You have Rs. 50 lakhs which you want to invest in equity mutual funds. But then you see stock markets touching all time highs. You are scared, what if you invest now and the markets fall, resulting in negative returns for you?

So, you are confused if you should invest all of it lumpsum or in parts through a mechanism such as STP ( Systematic Transfer Plan)?

You reach out to various forums, blogs, websites and friends who give this advice:

“Given the markets are at all time high, do not invest lumpsum. Invest systematically over the next few months.”

“Put your money in a liquid fund and then start an STP into the equity fund for 6 to 12 months.”

You suffer from confirmation bias and feel almost convinced that this is the way to go.

Really! Why?

Why STP at all? Does it really work? Why not lumpsum?

What’s the purpose of STP in a mutual fund?

An STP is a method through which you invest a lump sum money via instalments over a period of time.

Suppose you have to invest in an equity mutual fund but you don’t want to do in one shot. So you invest the lump sum money in a liquid fund of the same fund house and then make an application to transfer a certain amount from this liquid fund to the equity fund at defined intervals such as weekly, monthly, etc.

Since markets are typically expected to be volatile, with STP you will distribute your purchase over a period of time at different market levels, hopefully.

As a result, your average purchase price of 1 unit will probably be lower than the purchase price of a lump sum investment.

As a result, you will prevent your portfolio from suffering a massive fall in case the markets were to react and go the other way. And of course, you are likely to get more units too.

Awesome!

How true is that?

Turns out, it is not. Not at least on the basis of observed behaviour.

Let’s put this method to test.

STP or Systematic Transfer Plan put to test

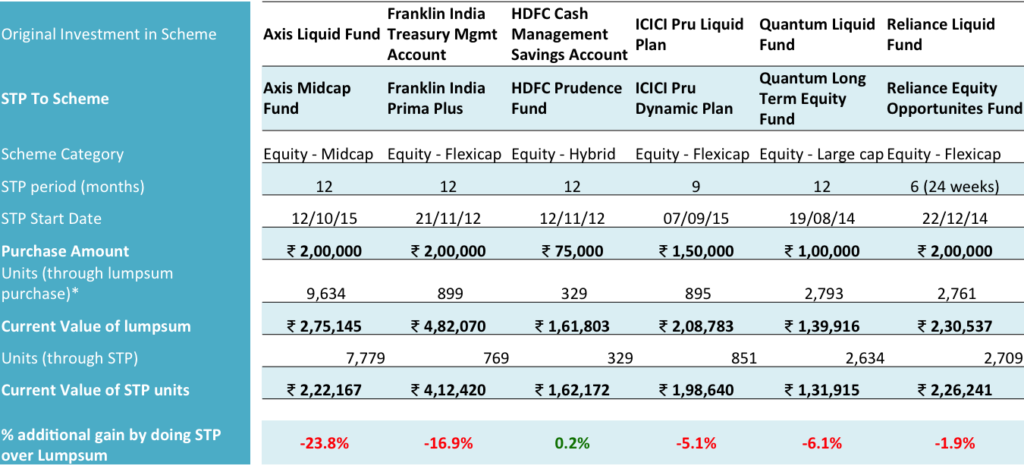

We took investment information of STPs actually carried out and put the numbers in an excel sheet. The summary of it is in the table below.

Note: All investments are in regular plans.

Units and values have been rounded off to zero decimals.

Current value is based on NAV of the respective funds as on June 1, 2017.

As you can see, the investments are in funds across categories including large cap, flexi cap, mid cap and a hybrid fund. So, there is no particular bias of fund type.

The STPs were done at different time periods in 2012, 2014 and 2015 over 6 to 12 months. In case of 6 months, it was a weekly STP. The others are monthly STPs.

For the purpose of caparison, it is assumed that the lump sum investment is made on the first STP date and the units of the equity fund have been calculated based on that day’s NAV.

You might point out that the liquid fund also brings in returns and is not captured here. Let us clarify that the same is adjusted automatically via the additional units of the equity fund.

So, what happened?

While the expectation was that the STP will help you get more units at a lower average price, it actually led to the opposite. You received fewer units in the equity fund with an STP as compared to the lump sum purchase.

