If there is “Know your Customer” then why not “Know your Mutual Fund”

In some or the other way, every type of investment requires that a KYC – Know your Customer – be done. Basically, in KYC key information about you is captured and stored before you are allowed to make an investment. This is true for opening a bank account, a PPF account, Senior Citizens Savings account as well as investing in Stocks and Mutual Funds.

To do the KYC, you have to fill a form, attach important documents and then visit one of the agencies to submit them. They check your details and the documents and in a couple of weeks your KYC, the systems are updated. As a new investor in mutual funds, you cannot make a large investment (over Rs.50,000) if your KYC is not completed.

OK, this post is not about KYC. The point that I am trying to make here is there is such an elaborate process to know you before your investment is accepted.

Why shouldn’t you do the same with your investment? Why shouldn’t you demand elaborate information before you make that mutual fund investment, for example?

While this is true for all investors, new or existing, it holds special relevance for a new investor. A new investor should definitely conduct a KYMF or Know your Mutual Fund process and make an investment after being satisfied with the information provided.

How to do a KYMF or Know your Mutual Fund?

First, what all is needed as part of Know your Mutual Fund?

This includes basic facts such as…

- What has it set out to do, its objective?

- What kind of fund category does it belong to?

- When did it began its journey (or was born)?

- With what index does it benchmark its performance?

- Who are the people helming the fund management?

- What kind of investing style does it have?

- What is the size of the fund?

Then there is information such as…

- How has the fund fared against its benchmark’s including the best and the worst periods?

- Where is the fund currently invested in various holdings, sectors, etc?

- Where is the money invested in various assets (equity, debt, cash)?

- What kind of market capitalisation does the fund invest in currently (large, mid, small cap)?

Finally, where does the fund stand within the peer group?

There are so many similar funds out there. You would want to know how does a fund fare in comparison to other peers as also the overall category and benchmark.

Now, there are several helpful resources out there including offline and online, that can provide you this information for KYMF.

At Unovest, we have made the job easier for you. We have put all these facts and information on just one page. Yes, the most important information on just 1 page.

Interested in a quick tour? Read on.

In a separate tab of you browser, please go to smart.unovest.co.

On the top of this page, you will see a search box right next to the Unovest logo which says “Search for funds”.

Type a fund name that you want to know about. For example, I am looking for an equity mutual fund, Quantum LT Equity Fund. LT here stands for Long Term.

I start typing the name and select the fund from the various suggestions that are shown to me.

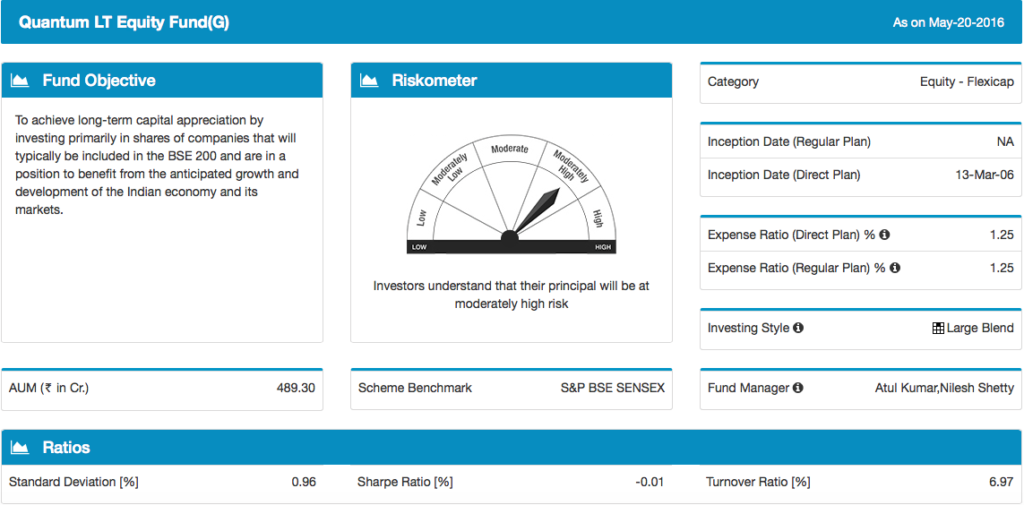

The key information on this fund is right in front of my eyes now. The first view is of the basic facts including the objective, the risk profile, the category, start date of the fund, expense ratios, investing style, fund manager, the fund size and the benchmark of the fund.

