The pain of selecting mutual funds from thousands of schemes and options is a deep one.

The matter become worse because it is so difficult to differentiate one from the other.

Even star ratings and rankings don’t help. They change too often and communicate little about the qualitative factors.

So, how does an investor like you go about this onerous task? How can this be done simply without taking too much of your time since you need to focus on the more important task of building your career and growing your income?

Here’s a step by step guide to help you do that.

Building a winning mutual fund portfolio

There are several criteria out there, which you can use to evaluate mutual funds. Let’s identify how to build an equity mutual fund portfolio.

A winning mutual fund portfolio needs to have the following characteristics:

- Investment across market capitalisation: That is, the holdings of the portfolio have to be across large cap, mid cap and small cap stocks.

- Investment across styles: The portfolio should be able to exploit growth, value and blended (mix of growth and value) styles.

- Total number of funds: Overall, it should not have more than half a dozen (6) mutual fund schemes, that is it. A fund itself holds a diversified portfolio. You don’t want to complicate matters by diversifying an already diversified portfolio. Moreover, too many funds will only lead to an overlap in investments.

- Weightage: Any fund should have at least 10% weightage in the portfolio to allow it to make a meaningful difference.

With these factors in mind, you can download a list of funds from one of the online aggregator sites or from Unovest.

Apply the following criteria to the big list to convert it into a short list.

- Sectoral/Thematic: For equity funds, skip the sectoral/thematic variety. There is no point restricting the scope of the fund in finding opportunities.

- Index Funds: Unless you are an investor who does not believe in active fund management, you can ignore the index funds. Fortunately or unfortunately, in India, the actively managed funds have beaten the index funds by a wide margin. That too net of expenses.

- Closed ended funds: Closed ended funds are open only for a limited initial period for buying. Hence, they can be excluded.

- Fund age: Consider funds with more than 5 years of existence. Entities that have a cumulative organisation experience of over 5 years in investment management can also be considered.

- Fund Size: A good criterion would be to have funds with at least Rs. 100 crore of AUM. However, we will not let a good fund pass just for this one criterion.

- Expense Ratio: Aim to go for funds that are not very expensive but deliver the right value for what they charge. There are some funds that charge the maximum allowed by law and deliver average results. Direct plans also ensure that your expense ratio remains on the lower side. In debt funds, a higher expense ratio can wipe off any advantage that you look for.

As you would notice, past performance is not one of the filters here. Why?

Simple. Past performance may or may not be sustained in future and is no guarantee of future returns.

We need to look at factors that deliver on performance.

So, after applying the above filters, you now have a shortlist. Most likely, it is still a large list, that is, more than a dozen.

What do you do? Now, that’s where the qualitative factors come into play.

To share with you, at Unovest, we apply our chief criterion – Trust.

Can you trust your funds?

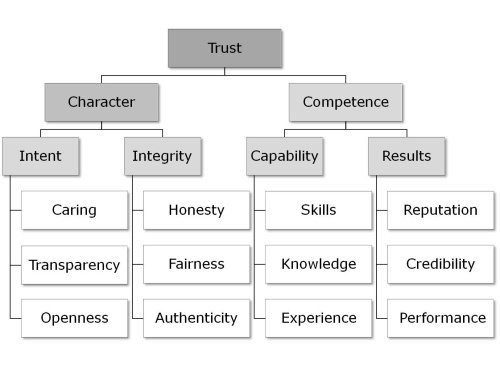

Let’s first understand the mechanics of Trust. Have a look at the chart below.

Trust is comprised of two key factors – Character and Competence.

Trust is comprised of two key factors – Character and Competence.

While competence can be determined using numbers such as performance, risk adjusted returns, etc., character is hard to quantify.

It is not something that an excel sheet or some software can tell you. You have to go beyond them to evaluate how trustworthy a fund can be.

Character is a result of integrity – the sync between the thinking inside and the behaviour outside. Does the person or organisation do what it says?

In case of mutual funds, it would be to ensure that it treats investor’s money with great respect and takes no undue risk just to chase returns.

It also means that the fund sticks to a well-defined strategy through thick and thin. It does not change its colours based on market fads.

If a funds mandates itself to invest across the market, it should call itself a flexicap fund and not a mid-cap opportunities fund.

Similarly, a mid cap fund should behave like a mid cap fund, a small cap fund should behave like one.

A fund that defines its mandate as “to not invest in Top 50 companies by market capitalisation” and then sticks to it, is always preferable.

Character also reflects in the intent, the way the organisations treat their unit holders / stakeholders. How open and transparent is the communication flow to the investors is equally important.

You can tolerate short-term underperformance (competence) but a misadventure on this front (character) is not acceptable.

As mentioned earlier, evaluating trust is a difficult job. To paraphrase a famous saying, “you will know it when it is there.”

Now further filter your shortlisted funds based on these criteria. Go ahead and build your own winning mutual fund portfolio.

All the best!

—

If you still think it is not going to be possible for you, to humanly track all these things and build your own portfolio, we have something to offer you.

We took it upon us to apply these criteria and come up with a list of funds. We then organised these funds into a dozen portfolios that you can pick and choose from.

Announcing the Launch of Mutual Fund Portfolios from Unovest

Yes, a dozen mutual fund portfolios that reflect the characteristics mentioned above. You can use these portfolios to invest towards your goals and build your wealth.

There are 3 key themes of these portfolios:

- Preserver – meant for 1 to 3 years plus of investment horizon to ensure that the money’s worth is preserved to provide for your goals.

- Builder – meant for 3 to 7 years of investment horizon and helps you grow your investments to meet your future goals.

- Enhancer – meant for 7 years plus of investment horizon for those who are willing to take on more risk and looking for additional returns, if possible.

Each of the themes has a portfolio for one of the 3 risk profiles – Conservative, Moderate, Aggressive.

None of the portfolios has more than 6 funds – thus offering a lean way to move forward. You will also get to know how much to invest in each fund through a weightage that is assigned to each.

On an ongoing basis, any changes/updates on the fund portfolios and what action you need to take, if any, will be informed too.

What these portfolios are not?

These are not asset allocation portfolios where you are asked to invest in a combination of equity and debt. It is assumed that, if you are picking an equity portfolio, you already know how much you should invest in equity.

Typically, you have existing investments in debt through Bonds, Fixed Deposits, PPF/EPF, etc and what you need is to invest in equity through mutual funds. These mutual fund portfolios serve that purpose.

But why do you need 12 portfolios?

No, of course, you don’t need all the 12.

You can make a selection based on your goals and on the two factors of risk profile and time horizon.

So, just go ahead and pick yours.

Click here to login to Unovest and get your access.

The final word: We would invest our own money in these portfolios.

Please note: Recommended Mutual Fund Portfolio service requires premium access to Unovest. If you aren’t a premium subscriber yet, click here to know more and subscribe.

[…] Mutual Fund Portfolio […]