You are probably looking at different names of your mutual fund schemes in the statements and portfolio trackers. They don’t look like what you invested in. No need to panic. Here’s a quick touch base on the changes that are taking place.

The changes are a result of the October 2017 circular from SEBI asking the mutual funds to make their mutual fund schemes more standardised in terms of category and benchmarks. The names should also communicate the purpose of the scheme. The action has started and here are some of the changes announced so far.

Let’s first take the quick and simple ones.

Parag Parikh Long Term Value Fund will now be known as Parag Parikh Long Term Equity Fund. That’s the only equity fund PPFAS MF has.

Mirae Asset India Opportunities Fund will now be known as Mirae Asset India Equity Fund (with effect from March 1). This is the only change Mirae MF is doing.

There is no other change in the fundamental attributes of the above 2 schemes.

The big changes in mutual fund schemes

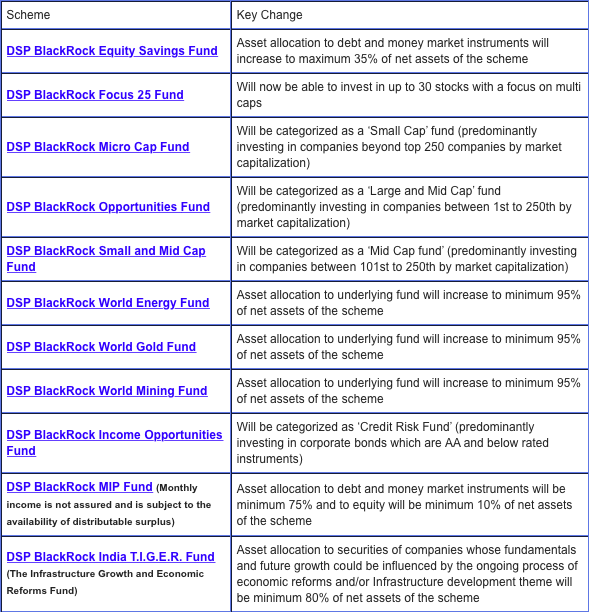

There are some wholesale changes expected from the biggies and right off the bat are the ones from DSP BlackRock. There are changes in fundamental attributes of the schemes. Refer the image below. (Source: Email sent out by the fund house).

You will notice from the Key change column that the scheme features are now in line with the categories defined by SEBI.

Since, these are changes in fundamental attributes, the fund house is also giving you an option to exit the scheme now without paying any exit loads. However, you are liable to pay taxes, if any.

We are expecting more changes to be announced by the biggies such as Aditya Birla, HDFC, ICICI, etc. in the next couple of months. Stay attuned – you can track all the updates in the mutual fund schemes here.

Mirae asset emerging blue chip changed to large and mid cap. It’s big change, hopefully returns also change in future. No More darling fund in midcap space.

They have only categorised it as per the SEBI category. Mirae EB will now invest min 35% in large and mid caps. Of course, it has the leeway to go 65% in midcaps. Not different from its current structure.

Do you read my mind? I was about to write to your team on smart.unovest.co on the Franklin fund recommended in the aggressive long term portfolio, and Franklin having plenty of funds in the same category.

Thanks for keeping us up to date here!

I’m a bit surprised with SEBI not including a small and mid cap category and vice versa having 65:35 ratio. Plenty of current funds fall in this category with fund houses having separate mid cap and small cap funds. They probably have to be merged with one or the other, most likely with their mid cap fund.

On the other hand, this may help with some of those funds being categorised as small cap funds, thus ensuring 65 allocation in to small caps. I feel there really is a distinct lack of good small cap funds, which is probably because it’s tough to maintain one considering higher AUM is actually a curse and most fund houses are greedy.

Thanks Srikanth. You have already got the reasoning correct on the small & mid cap fund. Cheers!

There is a spelling mistake and looks like “not” should be replaced with “now” for mentioned Mirae Asset fund.

Mirae Asset India Opportunities Fund will not be known as Mirae Asset India Equity Fund (with effect from March 1).

Thanks! 🙂