In case of Quantum LT Equity Fund, there is only one type of plan counted as both regular and direct plan. Since, the fund has never paid out commissions, its regular plan is as good as the direct plan.

In this particular fund’s case, the actual benchmark is S&P BSE Sensex – Total Return Index. However, since the data for this index is not easily available, a proxy in terms of BSE Sensex has been used.

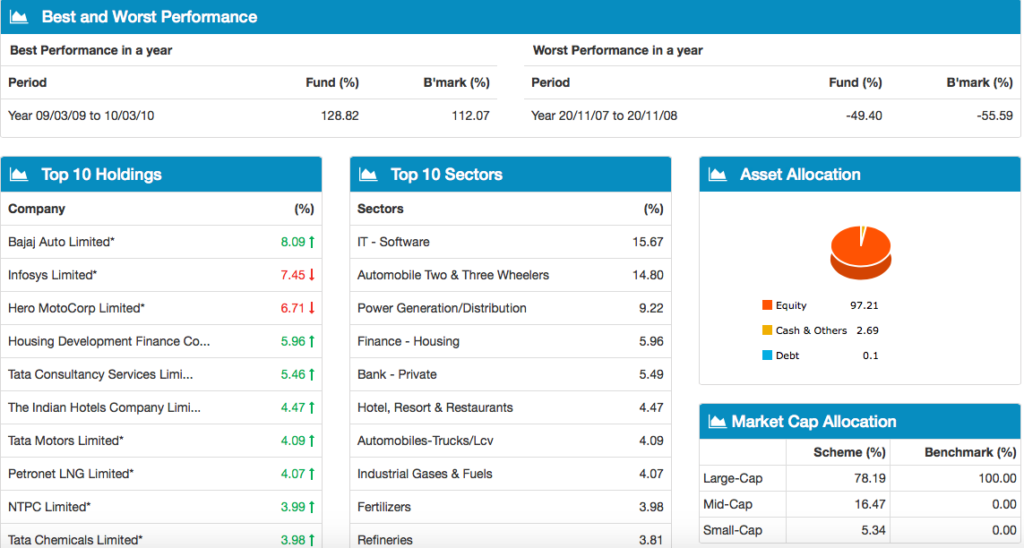

As we scroll down, comes in information about the top holdings, asset allocation and market capitalisation. You would also come to know the best and worst performance of the fund in any 1 year period vis-a-vis the benchmark performance.

