It’s that time of the year again. Tax savings is the top of the mind. Last few days to do anything that you can to save taxes.

Now that you are aware about some of the best ways to save tax for yourself, you also know that ELSS or tax saving mutual funds are one of the important investments that you can use to cover your Section 80C.

The question as always is “which of the tax saving mutual funds should you choose”?

While we will get there, let’s quickly recap some of the important features of tax saving mutual funds.

- Investments in tax saving mutual funds are allowed as deduction from your income under Section 80C of the IT Act. This helps to reduce your tax liability. The maximum that you can invest in these funds is Rs. 1.5 lakhs in a financial year.

- The funds are essentially in the nature of equity funds, which means that they invest predominantly in stocks. However, different funds can have different investing styles.

- These funds have a 3 year lock-in, that is, you cannot redeem or switch your investments before completion of 3 years of holding. This is the shortest lock-in period amongst all the investments that qualify for tax savings.

- There is currently no capital gains tax on withdrawal after 3 years.

So, how can you use these and make a twin score of investing in equity as well as getting a tax benefit on it.

Tax saving mutual funds – Which one to invest in?

There are 53 mutual fund schemes that qualify for tax savings under Section 80C. It is hard to differentiate one from the other. For simplicity sake, we looked at the 6 schemes in terms of size and compared them on various parameters.

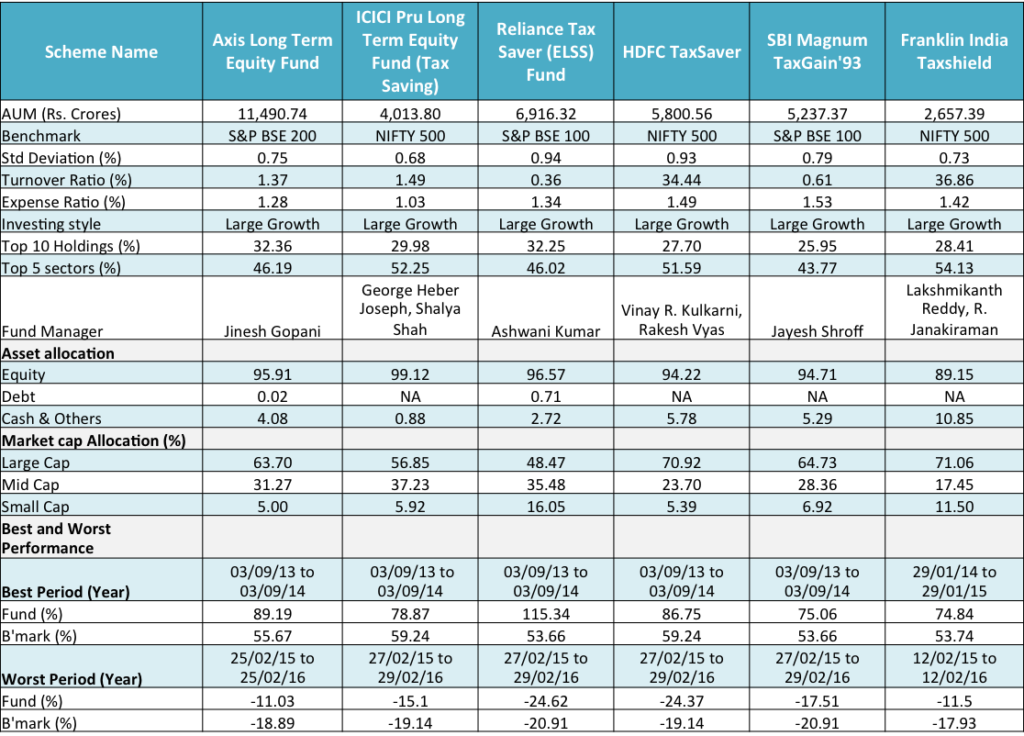

Here’s a comparison table of 6 tax saving mutual funds:

Source: Unovest; All data is for the direct plans and the growth option of the respective funds. The direct plans of these tax saving mutual funds were started on Jan 1, 2013. Ratios are based on past 1 year NAV data. Data downloaded on March 22, 2016

This comparison brings out some interesting observations:

- Benchmark & Market Cap allocation:

- If the benchmark choice is an indication of the expected portfolio, then Reliance Tax Saver and SBI Magnum Tax Gain are the odd ones out. Their benchmarks and their equity market cap allocation are not aligned. Both of them have chosen S&P BSE 100, which is a predominantly large cap benchmark. However, their current market cap allocation shows that a significant amount is invested in mid caps and small-caps too. This could be misleading.

