You know of equity mutual funds. You know of debt mutual funds.

Now, what is the fund that invests in both – equity and debt?

Easy one, right?

Well, it is a hybrid fund, popularly known as a balanced fund. This fund invests in both equity/stocks and debt such as corporate debt and government securities.

The name ‘balanced‘ suggests that it invests 50:50 in equity and debt. But that is not the case.

When a fund invests more in equity, it is called an equity-oriented hybrid fund. When the fund invests more in debt than equity, it is a debt-oriented hybrid fund.

The most popular ones in the hybrid category are the equity-oriented ones. This is because they get a tax treatment akin to that of equity funds.

However, to get this tax benefit, the equity portion of the fund has to be typically 65% and above. If you sell after one year of holding, there is no long term capital gains tax payable.

For the debt-oriented hybrid fund, the tax treatment is similar to a debt fund. Any realised gains in less than 3 years of holding are taxed as per your income tax bracket.

Let’s look at some of the other benefits offered by a balanced fund.

Balanced Fund – Best of both the worlds

- One fund for both equity and debt investments – This is its biggest promise. You don’t have to make separate investments in debt funds and equity funds. You don’t have to rack your brains to find one amongst thousands.One balanced fund takes care of both.

- Benefit from the upside and protect your downside – When equity or stocks perform well, it reflects in the fund’s growth. However, when the stock markets fall, the presence of debt in the portfolio curtails the downside. Similarly, when interest rates rise, the fund receives interest from its debt holdings. When interest rates fall, it benefits from capital gain. It literally offers the best of both the worlds.

- Automatic asset allocation and profit booking – A balanced fund works to maintain its predefined ratio of debt and equity. You don’t have to worry about changing allocations between debt and equity or to buy and sell stocks or government securities and bonds. It is all done within the fund. In a scenario, where equity markets rise a lot, the fund manager will simply book profits and get the allocation back to 65% by investing the money in debt. When the markets go very low, the fund manager will pull the money from debt and invest in equities, so that the allocation remains at 65% or above.

- Less volatility – Because of the presence of debt, the portfolio of a balanced fund does not suffer the volatility or ups and downs in value as that of a 100% equity fund. This gives the portfolio more stability and less risk.

- Save Taxes – You save taxes in two ways. One, even though a portion of the fund is invested in debt instruments, the overall taxation is same as that of equity funds. That means if you sell after 1 year, there is no long term capital gains tax. The proceeds are tax free. Two, the automatic reallocation in a balanced fund is tax free too. Now, if you have to do change in allocation yourself by selling equity, buying debt or buying equity selling debt, you have to likely pay taxes, specially on the debt portion.

Comparison of Equity oriented hybrid or Balanced funds

Balanced funds can come in various shapes and sizes. While the underlying theme remains a mix of equity and debt investment, they vary by strategy and the kind of investments they hold in equity or debt.

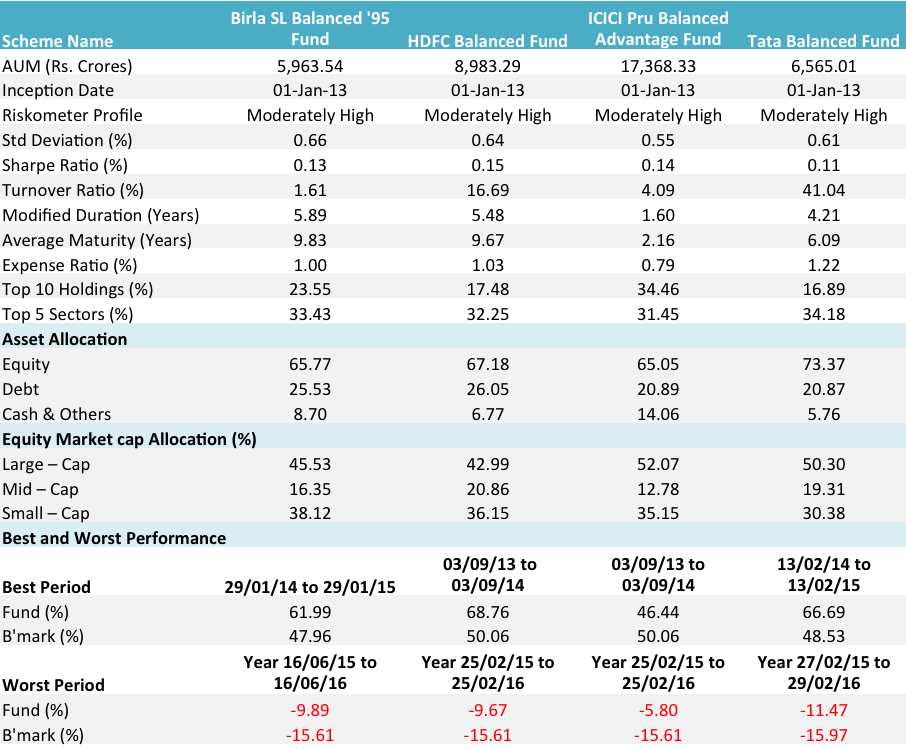

Here is a comparison of 4 popular equity oriented hybrid or balanced funds on various parameters.

Source: Unovest. The data is as on March 2, 2017 for direct plans of the funds.

To know more about these funds, click on the links below:

- Birla Sun Life Balanced 95 Fund

- HDFC Balanced Fund

- ICICI Pru Balanced Advantage Fund

- Tata Balanced Fund

Who should invest in a balanced fund?

If you are a first time investor or a moderate risk taker, a balanced fund or an equity-oriented hybrid fund offers a great opportunity to take exposure to debt and equity in just one fund. The presence of debt along with equity along with the other benefits as mentioned above make it a compelling moderate risk investment option.

Disclaimer: The list of mutual fund schemes provided above is for information purposes only. Please check with your investment advisor to know which fund scheme is correct for your time horizon and risk appetite. Mutual fund investments are subject to market risk. Past performance may not be sustained in the future. Please read the scheme information documents carefully before investing.

[…] 2: Invest in Balanced Mutual Fund but no tax […]