2018, 2019 and now 2020. Years are going by and there is no respite from bad news.

Latest: COVID-19 has finally been declared a pandemic by WHO, Indian Rupee is depreciating (reached 74+ as of this writing), Stock markets are correcting (10%+ in just last week) and your investment portfolio is in shambles.

If you started investing in mutual funds in the last 3 years, you are undergoing, what is called, a “TRIAL BY FIRE“.

You have been thrown at the deep end of the pool and all you have is a “sinking feeling”.

How does one deal with with this?

Ironically, there is so much written about it already that any more I say is going to read like verbal diarrhoea. And you don’t want that. I don’t want that.

I just want you to see this.

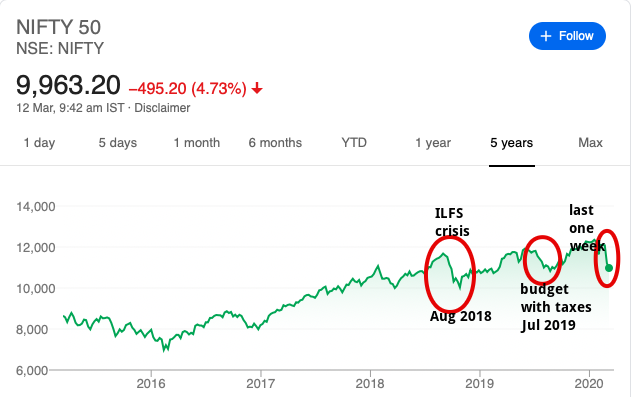

A horrible last one week with a 10%+ correction and may be more is on its way.

Oh my God, it has been happening every year with a new reason.

And yet, despite all the bad news, when you extend your horizon for a 5 year period, stock markets didn’t seem to care about any of the news. Even with all the falls, you are still looking at green.

Mind you I am not trying to raise hopes here. Likely, there is more pain coming up. However, if you live through this trial by fire, you are likely to come out ahead.

If that is your horizon, keep adding. Just don’t forget your rules, your asset allocation and your goals.

Its interesting that everyone in finance industry(AMCs, financial planners, distributors) says keep adding only when market is falling, good valuation, good correction, froth is gone etc etc.

I dont remember reading the complementary view by anyone above when markets are overvalued – Overvalued, full of froth, STOP investing, take your money out 🙂

It might not be said explicitly, but if asset allocation is being followed and a need for rebalancing arises, that ‘sell over allocated class and buy under allocated class’ is what is in action.

Well not really. It is not really about asset-allocation and rebalancing. It is not about the OVER allocated classs. Even if you have say 5% equity exposure and that 5% is OVER VALUED and FROTHY it must be pulled out. Where is such a narrative ? All the narrative is for ppl to invest blindly all the time. 🙂 cos investors interests always comes last.

YZ,

The human tendency is always to not accept mistakes or face consequences. This is true in all walks of life. For Eg, lets say at office I performed excellently well and they gave me a bonus one year. Next year I did a blunder, they will not recover some money from me nor will I be willing to give back some for my mistake.

Same in investment. You can be your own judge in your finances which is why most experts insist on asset allocation all the time. We are too greedy to sell equity at all time highs despite our asset allocation is skewed towards equity investment.