A reader wants to know that after the LTCG tax, does investment in a large cap + debt fund combo expected to generate a better tax adjusted return versus investing in one of the balanced funds. We find out.

Here is the query:

With LTCG on equity, without any indexation, debt funds can be more attractive from tax perspective. Even with 20% tax, since there’s indexation, this would be less than the 10% LTCG tax on gains of more than 1L.

I was putting 2500 INR / week into a Balanced fund, for a 5-6 year horizon to build a 10L medical fund. But with a 5 year horizon, I think a pure large-cap equity fund and a short term debt fund would be a better combo, with a proper asset allocation strategy where I reduce equity exposure year on year.

Is this really the case? If so, I’ll stop investing in Balanced fund, and invest in the large cap – debt fund (combination) from next month.

Let’s work this out.

So, what are the key points here and the assumptions?

- A fairly long term goal with a 5+ years horizon; Let’s use a 10 year horizon to work with.

- Regular investments of Rs. 10,000 a month (2500 / week). For simplicity, we will use Rs 1 lakh per year for the workings.

- Two scenarios

- Scenario 1: Invest in one of the aggressive balanced funds, which typically has 65:35 equity:debt ratio

- Scenario 2: Invest in the 65:35 ratio in separate funds. A large cap fund for equity and a short term debt fund. This has 2 sub scenarios:

- Sub scenario 1 – No rebalancing

- Sub scenario 2 – Rebalancing the portfolio to keep the allocation near 65:35

- Taxes – The tax treatment of an aggressive balanced fund is equal to an equity fund.

- Equity – we now know that long term capital gains greater than Rs 1 lakh in a financial year will attract 10% tax. There is no cost indexation benefit allowed.

- Debt – Debt funds held over 3 years benefit from cost inflation indexation and a flat rate of tax at 20%. On a 3 year period, this works out to be about 0.6% tax.

- Cost inflation Index – We have assumed the cost inflation index at a constant 5% per year. This will be used to inflate the cost of debt for calculation of capital gains.

- Expected returns: It is easy to assume the expected rate of returns at say 12% for equity and 7% for debt. If you do the workings based on these, what my reader has said will hold true.

However, as you understand, we are using a linear rate of growth for both equity and debt. In reality, we know, that’s not how it works. Equity is volatile and so are the returns. There are ups and downs.

So, to get some real answers , we will use actual calendar year returns for the past 10 years (2008 to 2017) for:

- An aggressive balanced fund (minimum 65% in equity)

- A large cap fund

- An ultra short term fund

Though it is the past data but helps us map the likely returns scenario going forward. The returns data is sourced from ValueResearch.

Let’s look at the workings.

#1 Own separate portfolios (without rebalancing) OR invest in one single balanced fund

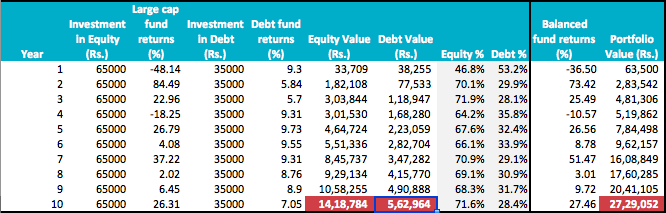

In our first working, we will create 2 separate debt and equity portfolio as also invest in one of the balanced funds. Here’s what the numbers look like.

At the beginning of every year, Rs. 1 lakh of investment per year is divided into 65: 35 ratio and invested in a large cap equity fund and a debt fund.

Equity and Debt fund values as well as % are calculated at the end of the respective year.

The year 1 in the table corresponds to the year 2008 and hence the negative returns number for equity and balanced funds.

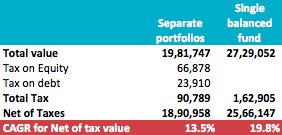

The final values are shown with the purple background. Counting for taxes, the CAGR in the two scenarios is:

The taxes are applied on the final values, assuming the entire amount is withdrawn in one lumpsum. If you were to withdraw over several years and take the benefit of Rs 1 lakh exemption every year, the taxes can be lower.

As you can see, there is a huge difference between the two CAGRs. 13.5% for the separate portfolios versus 19.8% for a single balanced fund.

Let’s now look at another scenario and answer the question if we can improve the returns of the separate portfolios via rebalancing.

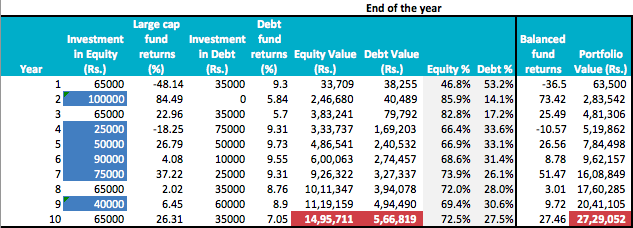

#2 Own separate portfolios (with rebalancing) OR invest in one single balanced fund

All other numbers remain the same as above except for the rebalancing part. This is how it turns out to be.

The numbers in the blue background for “investment in equity” are the points where we used our yearly investments to rebalance the portfolio. We did not actually sell anything, only used incremental cash flows. This way we avoided any interim capital gains taxes.

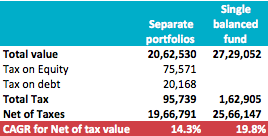

How does the CAGR fare in this case?

