Is SIP a name of a mutual fund?

After seeing scores of advertisements about how SIPs helped investors create wealth, every new investor is asking:

“Tell me the best SIP.”

The term “SIP” has become a confusion for new investors. They think it is an investment option.

Well, the fact of the matter is that you don’t invest in an SIP, you invest through it.

Through the following questions, let’s try and understand better what SIPs are and how do they work?

What is an SIP (read: ess, aii, pee)?

For simple understanding, an SIP is a method to systematically direct your cash / savings into mutual funds. It is a popular method to invest in mutual funds.

SIP is a convenience designed to give you a benefit of making regular investments without bothering about filling forms, or clicking buttons online, signing cheques or transferring money from one account to another.

To make these regular transactions happen, you would need to provide a bank debit mandate. That allows your mutual fund to ask your bank to transfer the money from your bank account to the specified mutual fund.

I hope it is now clear that SIP is not a type of mutual fund but a method of directing your savings to mutual fund.

How does SIP create wealth?

Two factors that contribute the most in creating wealth are – Patience and Discipline.

An SIP clearly takes care of the discipline part. When you start an SIP, your savings move into market linked investments such as equity over a period of time, regularly. It maintains the discipline through thick and thin.

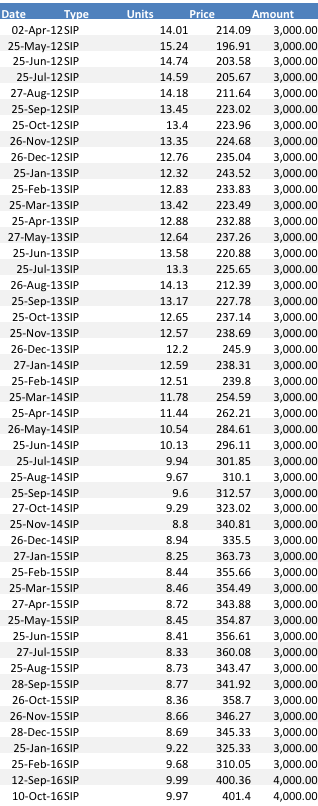

See the below SIP table in one of the bluechip large cap funds. An investment of Rs. 3,000 per month was started from April 2, 2012 and continues. In fact, it has recently been increased to Rs. 4,000 a month.

SIP Table from Unovest

It is well established that to make wealth through equity one should focus on “TIME IN THE MARKET” and not timing the market. The key lies in staying the course, being patient.

The current value of the transactions shown in the above table is Rs. 1.86 lacs against an investment of Rs. 1.49 lacs. This translates in an average annual return of 9.36% for now.

What type of an investor should do SIP?

SIP is for everyone with predictable regular cash flows such as a salary and wants to invest in mutual funds. In fact, SIP is perfect for the long term investor. It puts your investments on auto mode so that you can relax.

In fact, if you believe you are a lazy investor, then nothing better than an SIP.

Does SIP mean you can just ‘fill it, shut it, forget it’?

Quite literally! Once you have done your job of fund selection and started the SIP, you can go back and focus on your job or other important things. You don’t have to do something all the time.

However, that doesn’t mean you ignore your investments. You just don’t have to take action every now and then. A review once in 6 months or a year is good.

How does SIP work?

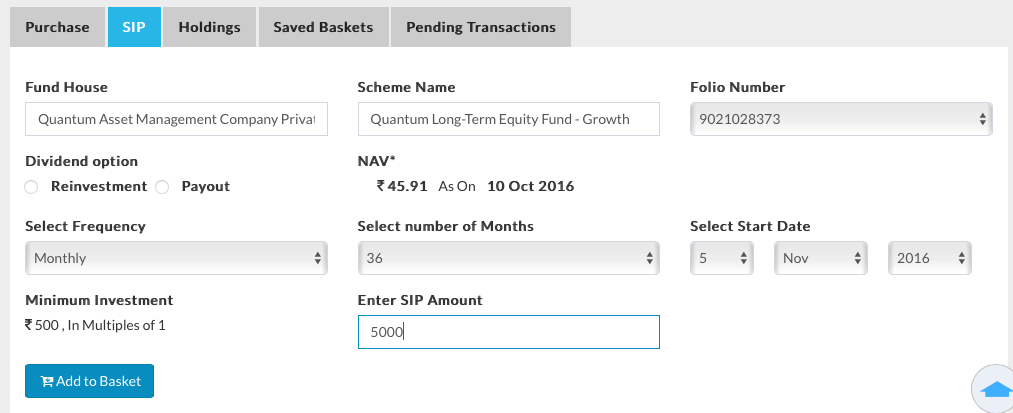

SIP is a method where your investments happen automatically. For starting an SIP, you select

- a mutual fund scheme.

- the amount (some funds have a minimum amount as little as Rs. 250 or Rs. 500)

- one of the dates available with the fund on which you want the money to be invested.

- the frequency (monthly, quarterly, etc.).

- the period (subject to minimum period – 12, 24, 60 or 120 months).

Below is an SIP input screen on Unovest.

The above fund name is only for example and is not a recommendation.

What is the one time bank mandate?

A one time bank mandate is an instruction to your bank to transfer a specified amount to the entity to which you have given the mandate. The transfer is made by your bank only when the request is sent by the entity holding the mandate.

You specify an upper limit of the amount that can be debited via the mandate. When you are dealing with platforms that offer multiple funds under one roof, the mandate allows you to create various SIPs for different amounts, if need be, without going for multiple mandates.

For starting SIP through Unovest, you need PayEezz mandate. Know more about PayEezz here.

What are the best funds for SIP?

The best funds are those that are aligned to your risk profile and your goals. There are all kinds of funds. You need to choose those that will help you fulfil your goals and help you sleep peacefully at night.

Consult your investment adviser to help you figure out the right investments for you.

Do remember that SIP is only a method.

Have more questions? Share them in the comments or send them over email.

If you found this post helpful then share it with your friends and colleagues and earn some good Karma.

WILL IT BE GOOD TO START SIP IN MICRO CAP FUND LIKE DSP Black Rock Micro Cap Fund – Direct Plan – Dividend OR SHALL I INVEST IN LARGE CAP OR BLUE CHIP FUNDS.

It appears you are only chasing returns. Pls understand it comes with risks or sharp ups and downs in performance.

Ideally, a diversified fund is what you should invest in. Multi caps or Flexi caps. Thanks.