Do you know if you make a single fixed deposit of over Rs. 1 crore with State Bank of India, what is the interest rate on offer?

3.75% only.

Yes, that’s right.

To put this in context, a normal savings bank account in the same bank pays you 4% interest. Why would you do a Fixed Deposit at all?

And yet FD is one of the choicest investments.

But you need to know something. If you are invested in FDs, you have to be prepared to lose some money. Courtesy negative real interest rates, especially if you are in the highest tax bracket.

Let’s see how. Suppose you are earning a 6% interest rate on your deposit. After a 30% tax cut, you are left with a mere 4.2%.

If your interest rate is 5%, you are left with less than 3.5% post tax return.

So far so good. The problem occurs once you look at inflation. Your personal inflation and not the one issued by government departments.

It is safe to assume inflation at around 10% per year.

So, if you earn 3.5 to 4% post tax return and inflation is at 10%, you are negative by 6%. That’s the rate by which your investment value is decreasing.

You see. The money needs to work harder just to keep pace with inflation.

It’s time to evaluate alternatives.

One of these alternatives is the Debt Mutual Fund. However, before you venture to these funds, it is good to know some facts about debt mutual funds.

10 things you need to know about debt mutual funds vis a vis Bank FDs

- Guarantee of returns– Debt mutual funds do not guarantee returns. Fixed Deposits do. If an FD says 6% interest when you sign up, it will pay you 6%. Period. Debt mutual funds returns can vary.

- Safety of Capital – Debt mutual funds take their own risks including credit risks, interest rate risks, etc, which can impact their performance. There is no capital risk with FDs except when the bank goes down.

- Variety – Debt mutual funds come in a variety and you can choose one based on your time horizon and risk taking ability. There are liquid funds, ultra short term, short term, income funds, corporate bond funds, dynamic bond funds, gilt funds, etc. In case of FDs, it is plain and simple. You only have a choice of interest rate and time period.

- Dividends/Interest Payout – With debt mutual funds, you can choose to have a dividend option. However, dividends are not guaranteed. With FDs, the interest payout as specified is guaranteed.

- Taxation – Debt fund is treated as a capital asset. The gains are taxed as per your tax bracket if you sell in less than 3 years of buying. The gains are taxed at 20% after cost indexation, if sold after 3 years. Just this one factor, gives it a significant edge over Fixed Deposits. Know more here.

- Investment Insurance – Fixed Deposits are insured and guaranteed by the Government to the extent of Rs. 1 lac per bank. If the bank were to go out of business, you will still receive upto 1 lac. There is no such insurance in case of Debt mutual funds.

- Investment Portfolio / Transparency – You don’t know what happens in a Fixed Deposit or how is it managed. Neither the associated costs. In case of a debt mutual fund, the exact portfolio is disclosed on a monthly basis as well as the costs of doing the same. Click here to view the factsheet of a debt mutual fund.

- Market driven – There is no market value to an FD. You have a principal amount which you invest and you earn interest on it. The debt mutual fund has a market value calculated in the form of its daily Net Asset Value or NAV. This value can go up and down.

- Interest rates and prices – There is an inverse correlation between bond prices and interest rates. So, if the general interest rates in the economy go down, prices will go up and vice versa. Debt funds are affected by this and it reflects in their prices or NAV. This may make the value of the investment to go up and down too. With FDs, once you have fixed your interest rate, it is assured to you till the maturity.

- Premature withdrawal – With Fixed Deposits, there is usually a penalty on premature withdrawal such as lower interest by 1%. In case of most open ended debt mutual funds, there are no penalties at all. You can take your investment back any time as per the current market value at that point in time.

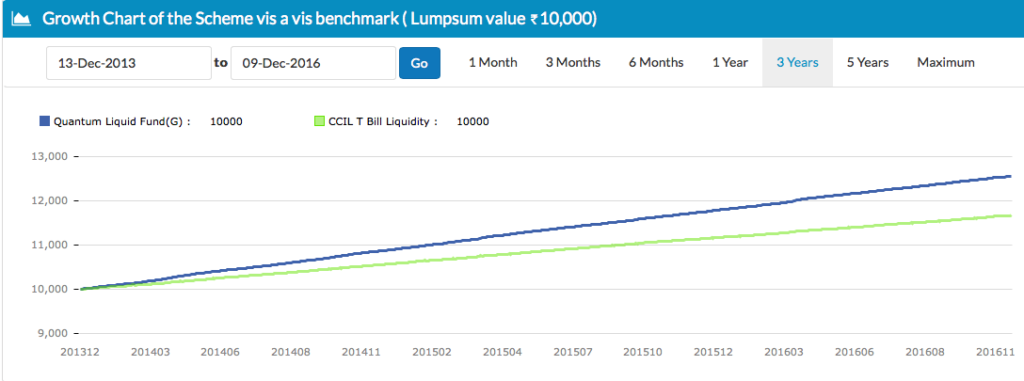

Growth chart of Debt mutual fund – Liquid fund

Above, a liquid fund displays a consistent growth as it invests in very short term instruments. The interest rate risk is limited or non existent here. Such funds do not try to anticipate or invest based on interest rate movements.

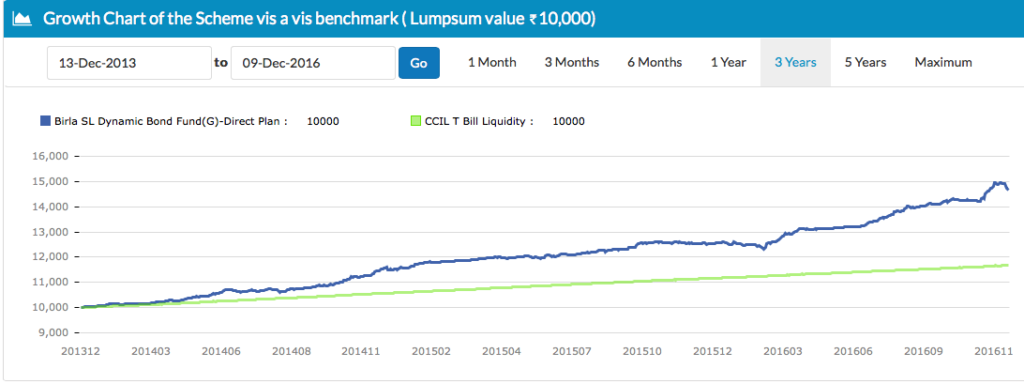

Growth chart of Debt mutual fund – Dynamic Bond fund

A dynamic bond fund tries to anticipate interest rate movements and manages its investments accordingly. This adds risk to the investment and can lead to volatile movements in value. See the curve going up and down at various points over the last 3 years.

So, are debt mutual funds for you?

If you are in the lower or zero tax bracket and you prefer certainty of capital and returns, FDs is still the option for you. Remember though that inflation is eating into your investments.

But for those who are in the higher tax brackets, it might make sense to look at debt mutual funds for your asset allocation.

For less than 1 year of investments, consider a liquid mutual fund.

For more than 1 year, consider a ultra short term fund. You can read more here.

Having said that, it is advisable that for money that you need within 5 years, it should be invested in FDs or debt mutual funds.

Not sure which debt mutual funds to invest in?

Use one of the Unovest recommended portfolios to park your money for periods of less than 1 year or 1 to 5 years based on your risk profile. Login now on Unovest and go to MF Portfolios.

Note: The above debt mutual fund names have been used only for illustration purposes and does not constitute a recommendation or advice in any manner. Please consult your investment adviser to know which debt mutual funds are the right fit for your portfolio.

Leave a Reply