- Franklin Tax Shield and ICICI Pru Long Term Equity follow a broad based investing approach. They have benchmarked themselves to Nifty 500. It means that they can go across the market to pick the best opportunities available. However, Franklin Tax Shield seems to be inclined towards large caps thus offering a more modest investment option.

- Axis Long Term Equity Fund’s benchmark is BSE 100, however, its current portfolio seems to be stepping out of it and holding quite a bit of mid caps.

- Reliance and ICICI appear to be aggressive in their market cap allocation with a larger share to mid caps and small caps.

- Best & Worst period performance:

- Both Axis Long Term Equity and Franklin Tax Shield have managed their worst periods well.

- Both Reliance Tax Saver and HDFC Tax Saver have done worse than their benchmarks in any one year period. It should be noted that Reliance also has done much better compared to others in terms of the Best period performance. This goes on to indicate that the fund is quite volatile. The standard deviation of 0.94, the highest in the comparison, supports that view too. Incidentally, HDFC Tax Saver takes the second slot in terms of volatility with a standard deviation of 0.93.

- Portfolio concentration: The exposure to Top 10 stocks and Top 5 sectors in all the funds appear to be in a close range.

- Expense Ratio: SBI Magnum Tax Gain has the highest expense ratio while ICICI Pru Long Term Equity manages itself frugally, in comparison.

- Turnover Ratio: HDFC Tax Saver and Franklin Tax Shield seem to have made large recent changes to their portfolios. The other funds have relatively stuck to their holdings to a large extent.

So, which one of the tax saving mutual funds should one pick?

To summarise the above observations, Axis Long Term Equity and Franklin Tax Shield seem fit for an investor with a not too aggressive an approach. ICICI Pru Long Term Equity is more aggressive with its share of mid and small caps in the portfolio.

Disclaimer: The fund names in this post have only been used for information and education. Please consult your investment advisor for the right investment for you in line with your time horizon and risk appetite. The author of this post does not have exposure to any of the above mentioned funds.

You can invest online in tax saving mutual funds, either one-time or as SIP, on Unovest. Create your FREE Account now.

I started an SIP in FT Taxshield and Axis Long Term Equity a year ago. Was my first foray into investing and my research wasn’t as exhaustive. Good to know they’re both doing well and were good choices. I have recently started Direct plans for both of them.

Cheers

Good to know that Roy. Keep learning!

Hi

quite enlightening article, I must say!

I am 32 years old and looking for investment opportunities, basically for retirement purposes, since I am just 32, I am ready to take bold investment ideas that bring me great rate of returns.

What would you suggest is better, p2p or mutual funds?

Thanks

Hi Amit

Thanks for the note.

I would like to know what is p2p?

Hi

I am 42 yrs old and looking for mutal fund for retirement purpose,as i am 42 yrs age pls suggest better plan for it.

Thanks

Dear Sandeep

Your selection of mutual fund would depend upon what kind of risk profile and time you have in mind. As also, what are your current investments. Can we suggest that you take up the MF portfolio service on Unovest? Please create an account on smart.unovest.co and then go to MF Portfolios under Premium section.

Hope this helps.

Thanks vipin. As usual very insightful, easy to understand and helpful article for beginners like me.

Thanks Prashant for reading and the comment.

Could you please add DSP Black Rock Tax Saver in the comparison list? It is one of the funds doing well. Your comments please

While it may not be possible to add in the list, thanks for adding. Each fund has its own characteristics and an investor can pick one suitable to one. Thank you