One of the most searched term on Google is “Top 10 mutual funds to invest in“.

Now, when it comes to mutual funds, we know that there are over 300 equity and equity oriented schemes. It is not so easy to select the right schemes for yourself.

And hence, the search starts for the top mutual funds.

Let me share a fact with you, which I hope you would appreciate.

Out of these 300 schemes, 10 schemes, that is just 3% of the total schemes, account for 25% of the entire Equity Assets in Mutual Funds.

To put this in perspective, the assets of Equity Mutual Funds currently stand close to Rs. 4 lac crores, out of which just these 10 schemes manage over Rs. 1 lac crores.

Wow!

Which are these top 10 mutual funds, which have the lion’s share of the investors’ money?

Or, rather let me put it this way – which are the top 10 mutual funds which investors trust to deliver?

Now, these funds may not be the funds where you are putting all your money but on a broader level, they are the ones which today are managing the largest amount of money on behalf of investors. I am kind of sure that you have an investment in at least one of them. 🙂

So, what are these top 10 mutual funds?

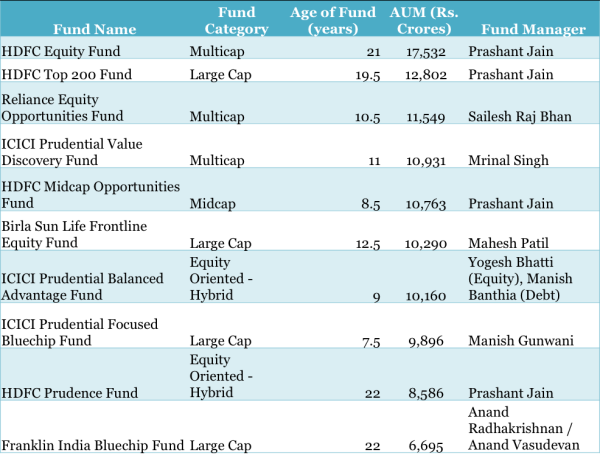

Based on the size or assets under management of each of the equity and equity oriented funds* here is a list of top 10 mutual funds.

TOP 10 MUTUAL FUNDS (EQUITY) BY ASSETS UNDER MANAGEMENT

* While equity oriented funds are known as balanced funds, I have included them here as they have minimum 65% of their assets invested in equity. This makes them as good as an equity fund.

One thing that is obvious is that schemes from the 2 largest fund houses HDFC and ICICI occupy the most number of slots in this list.

While the investor has placed their faith in these funds, the question that has crossed my mind is what made you, the investor, trust these funds with your money.

How much do you as an investor actually know about these funds, beyond the performance?

For example, did you know of any other Fund Manager of the respective funds other than Prashant Jain?

Typically, when we choose our mutual funds for investments, our first inclination is to see the star ratings and the past 3 or 5 year performance of the funds. We spend little time or effort going beyond that to look at other aspects of the fund.

Let’s uncover some important facts about these top 10 mutual funds and see some of their not so well-known aspects – facts that you would like to pay attention to.

#1 Investment Objectives and Asset Allocation

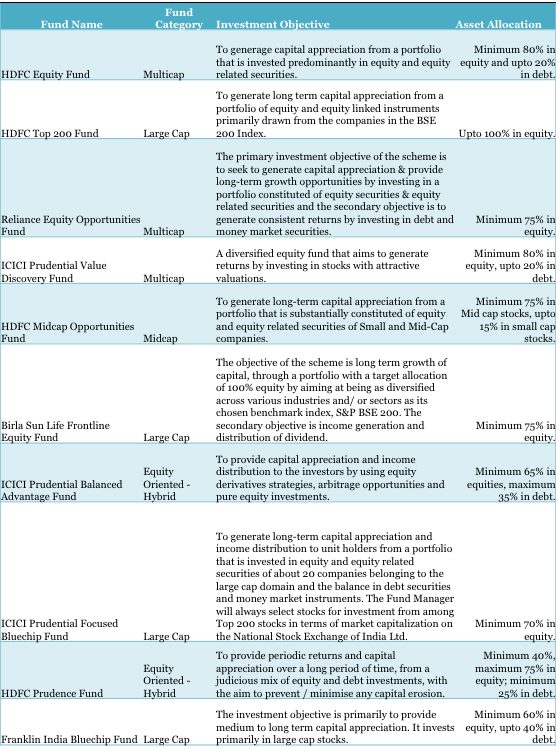

The first couple of things that we are going to look at is the Investment Objective and Asset Allocation of these funds – both indicate the way the fund is going to be managed.

