“Momentum” – the word has a certain charm, a positive reinforcement, a drive to deliver. Add that word to a mutual fund scheme name and you have got a winner.

Wait, isn’t that the promise of our new fund too!

“Keep your winners and weed out the losers.” Or, as the UTI Nifty 200 Momentum 30 Index Fund suggests – “Cut short your losses and let your profits run.”

That sounds like investor utopia where the portfolio has only one direction to go – up and to the right.

Has UTI Nifty 200 Momentum 30 Index Fund come to give you the ticket to this super ride?

Let’s find out.

What is Nifty 200 Momentum 30 Index?

Using the information provided in the NSE document on its Nifty200 Momentum 30 Index:

Momentum refers to the tendency of stock price trends to persist – stocks that have outperformed recently are likely to continue to outperform, and vice versa.

In short, you want to ride the winners, the stocks that are currently in favour, are attracting money and rising higher.

The Nifty 200 Momentum 30 Index aims to track the performance of the top 30 companies within the Nifty 200 Index selected based on their normalised momentum score.

The normalised momentum score for each company is determined based on its 6-month and 12-month price return, adjusted for its daily price volatility.

Stock weights are based on a combination of the stock’s normalised momentum score and its free-float market capitalization. (Source: NSE index strategy document)

Put simply, it means that we will watch which 30 stocks of the Nifty 200 index have been rising faster over 6 month and 12 month period, arrive at some sort of an average (adjusted for volatility) and then use their market cap x momentum score to assign a weightage in the portfolio.

Sounds simple.

The fund intends to cap weightage to 5% or 5 times the index weigh with rebalancing every 6 months.

What about UTI Nifty 200 Momentum 30 index fund?

Well, my friend, the thing is that based on the numbers, it is bound to make any investors gape. On a backtested results, this momentum strategy shows a higher return than say a Nifty 50 or Nifty 200 index.

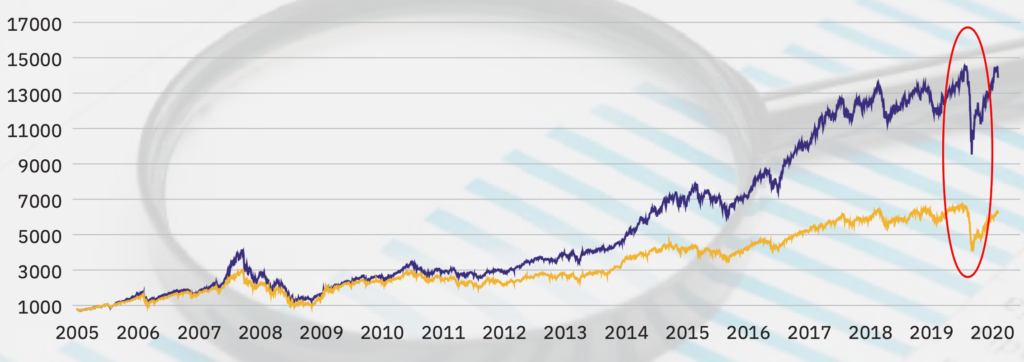

The momentum index has grown 16 times (including dividends) from April 1, 2005, while the Nifty 200 has gone up 12 times. (Note, these are only point to point returns assuming you invested on April 1, 2005)

I am not using the Nifty 50 here, which is a pure large cap index. Since the base index is Nifty 200, we will just stick to that.

Given the passive nature of the upcoming fund, it will come at a low cost and, with the MF structure, will also absorb any tax impact due to its very frequent changes.

If you were to deploy a momentum strategy yourself, the frequency of transactions would have caused you short term capital gains or business income, leading to higher taxes. With the fund, if you hold for more than 1 year, you pay only 10% on the gains.

Now, as investors, our sole purpose is to chase high tax efficient returns. So, why not?

Yes, why not this fund?

The faster a thing goes up, the faster in can come down. This index and the fund will be no stranger to volatility, worse than others, if I can put it that way. That’s the nature of Momentum. (See, it’s not all rosy!)

In the image above, the March 2020 period is highlighted with the circle. At that time, investors panicked with just their large cap funds. This one would have made you skip a few heartbeats.

Can you take this ride?

Nifty 200 Index, which has lot more midcap stocks in it, looks docile in comparison.

Even the sectoral composition of the index is concentrated. As per UTI MF presentation, as on Jan 29, 2021, 61% of the index is invested in just IT, Consumer Goods and Pharma socks.

Hey, but what? Just look at the damn performance.

Precisely, if that is all matters to you.

The investor who can include this fund in their portfolio is someone who says – “I don’t care how you drive or which route you take, just get me there, FAST! Even if you have to hit someone on the way, I am fine.”

Passive / Index investing is at the ultimate surrender to the wisdom of the markets. Looks like there is a Fast Track Club there, which you can enter via the Momentum index.

Remember, it comes at a cost – Volatility!

It is easy to say the word than to live it through!

Between you and me: How do you see this option as an investor? Do share your thoughts and comments.

(1) In my opinion your baseline for comparison is not chosen correctly.Just because it is Nifty 200 momentum 30, you dont have to use Nifty 200 as the baseline. The baseline should be the widely available index options namely Nifty 50 / Sensex 30.

(2) Fwiw wrt to backtesting, Use Nifty 50 and you see that Nifty 200 M30 is unable to beat Nifty 50 also. Then what is the point ? Rest of the arguments are moot as it doesnt even meet the performance bar of Nifty 50.

Hi Vipin,

Could you please share your review on below NFO

Motilal Oswal Asset Allocation Passive Fund of Fund

Hi Srinivasu, If I may ask you, why are you even considering a new fund like this one?

Here’s another note that you can refer to on this fund style: https://unovest.co/2020/08/multi-asset-funds-are-hot/

Can you please suggest, which the best index nifty50 value20 or the nifty200 momentum 30

Can you analyze the approach based on described scenario.

(Sorry for writing such long, but wanted to give a clear understanding.)

Can you analyze the approach based on described scenario:

I have a disposable amount of Rs 2000 to Rs 3000 for every month for next 25 to 30 years.

This amount is completely non-dependent which I can use without any condition.

So I want to generate a corpus of 1.5 to 2.5 CR using this disposable amount.

My strategy to generate this corpus is through mutual funds which has the highest risk with highest returns and which has the highest exposure to equity.

I would like to invest in SMALL CAP FUND because I can see that the Small Cap Funds gives highest returns when the market is at the peak and returns are negative when it goes down to lowest level.

Hence the lowest market will help me to buy the maximum number of units and the highest market will be help at the time of withdrawals.

At the time of withdrawals, I will wait for the market correction to happen that can take some months to some years like

it can take from 6 months to 6 years and I am very well aware of this.

Since the amount that I am using are completely non-dependent and disposable,

I want to take the highest risk throughout this journey without investing into debt fund to lower the risk.

So, can you please suggest if this is a correct approach.

If not then kindly suggest your approach.

Please Note:

I already have all the savings of all other fianacial requirements well set at their place.

I have this disposable amount (of 3k at the max) which I want to use to generate a big corpus over the long run as mentioned above.

Let me know if anything is not cleared.