Pension payments are a huge burden for Governments around the world. As populations age, this burden continues to grow. In the past, India (like several other nations) followed a defined benefit cum assured pension plan. Once you retired, a predefined pension was made available regularly for your post retirement needs. Over time, the realisation dawned […]

Quiz 2020 – Can you navigate the tax landscape, unhurt?

As you know, several tax changes have been introduced over the last couple of years related to all your favourite investment options and financial planning tools. Do you grasp them all? Let’s find out. Here is a fun quiz (updated for year 2020) to help you know how ready are you to navigate the tax […]

NPS (National Pension Scheme): NPS withdrawal made 100% tax free

This is the headline of one of the popular newspapers. What’s wrong with it? Not just one, there are other media outlets, which have something similar to say. Government makes NPS withdrawal 100% tax free. Entire NPS withdrawal at retirement is tax free now. Again, what’s wrong with the above? Simple, none of these is […]

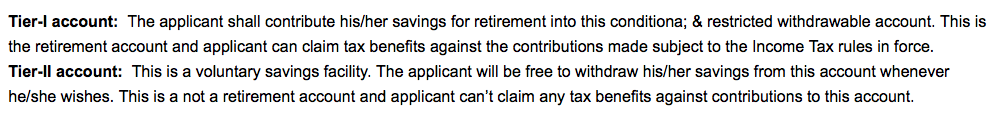

Is NPS Tier 2 Account the best kept secret in savings products?

My friend Vineet’s question got me thinking. He asked if NPS Tier 2 account, with all its benefits, specially super low cost, can be used for investment instead of in a mutual fund. I decided to explore this. Now, you have mostly likely read through my earlier unpopular views on NPS. Those views were primarily […]

Use double indexation to reduce your capital gains tax

One of the key outcomes driving investor behaviour is “how to reduce taxes”. It is an obsession. Now, how many of you know that the Income Tax department itself gives you ways to reduce your taxes on certain capital gains. Let us see how. For starters, when you sell assets such as equity, mutual funds, […]