Performance of small cap funds is the highest amongst all category of funds and so is the interest in buying them. So, today we take stock of small cap funds.

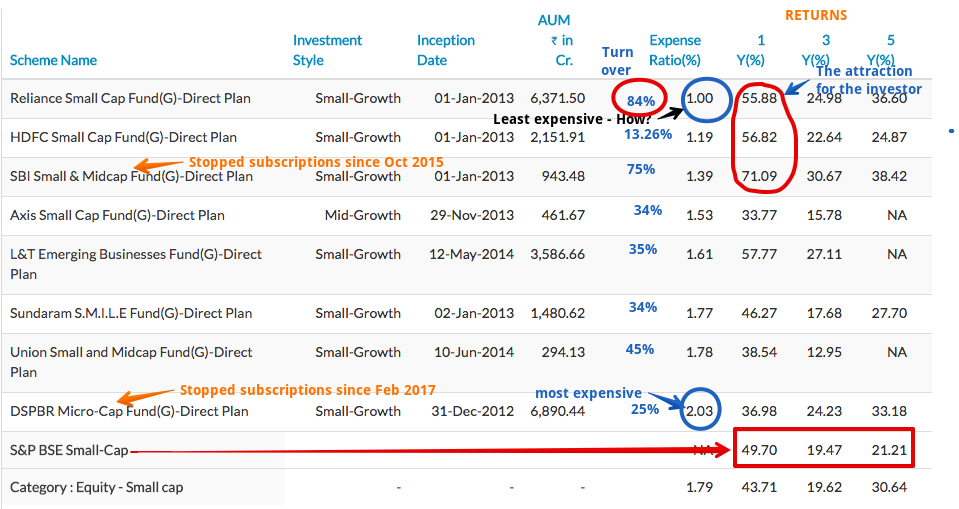

In the image below, you can see a list of some of the most sought after small cap mutual funds.

Source: Unovest, for direct plans only.

The most obvious number is the last 1 year (point to point) performance. This number for the first 3 listed funds is nothing short of eye popping. As I mention this is the main attraction of the current investors in these funds.

They are joining a party that is probably about to end. Just my words of caution.

One of the other things that needs to be noticed, which is not obvious from the image itself, is that most of the small cap funds are riding high on superlative returns during year 2013-14.

But then, 2017 has been so kind on all fund types specially mid and small caps. “It is only when the tide goes down do you come to know who is swimming naked.”

Let’s look at some of the individual funds.

#1 Reliance Small cap fund

As per the investment objective of this fund, it will aim to invest in small cap stocks. Small Cap stocks, for the purpose of the fund, are stocks whose market capitalization is in between the highest and lowest market capitalization of companies on S&P BSE Small Cap at the time of investment. The fund uses all kinds of strategies including momentum, growth, value, economic revival to identify and invest in opportunities.

One of the amazing things about the fund has been to maintain a very low expense ratio even as it operates in a difficult space, has grown its AUM to more than 2x in just about a year and runs a consistently high turnover ratio signifying portfolio churn.

The fund is not just restricted to small caps. It moves easily into midcaps and some of the large cap stocks too. Let’s say it is totally opportunistic.

There have been concerns on the fund manager churn with the most recent having spent only a year with the scheme. However, Samir Rachh, has experience handling Reliance small and mid cap fund for some time.

Having said that, since most of the returns of the fund were made in 2013-14, it remains to be seen if the fund will give similar results.

#2 SBI Small & Midcap Fund

At least once every week, I get a query asking why is this fund not showing up anywhere for subscription. How will it? It stopped taking any fresh subscriptions from Oct 2015. Yes, the fund exited the party quite early as it remained sober.

Do you know SBI Small & Midcap Fund emerged from the acquisition of the Daiwa Industry Leaders Fund, which SBI acquired in Nov 2013?

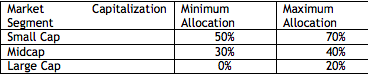

It then added a few features or restrictions. The capacity of the fund is limited to Rs. 750 crores. That’s when it stopped taking any more money.

For its allocation between various market caps, here is how it is divided.

Source: Scheme Information Document

Unfortunately, for now, investors can only admire it from a distance.

#3 L&T Emerging Businesses Fund

As per the investment objective of the scheme, the focus of the fund is to invest in emerging companies (small cap stocks). Emerging companies are businesses which are typically in the early stage of development and have the potential to grow their revenues and profits at a higher rate as compared to broader market.

