It’s that time of the year again. You have got a reminder to submit your tax saving investment proofs or take a huge cut in your salary, courtesy income tax. The only question on your mind – where do I invest to save taxes? Can tax saving mutual funds come to your rescue?

By now, you are aware that there are several ways to save taxes. You also know that ELSS or tax saving mutual funds can be a key part of your investment portfolio that you can use to make investments under Section 80C of the Income Tax Act.

OK, Fine! But which tax saving mutual funds to invest in?

While we will get there, let’s quickly recap some of the important features of tax saving mutual funds.

- Investments in tax saving mutual funds are allowed as deduction from your income under Section 80C of the IT Act. This helps to reduce your tax liability. The maximum that you can invest in these funds is Rs. 1.5 lakhs in a financial year.

- The funds are essentially in the nature of equity funds, which means that they invest predominantly in stocks. However, different funds can have different investing styles.

- These funds have a 3 year lock-in, that is, you cannot redeem or switch your investments before completion of 3 years of holding. This is the shortest lock-in period amongst all the investments that qualify for tax savings.

- There is no capital gains tax on withdrawal after 3 years.

So, how can kill 2 birds with 1 stone – that is – get tax benefits as well as put your money to compound better.

Tax saving mutual funds – Which one to invest in?

There are 50+ mutual fund schemes that qualify for tax savings under Section 80C. It is hard to differentiate one from the other. To help you make an investment decision, here’s a comparison on various parameters of 5 popular schemes. They are (in alphabetical order):

- Axis Long Term Equity Fund

- DSP BR Tax Saver Fund

- Franklin India Tax Shield Fund

- ICICI Pru Long Term Equity Fund (Tax Savings)

- Reliance Tax Saver Fund (ELSS)

You will appreciate one fact that each of the tax saving mutual funds is mandated to invest minimum 80% of its investments in equity or equity related investments.

With this background, let’s look at the investment objectives of each of the above schemes (from the most vague to highly specific):

Investment Objective of Axis Long Term Equity Fund

To generate income and long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related securities.

Investment Objective of DSP BlackRock Tax Saver Fund

To seek to generate medium to long-term capital appreciation from a diversified portfolio that is substantially constituted of equity and equity related securities of corporates.

Investment Objective of Franklin India Tax Shield Fund

The scheme follows a blend of value and growth style of investing. The fund will follow a bottom-up approach to stock-picking. The scheme will invest in diversified portfolio of stocks across sectors and market capitalisation.

Investment Objective of ICICI Pru Long Term Equity Fund (ELSS)

The Fund constitutes a portfolio, which is a blend of large, mid and small cap stocks. The fund manager may change the proportion of large cap and mid/small-cap stocks in the portfolio depending on the market conditions.

Investment Objective of Reliance Tax Saver

Seeks to maintain balance between large cap companies and mid cap companies. Endeavors to invest in potential leaders. Invest in companies with potential of high growth prospects over medium term (2-3 years). Generally, the fund has two or three sector calls at a time. They are mostly in-line of emerging market trends. Small percentage of portfolio is invested in contrarian calls. Significant percent of outstanding equity of the scheme is invested in high conviction midcap companies. Significant allocation/exposure is taken in Multinational Companies (MNC’s). Attempt to have a balanced portfolio on a macro basis, allocating to themes like Domestic, Consumption & Defensive.