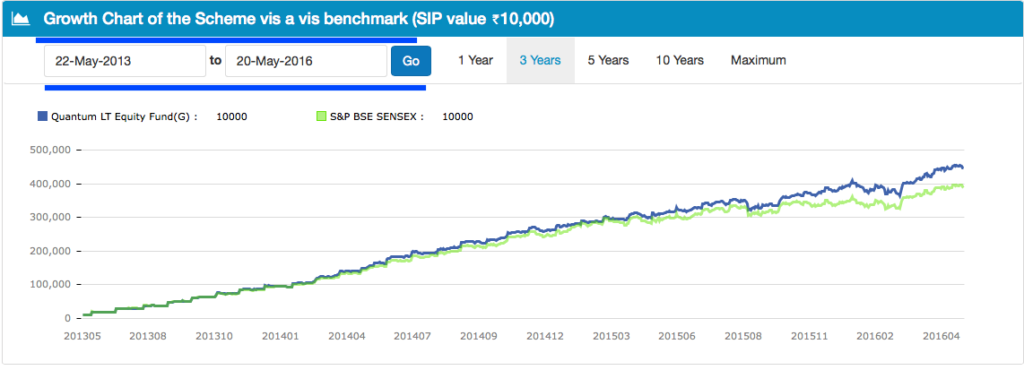

Next, as you scroll down some more, comes an interesting chart that of growth of Rs. 10,000 SIP into that particular fund. You can use various predefined time periods or select one of your own to know how an SIP of Rs. 10,000 would have fared in this particular fund vis-a-vis the benchmark.

When you hover the cursor on any point on the line, it will show you the values for both the fund as well as the benchmark. Try it out.

While looking at past performance to invest in a fund is like using the rear view mirror while driving, it still does give a good idea of how consistent the fund has been and what possibly can be expected in the future. Having said that, there is no guarantee of past performance being repeated in the future as well.

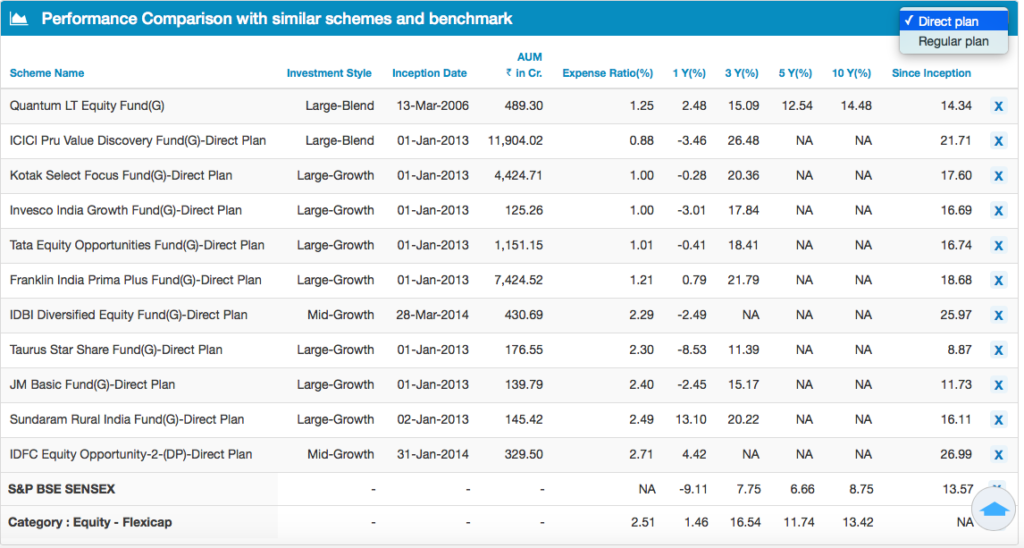

Finally, we come to, what I consider, the most important part of the KYMF or Know your Mutual Fund – Peer Comparison.

The peer comparison on Unovest, allows you to do it for direct plans as well as regular plans. While the default comparison is for the plan that you have chosen when you selected the fund. You can use the drop down on the right hand corner of the Title Bar and change from Direct to Regular and vice versa.

What you see as part of peer comparison is the performance of the fund with reference to investing styles, fund size and inception dates. The benchmark and the Category data has also been included to help you get a wider perspective of where the fund stands in its universe.

The choice of the peers has been made deliberately in a combination of category, expense ratios and size. That will help you see a comparison across the category spectrum and not limited to just the top performing funds in that category.

You can even remove any funds using the X in the last column. I am sure you will be surprised by the comparisons here.

So, this was a quick tour of the Know your Mutual Fund and how you can do it on Unovest.

If you are a first time investor, you should make the mutual funds stand up to some serious scrutiny. They don’t spare you either, do they?

So, which funds are you going to search for? What new information have you discovered about them? Tell you story in the comments.

Still have questions. Send them right away.

Leave a Reply