Investment Objective is a short, crisp statement about what the fund scheme intends to do with the investors money. It should help you get a bird’s eye view of the fund’s nature.

Asset Allocation means how much of the money available with the fund is going to be invested in what type of investments and in what proportion.

Top 10 Mutual Funds – Investment Objectives and Asset Allocation

What did you find new here? One of them for me is that I did not know the asset allocation pattern of HDFC Mid cap Opportunities Fund. But there is one more interesting observation on this fund that follows later.

Let’s move on.

#2 Key Indicators and Comments

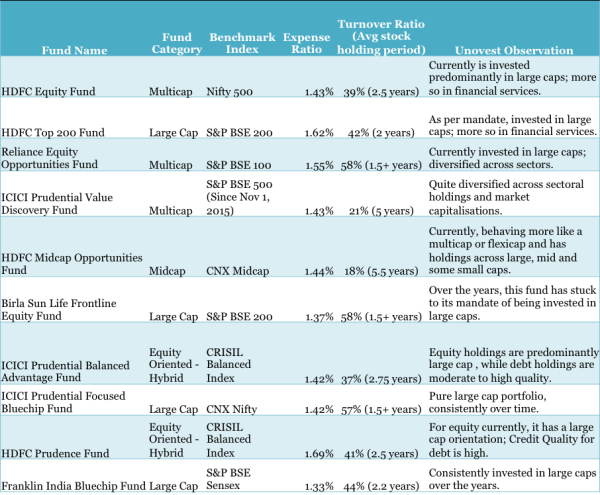

Do you know the fund benchmarks, expense ratios and turnover ratio, that is, how long does any stock stay in the fund?

TOP 10 MUTUAL FUNDS – KEY INDICATORS

Here again, I am pleasantly surprised by the average stock holding periods of ICICI Pru Value Discovery and HDFC Mid cap Opportunities.

I have added an observation for each of these funds.

HDFC Prudence was known for holding mid caps as a part of its equity holdings. One finds more of large caps now. As for its debt investments, they are in High Credit Quality investments.

On HDFC Mid cap, the fund currently has substantial holdings in large caps, which in my opinion, is a breach of the asset allocation mandate of being in mid caps for a minimum of 75%. If I had based my opinion on that fact, I would be in for a surprise.

#3 Investment Strategy

Next comes Investment Strategy. This is a more detailed write up on how the fund will specifically select its research universe, methodology of stock selection, what will it base its buying and selling decisions on, etc.

Can you find out the investment strategy of these funds?

Hint: You can look up the Scheme Information Documents.

So, what have you known about these funds today that you didn’t know before? Does it match with your original reasons to invest in them?

Note: This analysis and information is not a recommendation to invest in these top 10 mutual funds. As you can see, the intention is only to know these funds better. The sources of this information are:

- Scheme Factsheets and Scheme Information Documents

- MorningStar India

All data is as on December 25, 2015.

Unovest is starting a new section called FundStory – where you will get a perspective on various mutual funds beyond their performance.

Stay tuned.

My first comment on UNOVEST platform 🙂

I think such type of articles will definitely help in understanding the background truth about a mutual fund.

Thank you so much Umesh. Hope to see you here more often. Cheers.

One more stellar writeup from Vipin’s den. Thank you so much!

Thanks a lot Abhinav. Good to see you back.

Vipin, I suggest using text for the table rather than an image. The text size is small, and it renders poorly on Retina displays (high-resolution Apple screens). Speaking as an engineer, images should be used only for things that are really graphical — photos, flowcharts, and the like.

Point taken Kartick.

The investment objective of all funds (within a category, like diversified equity) seem to say the same thing in different ways. I get no useful information.

Oh yes! They need to make it more effective and differentiated.