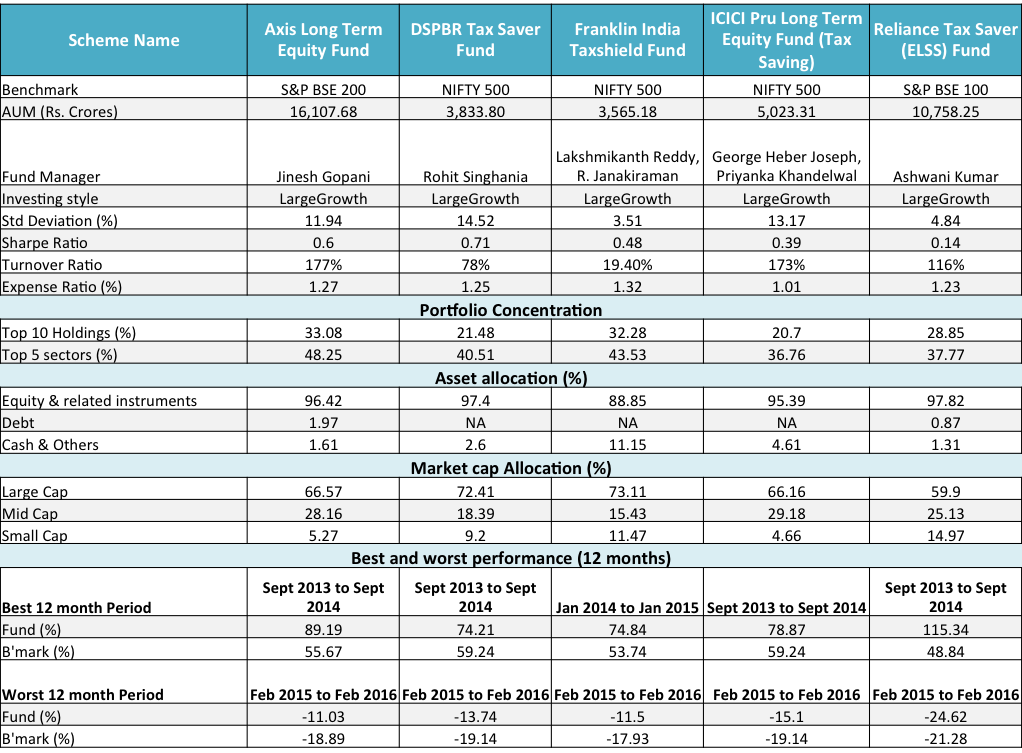

Comparison of 5 tax saving mutual funds

Here’s a comparison of the 5 schemes across various parameters.

Source: Unovest, Scheme Factsheets and Scheme Information Document as available in Jan 2018; All data is for the direct plans and the growth option of the respective funds. The direct plans of these tax saving mutual funds started on Jan 1, 2013.

This comparison brings out some interesting observations:

- Asset Allocation: Franklin Taxshield has a conservative view of the market with over 10% in cash holdings. Rest are more or less fully invested in the market.

- Market Cap allocation:

- If the benchmark choice is an indication of the expected portfolio, then Reliance Tax Saver is an odd one out. Against its benchmark of BSE 100, which is a predominantly large cap benchmark, the current market cap allocation shows a significant amount is invested in mid caps and small-caps. This could be misleading.

- DSPBR Tax Saver, Franklin Tax Shield and ICICI Pru Long Term Equity follow a broad based investing approach. They have benchmarked themselves to Nifty 500. It means that they can go across the market to pick the best opportunities available.

- Axis, Reliance and ICICI Pru appear to be aggressive in their market cap allocation with a larger share to mid caps and small caps.

- Best & Worst period performance:

- Except for Reliance, all the other funds have managed their worst periods well.

- Reliance Tax Saver has done worse than its benchmarks in the stated one year period. It should be noted that Reliance also has done much better compared to others in terms of the Best period performance. This goes on to indicate that the fund is quite volatile.

- Portfolio concentration: The exposure to Top 10 stocks and Top 5 sectors in all the funds appear to be in a close range. Going by the Top 10 stock holding, DSP BR and ICICI Pru funds have a more speared out investment portfolio.

- Standard Deviation: Franklin India Tax Shield has the lowest standard deviation amongst all, indicating low volatility or a relatively more stable value movement.

- Expense Ratio: ICICI Pru Long Term Equity manages itself frugally, in comparison to all others.

- Turnover Ratio: Except for Franklin Tax Shield, all other funds are running very high turnover ratios. This seems to be a result of arbitrage investments in the funds. Separate data is not immediately available for such investments. Franklin has been fairly stable with its holdings.

So, which one of the tax saving mutual funds should one pick?

While you can pick any of the above tax saving mutual funds, make a note of your expectations and invest accordingly.

For example, if you are not an aggressive investor and looking for a largely stable, less volatile fund, Franklin Tax Shield fits the bill. With its mandate to invest across the market and a predominantly large cap portfolio, it turns out to be a good choice.

Disclaimer: Please consult your investment advisor for the right investment for you in line with your time horizon and risk appetite.

You know Vipin, we keep hunting for good funds with better down side protection and all that, and yet these high risk funds have given spectacular returns in the long run. This is very similar to the Reliance Small Cap fund. Highly volatile, but best performing. Perhaps, if you plan to take the money out in the long run just after or during a bull run, like somewhere from the mid of 2017 till now in the current scenario, it wouldn’t make a difference how riskier a fund is? Basically, don’t take the money out during or an year or two after a massive fall, and you’ll be good. I understand, the higher the fall, the higher the returns should be to compensate the lost capital but these guys seem to be coming out on top anyway. Or am I having a recency bias?

Srikanth, you ask a very tricky question. In most funds, it is difficult to find out what is at work – skill / luck or a combination of both. I guess the last one. And who cares for downside protection? Most investors just want the highest returns, that’s all that matters.

As for the current scenario, any analysis about performance has to be taken not with a pinch but with a handful of salt.

Can we compare Funds having different Benchmarks? How to tackle the issue considering above example.

Tax savings or ELSS is a unique category where the funds can benchmark against different indices and follow different investment strategies.