Arbitrage Funds – What are they?

“I want my investment to be safe, tax-free and give me higher returns than an FD”.

In search for this “ultimate” investment, one of the strategies investors use is arbitrage.

Understanding arbitrage

Simply put, you buy a stock in the cash market and you book an advance sale of it in the futures market where it is being quoted for a higher price. By locking the price in advance, you lock your return as well.

Essentially, this is what arbitrage funds do.

An arbitrage fund exploits price differential between cash and future markets using stocks or commodities as an underlying investment. In the process, this limits the upside return since the selling price is pre-determined.

Isn’t that good? May be not.

Let’s understand arbitrage funds a little more.

First a few facts about Arbitrage Funds

One, the typical portfolio of an arbitrage fund constitutes of stocks, future contracts, debt and money market investments. Since they invest in a combination of investments, they are hybrid in nature.

Two, the benchmark of most arbitrage funds is a liquid fund index. What it means is that they intend to match returns of a liquid or ultra short term debt fund.

You ask – “why does a fund that invests predominantly in equity and equity related investments produces returns of debt investments?”

Worse, why do you take the risk of an equity investment and still get debt like returns? The next fact answers your question.

Three, the tax treatment of an arbitrage fund is like equity. After 1 year of holding, you don’t have to pay any long-term capital gains tax. And short term, that is less than 1 year, gain is taxed at only 15%.

This is the single biggest reason for investment in arbitrage funds. Though you earn debt-like returns, they are tax-free after 1 year. For those in the highest tax bracket, this is a huge incentive.

No wonder, many investors are pouring money into arbitrage funds, specially for short term.

Questions –

- Should you really invest in these funds?

- Is the tax benefit so large?

- Can you just stick with the debt funds?

Let’s do a comparison.

A comparison of Arbitrage Funds, Ultra Short Term and Liquid Funds

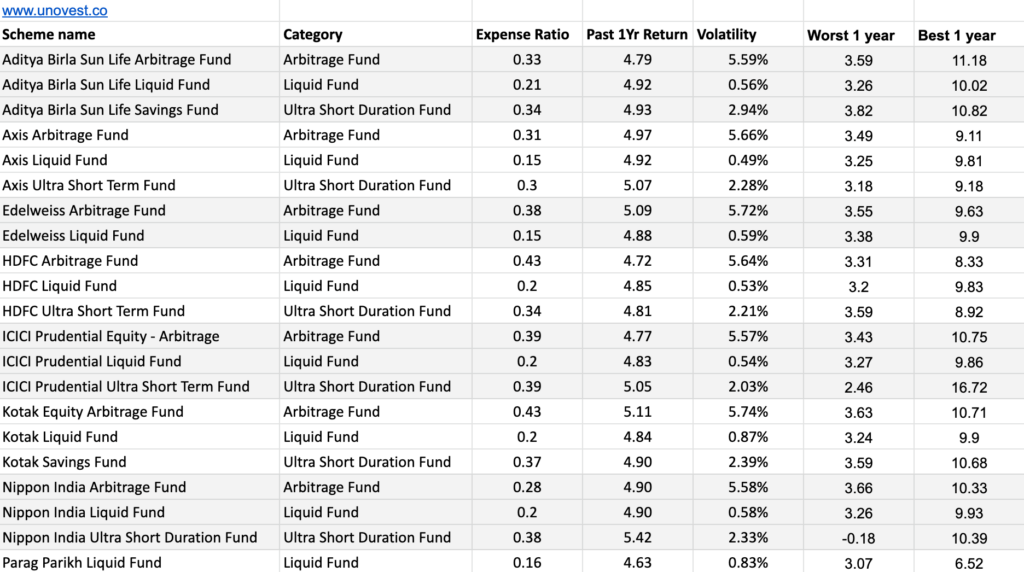

In the following table, we have compared some of the popular arbitrage funds along with ultra short term and liquid funds.

Source: Unovest Research; All scheme data is for direct plans and as on Dec 30, 2022. Best and Worst performance is for any 12 month period in the fund’s existence. All returns are in %.

Purely on the basis of returns, liquid funds and ultra short term funds are doing better than the arbitrage funds.

Even for the best and worst performance in any 1 year period, the arbitrage funds are not hugely better than the liquid and ultra short term funds. And they come with lower volatility (the whole up and down movement in prices).

It seems to be a no-brainer as to what you should go for.

But wait. What about the taxes? Now, that could be a twist.

Let’s consider taxes

The rate of tax applicable to short term gains on debt funds is as per your tax bracket. If you are in the highest tax bracket, you pay 30%+.

As you are aware, from a tax point of view, debt fund gains are treated as short term if sold within 3 years of purchase.

The rate of tax for arbitrage funds for short term is only 15% + any surcharge. The long term (post 1 year), it is 10% + surcharge.

It becomes clear that arbitrage funds get a decisive edge on the tax front. With a lower rate of tax (specially for those in the highest tax brackets), they make for a compelling reason.

Remember though, that you have to be invested for at least 6 months in arbitrage funds to benefit from it.

Note: If you are doing Systematic transfers, using liquid funds can still be a better option, given that they don’t scream volatility.

Looking at the > 1 year post-tax performance, worst performance, every single arbitrage fund beat every single debt fund, with one exception. And even that exception (Birla Arbitrage Fund) doesn’t trail the best debt fund by much, just 0.2%.

It seems that arbitrage funds are simply better than debt funds. They have better returns and lower risk (worst-case performance). Both at once. There seems to be no downside.

Maybe if we look at a longer period than just the past 3-4 years, a downside will emerge? But so far, your data tells me that arbitrage funds are simpler better than debt funds in both just risk and return, not just one at the expense of another.

The 30% tax bracket investor is expected to say that. 🙂

Some more information, if anyone is interested:

I looked at the worst performance of any of the arbitrage funds mentioned here over any time period (month, quarter or year), and it’s -1.2%. https://www.valueresearchonline.com/funds/fundperformance.asp?schemecode=3902 In other words, if you’d invested in any of the arbitrage funds listed in this article, you’d have lost at most 1.2% over any month, quarter or year.

So, the conclusion is that arbitrage funds have been very safe, like debt funds.