The difference because of rebalancing is to the tune of 0.8% in CAGR. From 13.5%, it has now moved to 14.3%. But it still remains lower than the return of a single balanced fund investment.

I guess the answer to my reader’s query is obvious. The bottomline is we can keep it simple.

OK, I know the query mentioned a 5 year horizon. I did it for 5 years and the difference remains. If we take the last 5 years of the same data as used above, the CAGR is 16.1% / 17.2% for separate portfolios and 26.2% for the aggressive balanced fund.

What is your view? What are the other assumptions at work here? What can go wrong? Do share in the comments.

Did that balanced fund actually go with a 65:35 split? I suspect the reason it performed better is that the equity allocation was way higher for significant durations.

The govt. seems to be moving towards removing preferential tax treatment for equity. So, the question really comes down to whether you should decide on asset allocation yourself or if you should let a fund manager do it for you.

Sagar, unlikely it remained 65:35 overall. But we will allow some margin of tolerance.

Another reason you can add for better performance is that a balanced fund also invests in midcaps+smallcaps. Even for debt, it tends to take bets for accrual + capital appreciation.

Should you choose your own allocation or take one offered by the scheme – we will leave that for individual choice.

Thanks

Dear Sir,

I have around 1 lac fund to invest

but don’t know where to invest

I have already invested 1,20,000 in elss funds.

could you please advise me

where to invest

Binod, hope you got a chance to read this mutual fund guide: http://unovest.co/2017/09/guide-mutual-fund-portfolio-xirr/

Dear Sir

Its Good analysis indeed.

It would be really helpful and insightful if it can also be analysed- between Arbitrage Fund Vis-a-vis liquid fund for short term of 1-2 years to morethan 5 years durations (as an emergency fund.).

Thanks in advance

Dear Vipin,

You haven’t mentioned the funds that you used in your analysis but wouldn’t it have been more pertinent to pick a multi-cap fund in place of a large-cap fund assuming the aggressive balanced fund invests across market caps?

So also, it would have been interesting to include a scenario where the returns from the two cases was theoretically assumed to be the same as that’s what the original question was about.

Tha total tax on balanced funds gains seems to be incorrect. Shouldn’t it have been 1,62,905.2?

How did you arrive at this no?

27,29,052 (Portfolio Value)

-10,00,000 (Principal)

=17,29,052 (LTCG)

-1,00,000 (LTCG Exemption)

=16,29,052 (Taxable LTCG)

1,62,905.2 (10% LTCG)

Thanks again Nilesh. You are super. I stand corrected.

Was waiting for someone to ask. The funds are Franklin Bluechip, UTI Treasury advantage and HDFC Balanced Fund.

The same returns per year scenario as you said is theoretical and can be done easily on the excel.

Thanks.

Hello Vipin,

I think there is an error in the 2nd year value for the equity fund. I think the 2nd amount of Rs 65k has not been added to the capital value. Hence the low number of RS 51k?

Would the title of “Sherlock Holmes” flatter you? 🙂 Thanks for pointing out this error. I have corrected it, the conclusion doesn’t change though.

Vipin,

Please also double check the annual values in the Balanced fund side. I get a total of Rs 11.78 lac after 10 years.

regds

Sridhar

How did you arrive at this number? Remember the investment in balanced fund is Rs. 1 lakh per year.

The result shows that a single balanced fund will do the job better than having a 60:40 AA approach.

1) Is it the choice of funds that got us this result? Would a different choice beat the balanced funds comparison?

2) In a span of 10-20 years equity does far better over any AA strategy, so why bother about AA and not go with 100% Equity for someone who can bear the volatility (keeping in mind that we STP out to a debt fund as the goal is approaching)

Thanks for the comment Jay.

It could be that the choice of the funds got the results. The selection was based on the reader’s query and the options s/he was considering.

Well, we don’t know the future. An asset allocation (through a fund) or individually is always recommended. I consider it a part of risk management. Even the most aggressive, should not exceed 80% allocation to equity (my view).

Warning: I’ve not done my math on this.

In the new SEBI classification, there is a balanced fund category that is neither conservative nor aggressive. It requires the fund to maintain a minimum of 40% in equity and 40% in debt, and it can spread the rest of the 20% as the fund house likes (no arbitrage is permitted). I believe, if a fund chooses to spread the rest of the 20% also in equity and states it so in their scheme document, the returns, my gut feeling says, in the shortish-long term can be impressive. Such a fund will take moderate risk (slightly lower than an aggressive balance fund), and yet can have the tax advantage of a debt fund’s capital indexation.

So to shift the question. With the new LTCG tax, is it better to shift to the new “balanced hybrid” fund instead of an “aggressive hybrid” fund? Are there even such funds in the market?

Oops, I should have written “In the new SEBI classification, there is a *hybrid* fund category that is neither conservative nor aggressive.”

Also, thanks to the reader who asked this question. I’ve been trying to shift my focus from chasing returns to chasing goals, and shift my mindset to a goal based investing. The question has convinced me that I should look for a good hybrid fund that keeps building at a lower volatility so I can withdraw it without any SWPs when needed.

Simple is the best!

HDFC Balanced fund was originally such a fund. I am hoping there will be many more funds now with this feature.