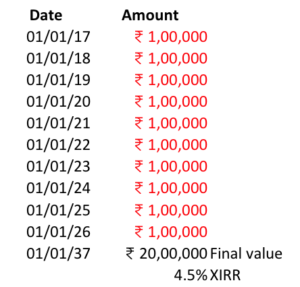

The bank relationship manager says that Rs. 1 lakh per year invested for 10 years will return Rs. 20 lakhs at the end of 20 years.

We will take the help of our third friend, XIRR to solve this problem.

You may first want to read this post to understand how to use XIRR.

Now, let’s look at the numbers presented in the investment proposal to Sid. Here are they. Rs 1 lakh investment for 10 years (red colour indicates cash outflow) and final value of Rs. 20 lakhs after another 10 years.

The red colour indicates a cash outflow or investment.

Using the defined method, we come to know that the internal rate of return from the investment suggested by the banker is a mere 4.5%.

What do you think now of the investment proposal?

Now you have these powerful financial tool in your kit to evaluate your money and investment decisions.

Are there any other tools you use to evaluate your financial decisions? Do share with me at hello@unovest.co.

This note is a part of the free course – Investing 101. Want to receive other lessons of Investing 101 on email?