Should I go for dividend option or growth option? Which is better? This is one question every new mutual fund investor asks.

Let’s consider some key facts:

Mutual funds offer 2 options – Growth and Dividend. Within dividend, you can either choose to receive dividend in your bank or reinvest in the same fund – Payout and Reinvestment options respectively.

When you choose growth option, the NAV or the per unit price of the fund grows as the fund makes profits, which it ploughs back into making further investments.

When you choose dividend option, and a dividend is declared, the NAV of the fund reduces proportionately. This is because some portion of the fund is used to distribute the dividend.

When you choose dividend payout, and the fund declares a dividend, you receive such dividend in your bank.

When you choose dividend reinvestment, the dividend declared is invested back into your fund. Basically, you are allotted additional units. This increases the total number of units that you hold.

The Tax angle of Growth and Dividend option

The dividends are tax free in your hands as an investor (that is, you do not have to pay any more tax) but the fund house pays a Dividend Distribution Tax or DDT. The DDT is paid on the dividend declared and you receive the amount net of tax.

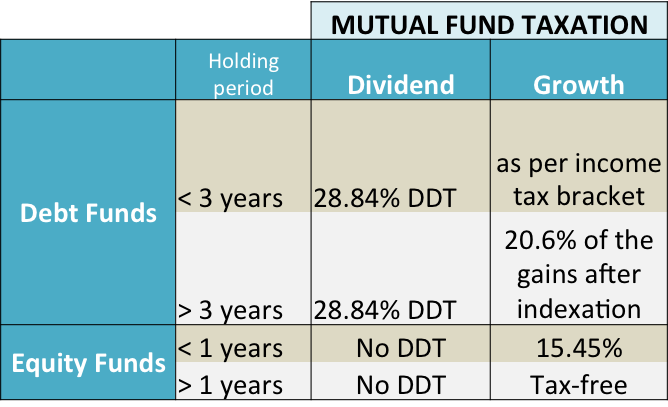

From a tax point of view, it makes a difference to choose growth or dividend only in debt funds. Have a look at the table below.

*DDT is dividend distribution tax and paid by the fund house.

DDT of 28.84% is a result of 25% tax + 12% surcharge + 3% cess.

The above rates are applicable only for individuals/HUF.

With effect from April 1, 2018, the long term capital gains tax in equity funds is 10% + surcharge. This is applicable on gains above Rs. 1 lakh.

Also, from April 1, 2018, there is now a dividend distribution tax of 10% + surcharge on all equity funds.

So, which option should you choose?

If you are in the highest tax bracket and you have to invest in debt funds for less than 3 years, choose dividend reinvestment option. This will help you reduce your capital gains tax. Simply put, DDT at 28.84%* is less than capital gains at 30.9%*, which is your tax rate as per the income tax bracket.

When you choose the dividend option, the fund pays out the dividend from the existing investments. Since the investment size is now reduced by the amount of dividend and the number of units remain the same, the NAV of the fund reduces. Because of which, the capital gain also reduces significantly. Remember, the normal capital gains tax rate would apply on such gains.

In case of equity funds, you invest for more than 1 year typically. So you should choose the growth option. If you hold an equity fund for more than 1 year, the capital gains are tax free.

Manvi is in the 30% tax bracket. She wanted to invest money for her emergency needs in an ultra short term fund. She selected the dividend reinvest option.

By choosing, the dividend reinvest option, she also ensured that the money stays invested.

Breaking some Myths

Dividend reinvest provide better returns than the Growth option.

In case of dividend reinvestment, the growth in the value of your investment is a result of the higher number of units. In case of growth option, the increase in NAV is responsible to the growth in value. The units remain constant.

Dividends can help plan for regular cash flow and income needs.

Plesae note that dividends are not guaranteed and they may not be regular too. It depends on the availability of funds and the internal policy of the fund house on dividend declaration. For example, Quantum Long Term Equity Fund has never declared dividends even in its dividend option.

Wisdom on Growth vs Dividend option

- Using dividend payout is not healthy for your financial life. You will typically spend the money you receive as dividends. This can hurt your progress towards your financial goals.

- With dividend reinvestment option you increase administrative hassles of looking at multiple dividend entries, tax reporting, etc.

- Unless you have a stated cash flow need or tax considerations, just go with the growth option.

- Even in case of debt funds, if you are willing to be invested for more than 3 years, choose the growth option.

- If you are in a lower tax bracket (10% or 20%), you can choose the growth option in debt funds even for shorter periods.

- You need not rely on dividends for liquidity. When you need funds,,you can sell some of the units and convert them into cash.

This is what happened with Dheeraj.

He opted for a Dividend Payout option for his tax saving mutual fund investment. He invested Rs. 50k and received a dividend of Rs. 9,000 approx.

He was excited and now wanted to use the dividend amount to buy a new phone.

His logic was that he had earned that money through his investments. It took him some time to understand that the current value of his investment had dropped because of the dividend and was now just Rs. 41,000 (Rs. 50,000 – Rs. 9,000).

He understood and reinvested the money.

Warning on Dividend option

- Dividend announcements are often used as a sales tool. Your agent can come to you saying that the xyz fund is going to announce a dividend and ask you to invest money. Do not get carried away with the ‘immediate short term’ benefit.

- Sometimes, seeing a regular flow of dividend makes you feel a psychologicalsatisfaction of a fund doing well. It is delivering regular dividends after all. While it might be a good thing, but as mentioned before, this may not be good for your financial health. Money allowed to compound itself over a period of time will deliver far better results.

So, which option will you choose – growth or dividend?

Great article, as always. When I invest in equity funds, I think I will choose dividend payout, so that I get an opportunity to rebalance my investments. Or to meet daily expenses if I’m not receiving a regular salary.

I can alternatively do that by redeeming from a growth fund, but that incurs:

– STT of 0.25%. It seems small, but on 10 lac, it’s 2500. Would you throw away 2500?

– Exit loads, which are up to three years on some funds

– Short-term capital gains tax, if it’s within one year

Dividend payout has less costs and gives me more flexibility.

I’ll go for dividend payout in the future for equity funds, unless you disagree.

Good points Kartick. I like that thought process. For the reasons you mention, dividend may make sense for you.

However, for long term investments, why make the money come out of the system via dividend.

Plus it will take super discipline for someone to send it back to work immediately, even for rebalancing.

Depending upon dividends for income needs is not reliable. Dividends are not guaranteed.

The STT point is a good one but has to be considered along with the above.

good one

Thanks Sachin.

Good to know on viewing but my concern is, is it better way to take a dividend every month or quarter and re-invest it in any equity growth fund ? so that dividend will be utilized effectively.Please respond.

Vaishnav, the dividend paid out by the mutual fund is effectively your money. When dividend is paid out, the value of your investment goes down. You can see that via the drop in the NAV of the fund. So, the point is why would you do that.

If you think you can take the dividend and reinvest it elsewhere more effectively, well, its your call. If you are doing it from a debt fund to equity fund, it again depends on what goal are you trying to achieve. If you are doing it from equity to debt, it could be an asset allocation exercise. But not sure, how effective it is going to be.