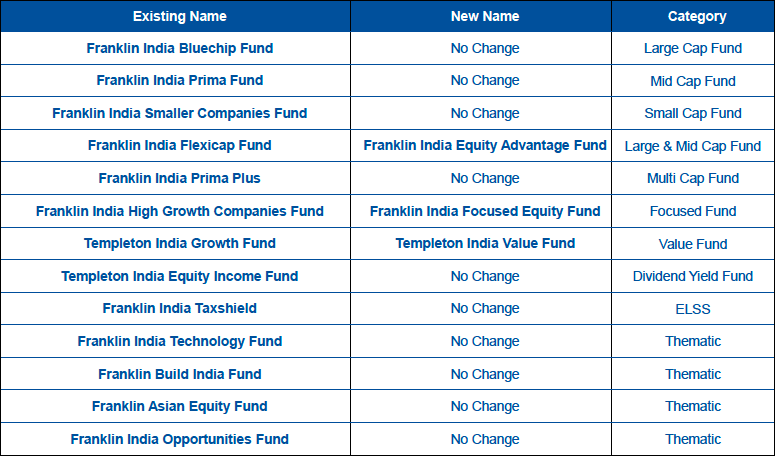

Franklin Templeton MF has also announced changes to its mutual fund schemes to align with the SEBI Circular on scheme categorisation and rationalisation. Here are the details.

Interestingly, Franklin Templeton has retained almost all its schemes by pushing them into one category or other.

This is what they have done.

Equity Schemes Rationalisation by Franklin Templeton MF

Franklin India Flexicap fund has changed from being a flexi cap / multi cap fund to a large and mid cap fund. The Prima Fund and the Smaller companies fund will now have a more defined investment universe.

Check out this note to know how the new universe and categories have been defined.

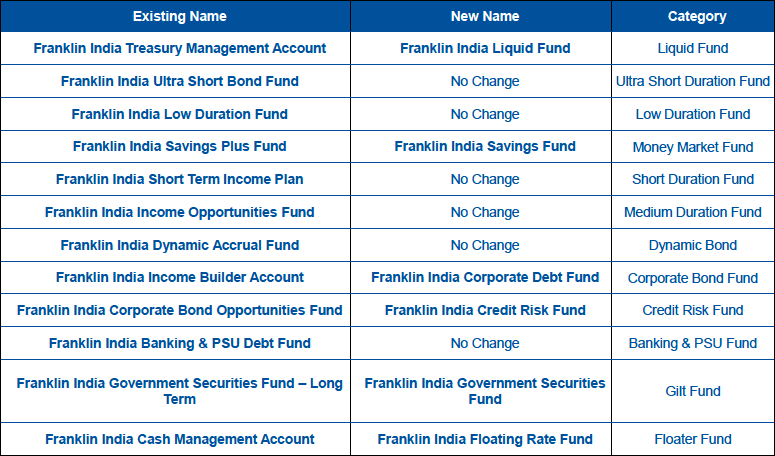

Debt Schemes Rationalisation

I had issued my own assumptions of how Franklin Debt funds would look like post rationalisation and quite a many of them have turned out that way.

The debt schemes undergo not only a name change but also a change in their fundamental attributes. As you will notice, the duration requirements for most of the funds has been clearly specified.

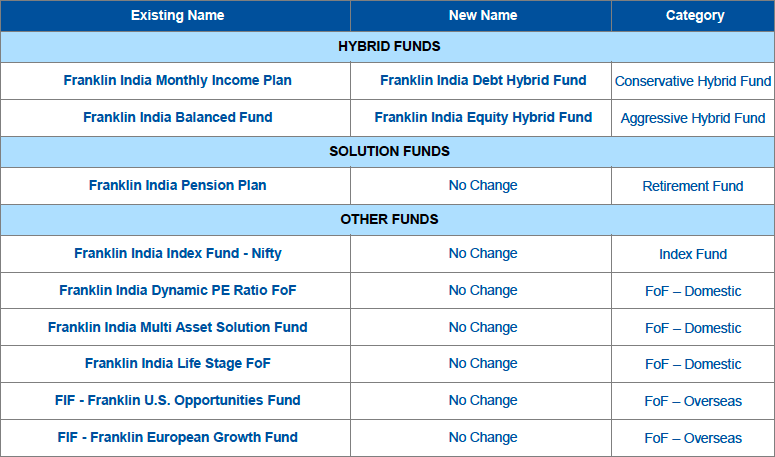

Hybrid & Other schemes

The other schemes only undergo a name change. Of course, this is the place where most of the funds of Franklin Templeton MF have found a new life.

What’s your take on this scheme rationalisation by the fund house? Does it make sense or is it just a farce? Do share in the comments.

I think Franklin smaller companies fund will change to Pure Small cap at least after this categorization. What do you think.

Value fund

Focused fund

Large and Mid cap

These names are synonym of Multi-cap fund, So AMCs are using this list of category to avoid merger of the schemes.

I doubt if it will be a pure small cap. The categorisation requires min 65% in small caps.

You right about the dicey names.

You’re itching for that small cap, aren’t you, Vandhi? 🙂

Yes Srikanth you are correct. I am trying to add small cap,

But waiting for any changes in Unovest portfolio after this Categorization by AMCs.

Lol, so these guys didn’t even merge a single fund?!? Wow, really good job!

Also for the Unovest MF Portfolios, Vipin, good job in identifying the two funds whose fundamentals haven’t changed! I didn’t invest in one of them because I wasn’t sure what they’d do when doing the classification but I’m happy to see your conviction become right.

They did the two GILT funds are merged into one now. 🙂

Thanks!

What could be the possible difference between Low duration and short duration?

Duration indicates the interest rate sensitivity. Assuming duration of a portfolio is 1 year, then for every 1% change in interest rates, the price of the portfolio will change by 1% in the reverse direction.

Low Duration is 6 to 12 months. Short Duration is between 1 to 3 years.

Vipin hello I am invested in Franklin Flexicap fund as SIP since 2007, Should i change anything, now. My short term of education for child are four years away.

I am not sure why you chose Flexicap. Based on your asset allocation, you can stay put. It is not going to be a huge difference, in my view. However you may want to derisk your portfolio as the goal timeline approaches. Thanks!

Vipin my short term Goal of education ( in above post ) is four years away. 2021.

Good to see now they will hold 65% small cap stocks in franklin smaller companies fund. But the big question is will they stop taking fresh subscription or will keep on accepting fresh investment. Size may be a concern going forward and it may have significant amount of negative impact upon performance of the fund

Dear Sanjay, That remains to be seen. The universe applicable to mid / small caps has changed and we need to see how that impacts the portfolio. Overall, the froth (excess valuation) in the small cap space does exist.