The debate on regular vs direct plan continues. Active commentary from both sides to bring out the virtues of the respective options is taking place.

Where does that leave you, the investor?

Some of you have been very confident and moving your holdings from regular to direct plans. You are not too happy with the value add of your distributor/advisor and you feel you can do a better job by doing it yourself.

There are others who still continue to hold their investments in regular plans. Some are not even aware that they have regular plans in their portfolio.

Regular vs Direct Plans of Mutual Funds

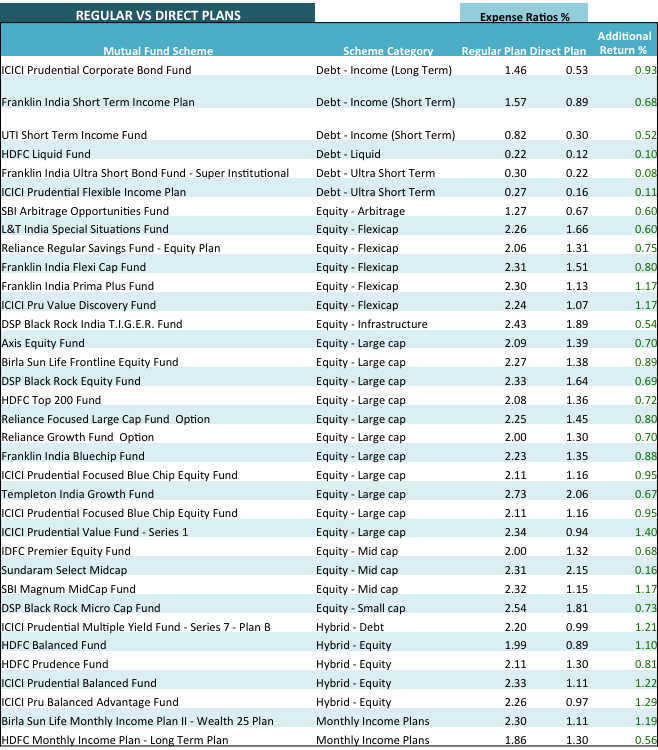

Here is a table that you would like to see. The table includes funds across categories and compares the expense ratio of Regular Plan vs Direct Plans.

The difference between the two expense ratios is your Additional Return (the last column), assuming you invest in or switch to a direct plan.

Some observations from the above table are:

- The median of the difference between expense ratios of regular vs direct plans of mutual funds is 0.75%. Since the table has funds from across categories – equity, debt, hybrid – the difference is not small.

- The maximum difference is of 1.4% for an Equity Fund and the lowest is at 0.08% for an Ultra Short Term Fund.

- The difference that you see between the expense ratios is the commission that is paid out to the distributor in the regular plan. More on this later.

- A portfolio of Rs. 50 lacs at 0.75% can generate an additional return of Rs. 37,500 just by saving costs. This does not factor compounding of this additional return over several years of investing.

- Debt funds have lower returns and hence any savings in terms of costs is crucial to get the maximum bang for the buck.

Cost of Advice

If you were to take regular plans, @0.75% commission rate, Rs. 37,500 would go to your distributor. When you do direct plans, you have to rely on your own research and selection, in which case you save all the costs and add to your returns.

Alternatively, you can hire a fee-only SEBI Registered Investment Advisor and pay separate fee for advice. The good thing is that since you invest in direct plans, no commissions are paid out from your investments and hence you earn a higher return.

The best part is that you along with your advisor get to decide what is the right fee for the advisory services. It is not decided by a third party, that is the mutual fund in which you invest, which is the case in regular plans.

The biggest benefit of following the advice+direct plans model is that you align the interests of your advisor with your goals. In the commission based model (regular plans), the distributor receives commissions from the mutual funds. The distributors interests may not be truly aligned with your goals.

Finally as someone said, no man can serve two masters.

FAQs on Regular and Direct Plans of Mutual Funds

#1 How to know if you have invested in regular or direct plans of mutual funds?

If you have invested through your bank, you have invested in regular plans.

If your agent is not charging anything to you, you have invested in regular plans.