Even though this fund scheme was a relatively late entrant in the space, it has managed to get a lot of attention with the numbers becoming one of the top 3 funds by size.

Nothing particularly good or bad about this fund.

#4 Sundaram S.M.I.L.E Fund

S.M.I.L.E. here stands for Small & Medium Indian Leading Equities.

This fund is really a poor cousin of Sundaram Select Midcap Fund. Both share the same scheme objective and don’t invest in the top 50 stocks by market capitalisation.

Of course, the SMILE fund has a larger tilt towards small cap funds something it has not been able to do very efficiently. In its worst 1 year period, it fell more than the market, a rare feat.

In summary, this is not a fund that can make you SMILE.

#5 DSP BlackRock Micro Cap Fund

Yet another fund with a focused mandate. In a space like micro caps, it clearly suggests that it will not invest in the Top 300 stocks by market capitalisation. For an investor looking to unearth the real small and micro companies, this is a worthy mandate to work with. A focus is always refreshing.

Read more: What you should know about DSP Micro Cap Fund?

However, the small and micro space has its own limitation as it cannot absorb a lot of money. For the last few years, the fund has been slow in intake of funds and has usually restricted it to daily limits. Finally, in Feb 2017 it stopped taking any fresh money.

Final words

If you are investing in small cap funds, please pay attention

- Don’t invest because you see money doubling in less than 2 years. This is rare and not repeatable.

- Remember if you see something going up too high in a short time, the reverse is also likely to happen (soon).

- Invest if you can live with a gut-wrenching feeling. Yes, that’s what a small cap fund can lead to.

- Do not invest a very large portion in the fund. Keep your risk appetite and allocation in mind always.

- When you invest, resist checking the price or value everyday.

What’s your take on small cap funds? Do share with us.

Once SEBI categorization comes into full force in AMCs, then we can expect pure small cap funds like DSP micro cap fund. Till that time, we have to stay calm and not to venture Small cap funds.

But vipin, I have never come across any Blogger/RIA/FP scan the funds in this angle (ie. Pure mandate). Why so 🙂

Most of the advisers recommending Franklin prima fund ( 23 years history). Do you think past performance is the only key for them to recommend funds to clients.( or they are looking in narrow mandate of choosing fund).

I know Vipin goes far deeper in his analysis, but I can see why Franklin India Prima Fund is recommended. Among all the mid-caps that have been through multiple bull and bear phases, it’s the one with the highest R-Squared of 0.8 (meaning, a reliable beta), lowest beta (meaning, best down-side protection among the peers), and a very high sortino ratio and alpha. Its trailing SIP and CAGR returns have always been top quartile. Who has the time to find out rolling returns, they aren’t easily found anyway. And who cares if they are true-blue mid-caps. And its fund manager, Janakiraman, is a super star. Considering all these scenarios, I can see why a skin-deep analyst (read amateur) will recommend this fund. I’m not saying they are wrong. It’s probably a perfectly good fund to choose and you won’t go wrong in the long run, unless the India growth story takes a nosedive, in which case we’re all going to sink in equities anyway.

Oops, this was a reply meant for Vandhi.

Thanks Srikanth, I will consider this is the reply from vipin 🙂

” And who cares if they are true-blue mid-caps. ” – This is what i meant , After reading unovest blogs , i also started thinking true market caps is essential for selection.

If i want to create a portfolio, then my hunt will be on Pure (true) market caps for selection. 1 large cap , 1 Mid and 1 small with pure mandate to market caps is sufficient to build for long term goals. – Its my view.

Same here — I want what I’m asking for, even if it’s risky. Some of the mid-cap funds have provided better downside protection by actually having a considerable portion of the portfolio in large caps, not completely through their mid-cap stock picking skills.

This is why I’m disappointed in Sundaram SMILE fund. It’s predominantly small cap, has very less AUM, a good fund house, a good manager (who takes care of their mid-cap), yet the volatility is disappointing. I don’t know why. I’m still tempted to include it in my portfolio but I’m resisting it hard. As a first time investor, perhaps I should draw a line somewhere with my aggressive stand.

Also, I immediately discard any fund categories from a fund house that has multiple funds in the same category; it drives me wild.

Whoa! I don’t think I went that far in understanding a fund. Thanks for putting this info across Srikanth.

Vipin, thank you so much for this post. I was very close to investing in SMILE.

There are many ways to SMILE, not this one though 🙂

Can you please suggest whether to continue in Reliance and Hdfc small cap.

Depends on several factors. Not possible to give a blanket view.