Here is the big warning to you, the investor. Never ever trust your investments to banks, national distributors or an institutional distributor of mutual funds. Want to know why?

This will not take long.

So, my client, who has just signed up with me, shared his mutual fund portfolio.

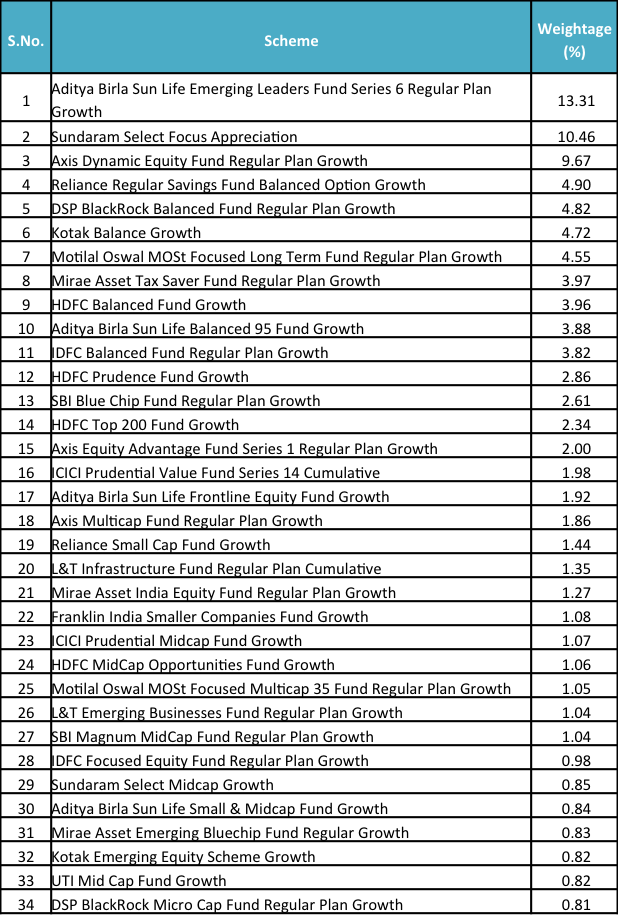

This is what it looks like.

As you notice, there are 34 unique schemes in the portfolio.

How did this portfolio come to be?

My client has a clear objective. He wants to retire in the next few years and the portfolio has to help him generate an income post retirement.

The client is a busy executive with little time that he can spend managing his own investments.

A big national distributor approached him and he got started.

This portfolio is a result of recommendations and investments over the last 2 years.

What’s the issue?

The 2 big issues in my view are:

- Having 34 mutual fund schemes in a portfolio is equivalent of holding a broad market index fund. Now why would you hold an equivalent of an index fund and pay active fund management fees. Beats me!

- 31 of the 34 schemes have insignificant presence in the portfolio. I mean even if they double, will it make a difference? Any scheme needs to have a reasonable allocation in the portfolio to be able to move the needle.

I told my client in jest, “your portfolio is big enough to make a ladder out of it and reach the moon.”

But frankly, I am appalled.

The portfolio noted above seems a result of greed gone unbridled, not of the client but of this national distributor.

In fact, this looks like an attempt by the relationship managers to fulfil sales targets and earn incentives and rewards.

I shouldn’t be surprised. They are just doing business – the business of distribution and earning commissions. Advice is an alien concept for them.

I have to warn you again!

You may remember that I have been vocal about avoiding banks for investment advice with a 10 feet pole.

I have to now add the other category – the National Distributors. These distributors are those, which have offices and branches spread across the country to sell mutual funds, insurance, loans, etc. They are always eager to sell something to you.

I now revise and repeat: Don’t take any investment advice from banks or national mutual fund distributors.

No, this is not a result of just one observation from one such national level distributor. There have been several instances observed over the last many years.

Clearly, the investor client is not at the centre of their thought process.

Why would you want to deal with someone who doesn’t keep you at the centre of the relationship?

I would be glad if you can share any personal experience and help spread the message. Thank you!

Yes but national distributor are of two kinds. One is B to C and second one is from B to B.

Would you put both kind of distributor in the same category.

Exampleof B to C: Bluechip Investment, Bajaj

Example of B to B : NJ

I would love to know from you. How do you see this difference?

In B to C, incase of misselling, company is responsible.

In case of B to B, its the advisor who is responsible.

Thanks to one of famous Free-for-life account online portal , where i have started my investments with mutual funds and they dumped me 21 Schemes in my account.

The reason for these many funds, multiple portfolio for different goals. So i too accepted the all these schemes.