If your agent/distributor/advisor has not told you explicitly about which plan you are getting invested in, then too you have invested in regular plans.

Check out your account statement. In every mutual fund that you have invested, the name would have ‘Direct’ included in it. That is only when you have invested in Direct Plans.

Note: You can upload your mutual fund portfolio on Unovest and view the Savings Report, which tells you how much you are likely paying in commissions.

#2 How is commission paid in regular plans?

Unlike other financial products, the commissions in mutual funds are not paid on the investment amount. Rather they are paid as a % of the value of your fund every quarter on an ongoing basis. The word for that is trail commissions.

Even if you stop using a distributor’s services but the code in your investment is still of the same distributor, then s/he will continue to receive the trail commissions on those investments.

#3 How can you switch to direct plans? What are the costs involved?

A switch from a regular to direct plan is as much a normal redeem/sell and fresh purchase transaction.

However, you should keep in mind that if you sell or switch an equity fund in less than 1 year of holding, you will incur short term capital gains tax at 15.45%. After 1 year, there is ZERO long term capital gains tax on equity mutual funds.

In case of debt funds, the cut off period is 3 years. In less than 3 years – it is short term capital gains which is taxed at the rate of your income tax bracket. If you sell after 3 years, you get the benefit of indexation and pay 20% tax of the gains after indexing your cost. This can reduce your tax liability significantly.

Read more: Choosing growth and dividend option – Taxation of debt mutual funds

Note: You can use the Switch Report on Unovest to know which of your mutual fund holdings are free of capital gains and exit loads and you can switch to direct plans. You can also use the FREE forever online transaction facility on Unovest to make your transactions and track them with additional reports.

Do you have more questions on Direct Plans? Send it to us or mention in the comments. We would be happy to answer.

I looked at your older posts, and I didn’t find any comment arguing for regular plans. Is there even a debate?

I am for Direct plans. There are other notes on the internet and in media that you will find against direct plans.

IMHO direct plans are beneficial only if you are good at DIY. I would like to elaborate it with an example. My father started SIP in Reliance ELSS in 2007 through an agent, obviously, a regular plan and the agent doesn’t charge anything extra. The current value of my father’s investment in Reliance ELSS is Rs. 4,34,308. The present expense ratio for the direct plan is 2.01% . Had he invested back in 2007 in a direct plan whose present expense ratio is 1.46%, the portfolio would have been augmented with 4,34,308 x 0.55% = Rs 2,388 extra. But this is possible only if he had done himself without subscribing for any plan/fees for advice. For example, the basic plan at Unovest costs Rs. 850 pa. Taking the case of my father, assume that he invested in Rel ELSS in 2007 after subscribing to the basic plan. Today he would have shelled out a total of 850 x 10 = Rs 8,500 for advisory services only !!!! This is more than 3 times the amount he loses by investing in Regular plan.

Please let me know if I have made any mistake/s in above example.

Dear Alok,

Thanks for this comment.

For lack of data, I am assuming some numbers. For example, your father started an SIP of Rs. 3,000 and it has currently run for 105 months or 8 years and 9 months. At 15% average annual return, it gives a current value of Rs. 4.35 lacs.

Now, if your father had got a 0.55% extra return every year, the value of the same SIP today would be Rs. 4.48 lacs. Remember compounding is at work here. 0.55% additional return every year.

This is a difference of Rs. 13,000 over these years. Of course, direct plans didn’t exist then. But this is the real story.

You can use the FV (Future value) formula in excel to arrive at the correct result with the actual numbers you have.

So, if you had gone DIY, you would have today got Rs. 13,000 extra. Assuming you had taken advice from someone like Unovest, you would have paid Rs. 7650 over the 9 years, still having a better return by an extra Rs. 5,500.

Hope this brings across the right perspective.

Thank you.

Another cost or charge which is often missed out (and of course never told by banks – in fact their employees are not even aware) is that of “opted out” or “opted in” whereby Rs 100 flat charges may be charged or not for existing investor upfront & only the balance invested !!

Yes, you are right. But even that is offered only by distributors on regular plans. Direct plans have no such costs associated. Thanks for the comment.