What is volatility?

As you understand when a thing is volatile, it does not have a linear movement. It tends to go up and down based on several influencing factors.

Volatility and Investments

Investments and their markets by their nature are volatile. You take any of them – oil, gold, copper, silver, stocks, etc., the prices of each tend to have ups and downs.

With that perspective, an investment in an FD is NOT volatile. It is safe and steady and guarantees a return of capital and interest thereon, subject to any terms and conditions.

However, an equity mutual fund invests in stocks, which are volatile and results in the fund being volatile as well. A ULIP is volatile for the same reason.

For that matter, any product, the value of which is linked to market instruments, is volatile.

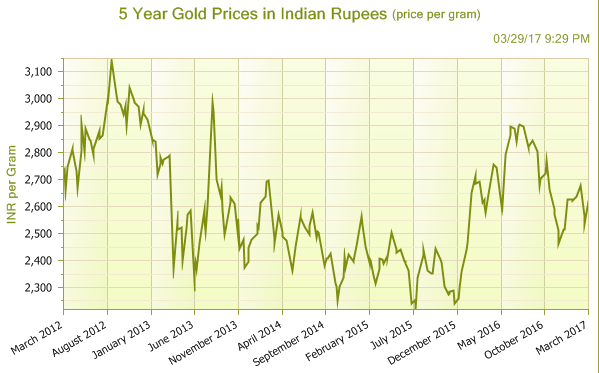

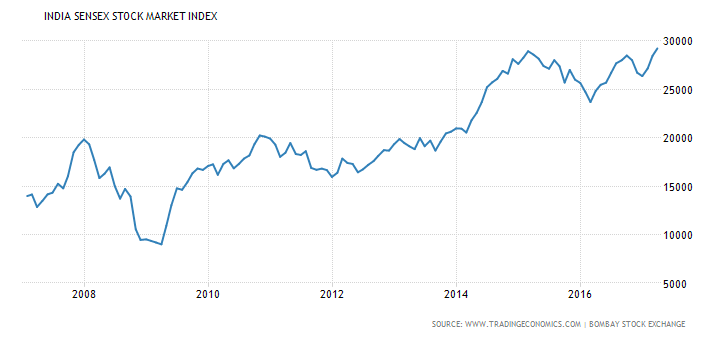

Have a look at the following charts.

Do you notice the volatility in each of the charts?

Is volatility good?

Volatility brings uncertainty, another name for risk. The risk is that it can lead to temporary loss in value or of capital. If you have plans in mind, volatility can hamper them.

However, if you can suffer the volatility, the ups and downs, it may even reward you with higher returns compared to a non-volatile, steady investment with certainty of returns.

An example of such an investment is stocks or an equity mutual fund.

See the Sensex chart above. There has been volatility almost all the time. In fact, there have been some acute phases.

However, those who stayed put with the ups and downs, the returns over the years have exceeded inflation thus building wealth by increasing the purchasing power of your money.

Well, how much volatility in investments is good?

This needs to be answered in 2 parts.

#1 What is the volatility of an investment for a given time frame?

#2 How much volatility can YOU digest?

Let’s take the first question.

As seen earlier too, an investment into equity or equity mutual fund can be very volatile. You can see RED or losses in short time frames of 1, 2 or 3 years, sometimes even longer ones.

An investment into pure debt funds such as liquid fund or ultra short term fund behaves relatively very steady. Unless, there is a goof up in terms of a bad investment or a drastic change in the economic conditions, debt funds (liquid, ultra short term variety) tend to be stable.

Remember though that debt funds are not Fixed Deposits – fixed, safe and secure.

Then you have the investments, which are a mix of both – equity and debt, also called hybrid. With hybrids, the debt portion of the investment works to reduce the volatility of the total portfolio.

To what extent? It depends on the ratio of debt and equity. More the debt portion, more stable the fund’s value. It also depends on the type of debt instruments. Long term debt investments or Government securities can be very volatile too.

So, you understand that in short time, your investments can suffer because of volatility. When you need the money the value of your investment may be down. This could be temporarily, but yet harmful. So, if the idea is to meet goals then there is no point subjecting your investments to volatility.

Now, if you have a longer time frame, you can afford to include volatility in your portfolio. Over longer periods, volatility can bring to you better returns. Consider it to be your reward for suffering volatility.

Now, lets take the second question. How much volatility can you digest?

You may be someone who, irrespective of short or long term, may just not be comfortable with volatility. You need to see your investments safely, growing in a linear fashion with no hint of volatility.

You are willing to suffer the loss of purchasing power but not loss of capital, even temporary, at any cost.

On the other hand, you can be someone, who is willing to take on volatility anytime. Temporary loss of capital is not a concern for you. You have the stomach for it.

Taking on volatility all the time is not warranted though. In some cases it can be downright foolish.

If you can get a finger to do a job, why use the whole body.

So, with a combination of time available to you, the volatility of the investment and your own tolerance to ups and downs, you can decide, how much volatility you can afford to have in your portfolio.

Finally, volatility is a short term distraction towards long term benefits. Make it your friend.

Leave a Reply