Why did that happen? Why did you get fewer units through STP when the expectation was to get more units by taking benefit of market movements?

Quite obviously, the market did not enforce the logic that you wanted it to. You believed that the markets are at a high and they would probably come down or be very volatile and your investment would benefit from this volatility. By staggering your investment, you thought you would be able to buy more units at different price points.

The fact is markets are no one’s slave. They have their own mind or may be no mind.

The verdict is clear

It is obvious that an STP as a method of investment has failed to generate any additional value for the investor. On the contrary, it has led to a loss of profit for the investor – as high as 23.8% in the Axis Mid cap Fund.

With the STP in Franklin Prima Plus Fund, the investor has received reduced gains by almost 17%. That is his loss of profit by not investing lump sum.

The only STP that offers some solace to the investor is the one in the hybrid equity fund, HDFC Prudence. The investor is better off by 0.2% in this STP investment vis-a-vis the lump sum.

The question that deserves attention though is “was the effort for the 0.2% extra gain worth it?”

Attempts to capture market highs and lows fail. The market may not work as you intend it to. The real examples used above leave no doubt.

What is clear is that a one shot lump sum investment should be preferred over an STP. You are better off handing over the money to the fund manager as per your allocation and let him/her do the job.

Is a systematic transfer plan or STP not useful at all?

Honestly, I don’t think so. The current STP behaviour does not work for sure.

Has STP worked for you, consistently? Do share your experience.

Disclaimer: The scheme names mentioned in the post are for information and education purpose only. Please do not accept them as any form of recommendation or advice.

Dear Sir,

If you see the subject period, where you had done the caluclations for STP, is the rising period. The market bias was up. Naturally, in up market bias, lumpsum will yield more gains than STP..

STP can be looke for a period of not less than 7 years for equity mutual funds..

Hi Sachin

The point is that at each of those points, the investor expected the market to fall, which didn’t happen. The idea to understand is that.

BTW, can you share a real example of a 7 year STP? Did you do that?

Thanks

dates chosen may be to prove your point take another date and another set of period and the same funds give you better retutn in SIP mode

Dear Shankar

There has been no bias in date selection. These are actual STPs done by real people. IN short real investments. Just to clarify again, the question is STP vs lumpsum and not SIP. Thanks

take he case of Franklin Prima fund and compare a 50 Lakh lumpsum on 1st june 2007 held on till 1st june 2016 and a monthly SIP of 5000 for the same period.

you wil get a result that is totally different.

i feel it is prudent to put lumpsum when the nifty pe is about 14 to 17 and sip when the pe is about 22 plus

I am not convinced that the selected duration is proper to generalize if lumpsum is better over STP. If the markets are falling over the duration, an STP will work better. If the markets are rising over the period, then lumpsum will work better. There is no proper answer.

Swapneil,

On the one side there is theory and on the other side, the practicality or what actually happens.

on theory, you are bang on. Unfortunately, the script does not play out in real life.

have you personally done it?

i am planning to invest 30 lakhs in mutual funds and have selected 1 large cap, 1 mid cap and 1 balanced fund. if i go with your article then according to it i should straight away distribute funds in all three schemes in one shoot. and not via STP. please confirm

Hi Tom,

Yes, that’s what the article’s conclusion is. Be ready for any volatility though!

BTW, why 3 funds and not 2 or 4?

Hi, Agree with your views, that the market’s may not work as you intend. But the fact that the last corrections happened in 2000, 2009 and a next correction is expected anytime as the markets are at a all time high.

So as of Jun 2017, if a person say were to invest Rs 50 L, isn’t it better to go with STP over a 36 month period instead put the lump sum in Jun 2017.

a) On one side if the markets go down in the next 1 – 2 years, this approach of 36 months STP will work good.

b) But if there’s not correction in the next 3 years, then as you say lump sum in Jun 2017 is better.

for ex: if you have a lump sum of Rs 50 L now, what would you do ???

Thanks for the the comment Shanti Swaroop. I would focus on my goals, my asset allocation and invest my money accordingly, lumpsum. Thank you