Our Services

Smart investing isn't about constant action—it's about thoughtful, strategic decisions.

Explore our tools below and take control of your financial future.

Do you feel like your financial approach lacks structure?

Do you ever feel lost or overwhelmed when reviewing your investment portfolio?

Is it difficult for you to build conviction in your investment choices?

Are you uncertain about how to prepare for your future financial milestones?

Is your money just sitting in the bank, not working as hard as it could be?

If these questions resonate, your portfolio may not be reaching its full potential—not just in returns, but in what your money could achieve. The good news is, with the right advice, you can align your investments with your goals. Imagine a portfolio that works for you while providing peace of mind about your financial future. Our services focus on what matters most—your family's security, your time, and your dreams.

Smart investing isn't about constant action— it's about thoughtful, strategic decisions.

Frequently asked questions

.jpg)

Absolutely. We are a remote-first advisory service, fully equipped to provide comprehensive advice and support no matter where you are.

No, our consultations are designed to provide you with valuable insights and options. You’re never obligated to follow our recommendations.

We begin with a detailed assessment of your financial situation, followed by a customised plan that aligns with your goals. From there, we offer ongoing support and advice as needed.

Our services are designed to be accessible to a wide range of clients. We tailor our approach to fit your financial situation, regardless of your asset size.

Yes, we offer comprehensive advisory services to Non-Resident Indians (NRIs) who want to manage their investments in India and globally.

The choice is yours. We offer both one-time advisory services and ongoing support to help you implement and monitor your financial plan.

We provide you with the guidance on the right tools and resources to easily track your investments. Regular updates and reviews ensure that you stay informed and confident in your financial journey.

We offer flexible pricing models, including one-time fees and hourly rates for ongoing advisory services. We’ll work with you to find a plan that fits your needs and budget.

We believe that wealth-building is about structure, discipline, and time. While there are no guarantees, following a well-thought-out plan with disciplined execution can set you on a path to significant financial success.

FAQ's

Vipin Khandelwal is a SEBI Registered Investment Adviser with Registration no. – INA000003643 (Oct 14, 2015 to Perpetual); BASL Registration no. - 1517 Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in securities market is subject to market risks. Read all the related documents carefully before investing.

See our SEBI Disclosures

Our services are designed with a focus on what truly matters

OUR SERVICES

Mutual Fund Portfolio Advisory

Investing in mutual funds can be overwhelming with numerous choices. We help you build a diversified, goal-oriented portfolio that adapts to market conditions. Through strategic allocation, we ensure your investments are working efficiently to achieve your financial goals.

Stocks Portfolio Advisory

Navigating the stock market requires discipline and expertise. We focus on quality stocks and long-term growth strategies, aiming to maximise returns while managing risk. Our curated stock portfolios are designed to weather market volatility and build sustainable wealth.

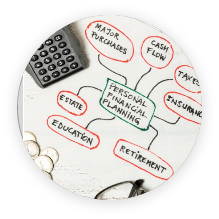

Goal-Based Financial Planning

Your financial choices should align with your life’s goals. Whether it's buying a home or preparing for retirement, we create a customised plan to ensure your investments stay on track to meet your milestones, adapting as your life changes.