For a long time mutual fund houses were busy selling the equity upside and how a large, mid, small or multicap fund matters to an equity starved portfolio. They were right about the allocation but they could not guess the deep strike the markets did on these portfolios and left investors wondering if they should have ever invested in equities.

You see, we love our gains but we hate our losses twice as much.

Finally, the mutual fund companies have figured out this real problem of the investor. The solution on offer is the multi asset fund.

What do multi asset funds do?

Quite simple. A multi asset fund chooses to invest in various investment types in a way that reduces the chance / amount of losses in the portfolio. While doing that, it aims to produce a respectable return too.

The aim is to create a less scary experience for the investor than a full equity exposure.

The assets / investments on the menu are:

- Equity – Domestic

- Equity – International

- Fixed Income

- Commodities / Gold

The fund decides a target allocation range to each of the above and works its way to maintain that allocation. This ensures that no asset class goes too under represented or over represented in the portfolio.

Does the multi asset fund proposition really work?

We need to break this down further into 2 parts.

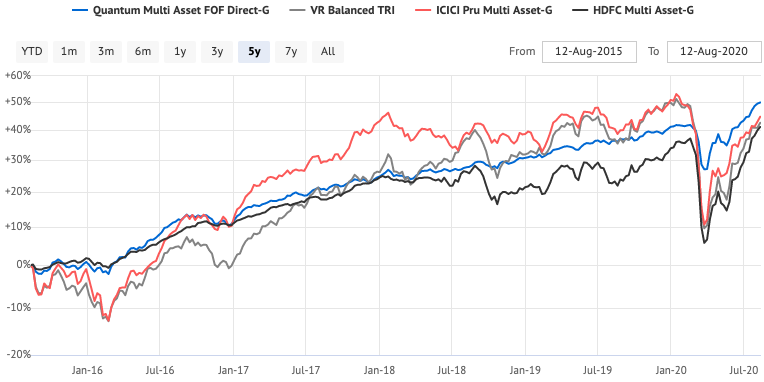

Do multi asset funds reduce the losses? Yes, they do. In fact, a couple of existing funds have not faced a single calendar year with losses.

Do they deliver a respectable return? That will be a big debate. The one which protects you from losses, has to forgo potential returns to achieve that objective. As soon as you start aiming for more, you will have to start accepting a short term, temporary loss in the investment.

Over 3 years, they are better positioned to deliver a positive return.

What is different about the new multi asset fund offers?

Motilal Oswal Multi Asset Fund recently concluded its initial offer. The latest NFO is of Nippon India Multi Asset Fund.

Compared to other existing multi asset funds, the 2 funds have an additional feature – International Stocks.

International Stocks have done so well in the last few years that any portfolio that runs a backtest to show how lucrative the opportunity is, will come across as a winner.

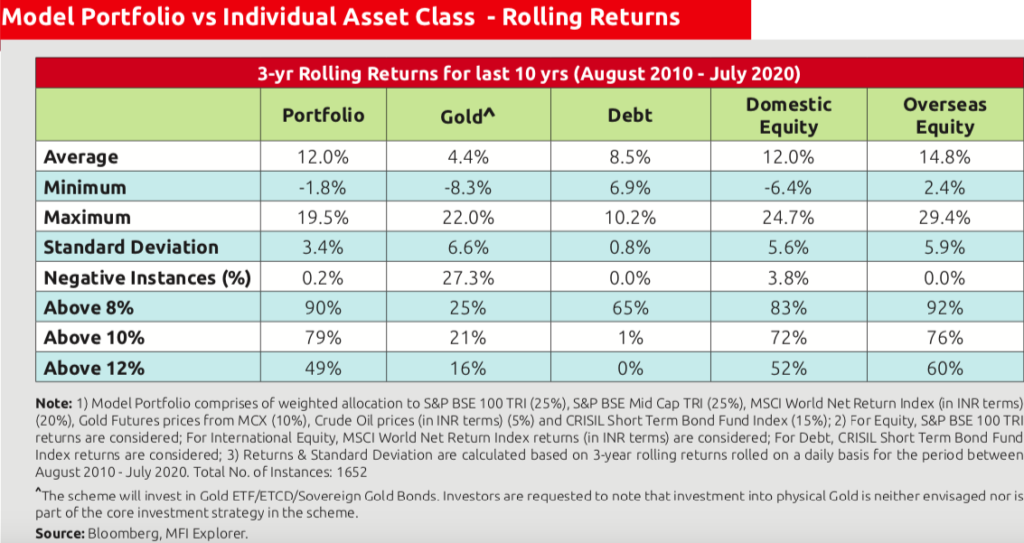

Nippon in its fund presentation shows 3 year rolling returns (assuming invested as per its allocations) with an average return of 12%. This while reducing portfolio risk in terms of drawdowns significantly.

Look at the image below and you will know what I am saying.

Look at the last column – Overseas Equity. It seems to be responsible for all the returns of the model. The reality over the next 10 years may be different.

How are they different from Dynamic Asset Allocation funds?

Dynamic Asset Allocation Funds use only Equity, Arbitrage and Fixed Income in their portfolios. The equity is usually limited to domestic or India stocks. The dynamic nature is mostly a function of determining an appropriate level of equity allocation based on multiple factors on their radar.

In contrast, the multi asset funds have a wider choice to work with. They can also use Gold, other commodities and International Stocks.

What is the taxation of these funds?

The multi asset funds are typically structured as Fund of Funds, that is, the funds invest in equity, debt or gold schemes of the fund houses. The primary job of the multi asset fund is asset allocation. The underlying fund does the actual investment management.

This structure makes the funds eligible for Debt based taxation. If you sell before 3 years of purchase, your gains are taxed as per your marginal income tax rate. If you sell after 3 years, you get to cost index and then pay 20% long term capital gains tax on the cost indexed gains.

Should you invest in multi asset fund?

A multi asset fund is like a ready made, diversified portfolio.

One of the big benefits of investing in a multi asset fund is that it does the most important job for the investor – maintain an asset allocation.

However, this comes at a cost – expense ratio of the fund.

One can argue, that which they charge, they also help save all the rebalancing costs and taxes and most importantly, they do it. Unlike an investor, who may let the biases dictate behaviour and lead to sub optimal results.

Basically, you outsource the job along with the costs.

In my view, this investment category can work for a strict Do it Yourself or DIY investor, who understands that asset allocation is what truly matters and wants a fund which can offer it at a low cost. S/he is not interested in comparing funds for finding the best performers.

Which of the multi asset funds should you invest in?

Well, that depends on a lot of things.

To keep it simple, you can just choose a few based on their investment mandate and track record. Remember you need the asset allocation job done. The returns come after.

If your selected fund is a Fund of Funds, then you may want to focus on cost / expense ratio too.

If you are interested in the NFO of Nippon India Multi Asset Fund, here are my comments.

I say AVOID for now. Let the fund work out the next 3 years and show what it has got. You can make a decision after that.

Till now we and only Balanced Funds for the risk-averse investor, then we had Dynamic AA funds and now we have Multi Asset Funds —maybe the next offering from the MF industry will include the remaining asset classes as well – the commodities and real estate /REITs as well ! Maybe we can think of including Derivatives also after that !

Welcome to the fun!