As an investor, how do you know if your fund is working for you or not? This is specially relevant to the actively managed funds where a fund manager makes investment decision of how much to invest and where.

You can evaluate your mutual fund’s performance by finding out if your fund outperformed its stated benchmark or not.

Take, for example, Franklin India Bluechip Fund. and HDFC Large Cap Fund. The benchmark for both is Nifty 50. A broader fund such as HDFC Equity Fund’s benchmark is Nifty 500.

These funds are expected to deliver a better performance than the Nifty 50 or Nifty 500 respectively.

If they don’t, there’s no point paying the fund manager fee. You can simply switch to low cost passive funds such as Index Funds or ETFs.

Index funds or ETFs are called passive funds. They simply mimic the holdings of the respective benchmark they track with an aim to deliver a performance as close to the benchmark as possible.

Coming back to how do you know if your fund has done a good job?

The popular method is to see if the fund has beaten its benchmark in performance. If your active fund has delivered a return of 15% while the index return is only 14%, after adjusting for all expenses, then it is a clear thumbs up.

However, this comparison with the index has a shortcoming.

The point is most benchmarks used by actively managed funds are just price based. They reflect the price change from an earlier date to the one as on the date of comparison. It does not include dividends, bonus issues, etc. that might have been declared by the companies represented by the stocks in the index.

In short, they reflect only the change in price and don’t capture the total returns inclusive of the dividends, bonus issues, etc.

So, what’s the alternative? You could go for Total Returns Index values that include the dividends, etc. The problem is that total return index values are hard to find and in some cases command a hefty price.

A better and more practical way is to use a passively managed index fund or ETF for comparison with the fund that you have invested in.

In case of Franklin India Bluechip Fund, the relevant passive fund is the Franklin India NSE Nifty Index Fund and in case of HDFC Large Cap Fund, it would be HDFC Index Fund – Nifty Plan.

Why are we choosing passive funds for comparison?

A passive fund provides two levels of meaningful comparison.

#1 In practicality, you don’t invest in an index directly. In fact, you cannot. You invest via an index fund or an ETF, which does the job of investing. An index fund or an ETF is a better representative of the benchmark then the benchmark itself. It accounts for the expenses and other costs that might be incurred to put the investment into action.

#2 The passive fund, because of the virtue of its holdings, also captures the total returns of the index. Since, it invests in the same stocks, it also benefits from any dividends or bonus issues that are made by the companies, the stocks of which it holds as investments.

These 2 reasons make a passively managed index fund or an ETF a more practical alternative to compare your actively managed funds with the passively managed funds.

Some data on active funds and passive index funds

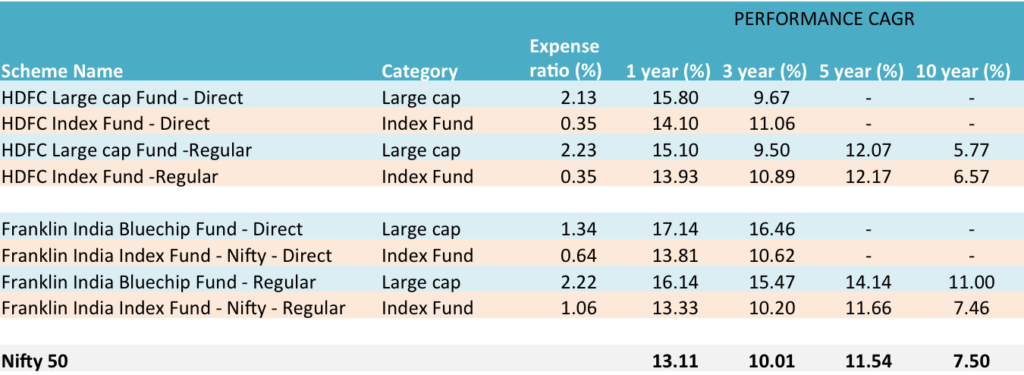

The table below gives a comparison of the funds against their benchmark, Nifty 50 and the index funds.

Data from Unovest as on Jan 17, 2017.

As you can see, performance of Nifty 50 index and the index funds is different.

What are the other conclusions? Do share with us in the comments.

Disclaimer: The fund names mentioned in this post are only for educational purposes. Please do not consider them as investment recommendations.

Leave a Reply