Well, finally Unovest(aka Vipin 🙂 ) helps me to declutter my portfolio into just 4 funds.

Lesson learnt : We need to learn before/after/during investments, after all this is our money .

Ah! For once I thought, you were talking of Unovest, as the free for life account. 🙂

Thanks Vandhi.

Lol, I was thinking the same till I read the word ‘dumped.’ Then it was clear.

Srikanth ,

Just to keep some suspense till the end of the movie 🙂

Dumped is a right word to express my anguish over fund selection.

Lol. But you’re absolutely right about making mistakes before we learn it the right way. My biggest mistake was a Jeevan Anand policy where I lost anywhere between 2 to 4 lakhs; 2 if I had chosen a modest RD in bank, and 4 if I had chosen a modest ELSS. Stupid, stupid mistake, because I trusted the LIC agent uncle who’s the trusted financial advisor of my trusted friend. Which reminds me, I’ve to catch up with my friend to make sure he’s not investing anymore with through the agent uncle — I had warned him once or twice.

Plzz share the names of just 4 funds.

Raj, it doesn’t matter. No seriously, it doesn’t matter. Choose any decent multicap fund that performed well and offered good downside protection (which can all be found in ValueResearch or smart.unovest.co). If you want to diversify, choose two of them. Put a very small percentage of your equity allocation in to a mid-cap, and even smaller in a small-cap fund if you’re a brave man. The keyword there is ‘4.’ So don’t go above 4 for all of your very long term goals. For a medium term goal (that is, 5 to 7), choose a balanced fund (aka Hybrid Aggressive). But, keep it at 4.

Use Vipin’s guides (they are on the home page). And work on your DIY portfolio. Use Unovest’s free platform which is backed by MFU, so you can use MFU should Vipin turn evil and starts charging you 1.5% of your returns (which he can’t even if he wanted to because the platform only offers Direct option) like those distributors.

But I would recommend paying for one reason (other than wanting to see and invest in Vipin’s handpicked choices, in which case, it’s fair that you pay). My reason is their superior support. I was handheld throughout my DIY process, however stupid my questions were.

Also, before I was a paid member, I had handpicked a few funds myself, following his guide. I expected to see at least 2 out of the 4 funds I had picked. But none of them were there. That was shocking to me. I went back and I relearned about funds picking. I don’t know how good I’m, for a layman, but I’m a lot more confident than I was an year ago. Most of us tend to go overboard and aggressive. His fund choices keep us on the ground.

The other reason I’ll continue to stay a paid member is the portal itself. It offers goal based investing tools. Something that is very underrated (goal based investing, I mean, along with asset allocation and behavioural alpha). If these are new words for you, start learning them. They are really not that difficult.

Sure, I can do this myself, but the portal keeps improving. So I’m sure it will grow at a steady pace, just like his portfolios do. There are several other features that you may find useful (like managing multiple family members’ investments from a single login).

Other reason is, I want to support Unovest and Vipin for doing a very honest and a “professional” job of educating investors and earning money the right way. We’ll pay (mostly unknowingly) the distributors, agents, bank relationship managers (aka bank salesmen) so much. Why can’t we pay for this.

That was long, but I was in that kind of a mood 🙂

Srikanth, you are my MVP! 🙂 Thanks for the support.

I strongly recommend you to subscribe to Unovest MF portfolio services , in case you are not sure which one to pick for your goals.

Absolutely true. Such practices are rampant where the investor’s interest is the last thing to keep in perspective. In fact, in the month of March where annual targets are being scrutinized these sales people can go to any extent in committing returns just to see their targets met. Sincere advise to all investors is to know their investments, keep them simple or at least find some advisor who work for their interests rather than their own commission.

Well said, Vipin!

I have also invested 15k each in 8 elss funds through paisa bazaar And all are direct growth plans. Am I also doing any mistake?

Totally not required!

Atrocious. They could have atleast mis-sold fewer funds 🙂

Jokes apart, banks are the biggest culprits (who else has the knowledge of money coming in and going out of your bank account?!) and the distributors are next in line. Fees-only financial advisors like you bring some sanctity to the whole topic. You have established a gold standard, Vipin / Unovest, and I wish you all the best. Investor interest comes out predominantly while interacting with you. Your blogs are also a short but impactful reminders. Stay strong.

Thanks a ton for this generous comment Naren. With you and people like you around, I hope to continue doing this. Thanks.

Pardon my ignorance, but what are National Distributors? I have no idea and can you give examples?

Aalok, read an earlier comment on this post by Dinesh Jain.